Categories:

Energy

Topics:

General Energy

Oil Market: Bulls Haven’t Given Up and Crude Oil Hasn’t Declined

Light crude rose today above $98 a barrel. It seems that investors are worried about the supply disruptions in the Middle East and Africa. According to Reuters, oil output in Libya has fallen by a third after protesters shut several oilfields and anti-government demonstrations in Egypt have raised concerns about the stability of the whole region. Yesterday’s data from the Institute for Supply Management showed the U.S. manufacturing activity grew in June which also supported crude oil price.

"It's a mixture of supply worries and general market sentiment with yesterday's ISM index in the U.S. better than expected," said Carsten Fritsch, oil analyst at Commerzbank in Frankfurt.

Keeping in mind these pieces of data let’s focus on the light crude chart today.

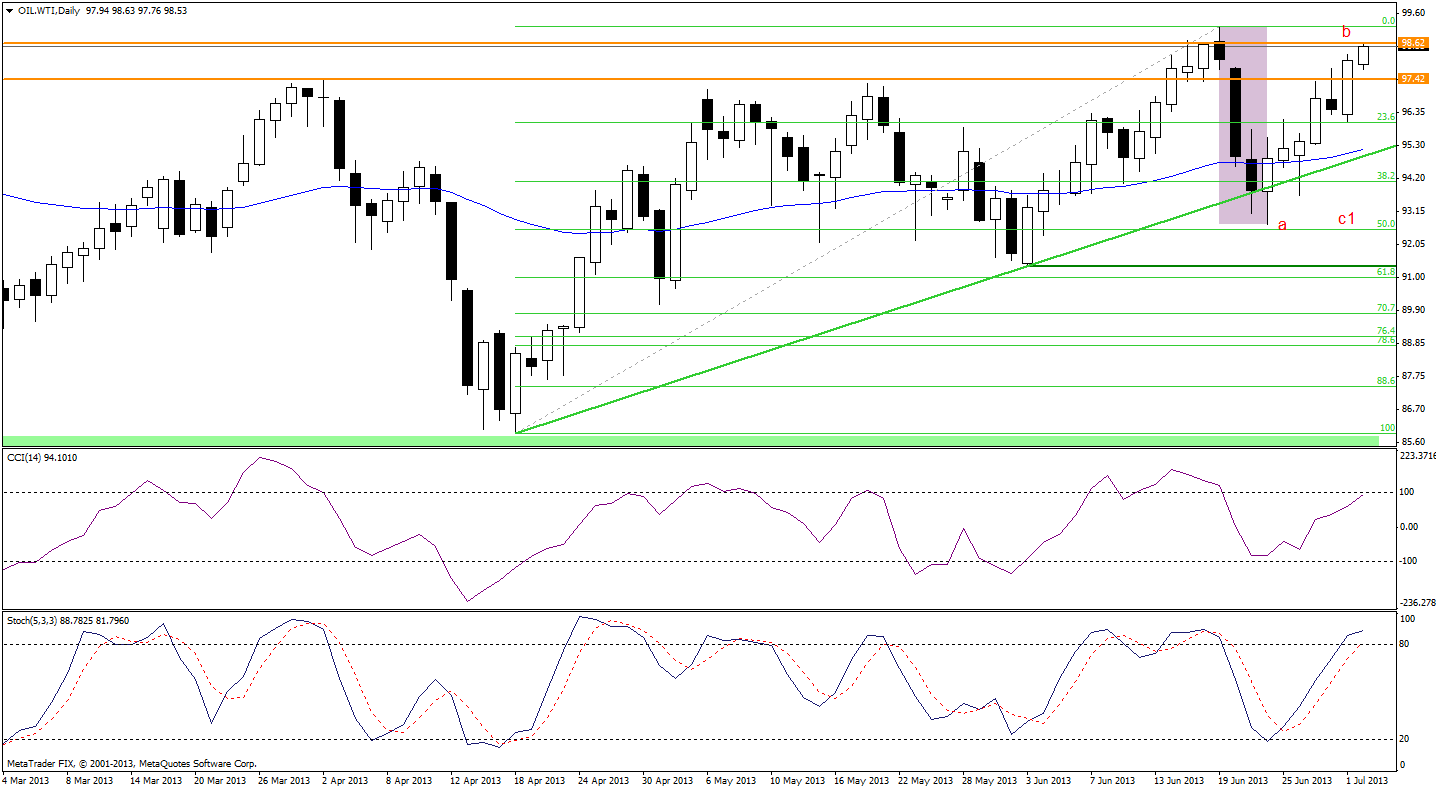

In this daily chart it seems the situation becomes a little more bullish. Yesterday buyers decided not to give up and the price started its small rally. This resulted in (at least at the present moment) another white candle, which led trading above $98 a barrel.

Even when taking this positive event into account, we should still remember about the strong resistance zone based on the February and April heights (the orange horizontal lines). As long as it remains valid declines are still likely. Another factor which prescribes caution is the position of indicators. Both the Commodity Channel Index and Stochastic Oscillator support buyers, but they are almost overbought and they have little space for further growth.

Let’s zoom in on our picture of the oil market and see the 4-hour chart.

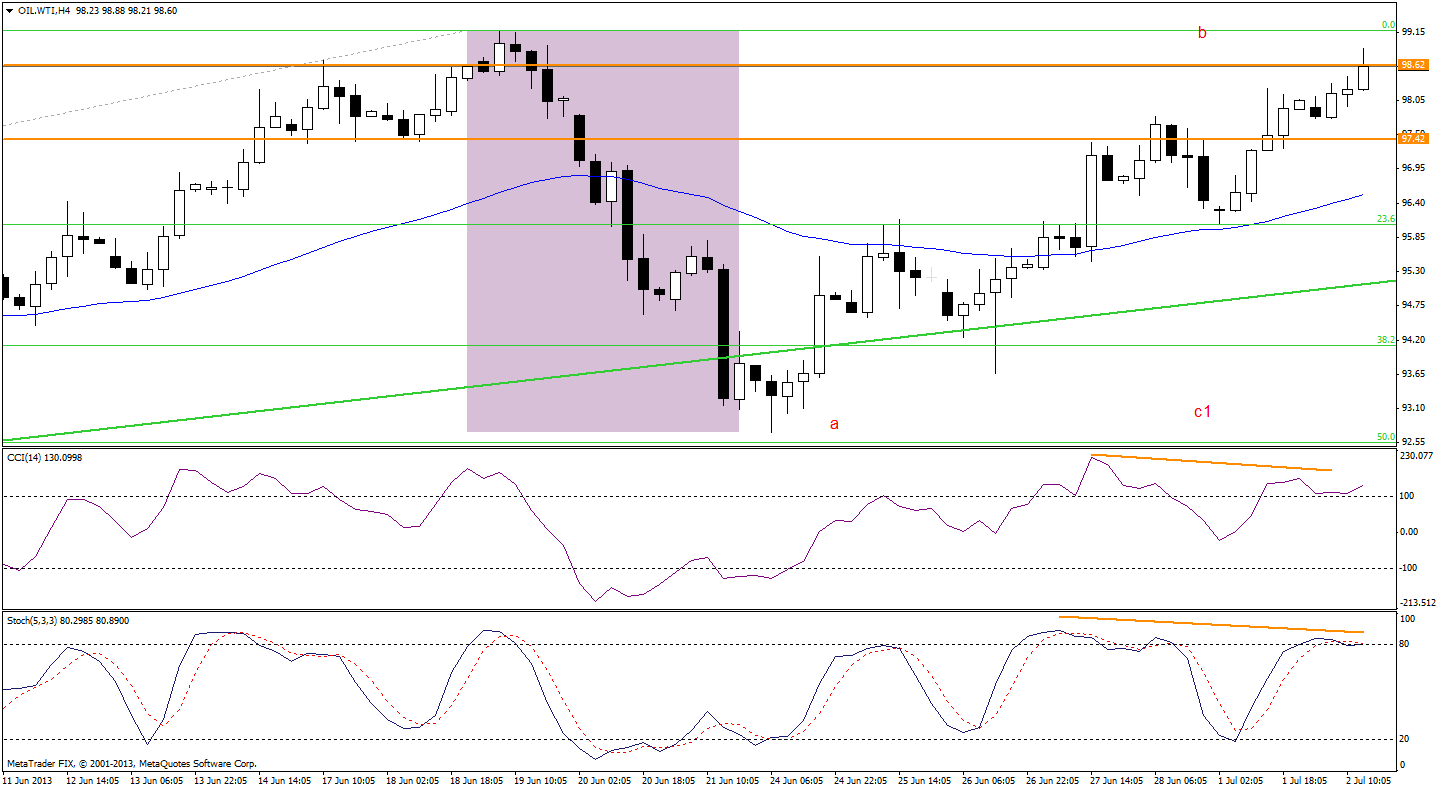

From this point of view the situation is not so bullish any more. First of all, we see negative divergences in our indicators which may encourage oil bears to go short and possibly trigger a correction.

Please note that if the buyers are not able to defeat the previously mentioned resistance zone, we should prepare for a decline. The first target for sellers may be the 50-day moving average. If it is broken the price may drop to the yesterday’s bottom, at the least.

Thank you,

Nadia Simmons