Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Prophecy Development CEO: Silver is set to outperform gold based on gold/silver ratio

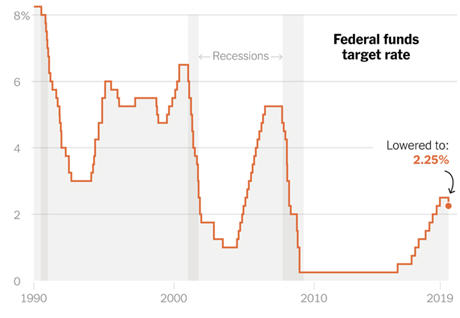

Gold and silver boosted by first Fed rate cut since 2008 crisisThe Federal Reserve cut interest rates on Wednesday (July 31, 2019) for the first time in more than a decade. It was trying to keep America’s record-long economic expansion going by insulating the economy from mounting global threats.

Source: US Federal Reserve

August 1, 2019, just a day after Fed rate cut. US President Donald Trump said the US would place a 10 per cent tariff on $300bn in additional Chinese goods. This escalation of the trade war between Washington and Beijing is a new threat to the global economic outlook. The announcement unsettled financial markets continued on Friday and lead to a haven buying of bonds and a broad equity sell-off.

Gold chart shows 6-year breakout above $1,380. Head and shoulder pattern indicates imminent reaching of $1,660

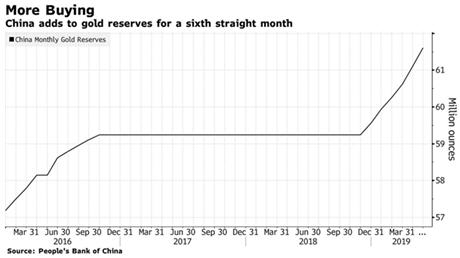

China is buying more gold as the trade war drags on; Russia joins the party.

The rise China’s gold holding reflects the Chinese government’s “determined diversification” away from dollar assets, according to Argonaut Securities (Asia) Ltd analyst Helen Lau. She added that retail demand has also picked up. At this rate of accumulation, China could buy 150 tons in 2019, she says.

“It’s a diversification away from the U.S. dollar, particularly given the trade tensions and the potential technology cold war that’s evolving,” says Bart Melek, global head of commodity strategy at TD Securities. “We have to remember that gold is nobody’s liability.”

Russia’s total gold reserves top $100 billion as central bank adds another 600K ounces in June

Russia bought 200,000 ounces in May, 550,000 in April, 600,000 in March, one million in February, and 200,000 in January.

During the last decade, Russia’s gold reserves have gone from 2% to 19% (as of the end of 2018 Q4), according to the World Gold Council.

With central banks rushing to buy gold, other institutions and retailers will surely follow.

With real estate crumbling, investors rush to gold and silver

- Manhattan real estate had its worst first quarter since the financial crisis, according to a report from Douglas Elliman and Miller Samuel.

- Sales fell 3 percent in the first quarter, which marked sixth straight quarters of decline.

- That is the longest decline in the 30 years that the real estate appraisal firm has been keeping data.

With the housing market toppling, it’s no surprise investors are turning to gold and silver, the hard assets whose value has stood the test of time.

Ray Dalio says gold will be a top investment during the upcoming “paradigm shift” for global markets

Hedge fund multi-billionaire kingpin Ray Dalio is seeing a case for gold as central banks (1) get more aggressive with policies that devalue currencies and (2) are about to cause a “paradigm shift” in investing.