Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Rare earths give abundant returns as investors guess trade twist

Returns for investors in Chinese rare earths stocks are looking anything but scarce.

Investors are piling into the sector on speculation the materials may be weaponized in China’s tit-for-tat trade war with the U.S. President Xi Jinping’s visit to a rare earth facility in Jiangxi last week fueled an initial rally, with shares surging again on Wednesday after a slew of Chinese media reports advocated the threat of using rare earths as retaliation against the U.S.

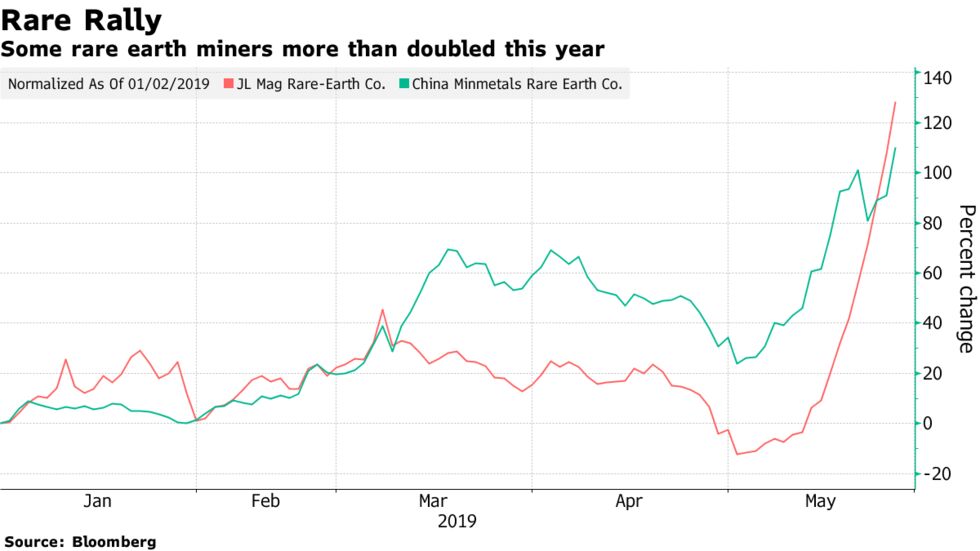

Analysts say domestic producers are the big winners as any curb may boost rare earth prices enough to counter a decline in demand. China Rare Earth Holdings Ltd. ended up 24 percent Wednesday after gaining as much as 41%, and JL Mag Rare-Earth Co., the plant Xi visited, climbed by the 10% daily limit for the seventh time in eight trading sessions. Other companies posted more muted gains, with China Northern Rare Earth Group High-Tech Co. adding 8.7% and Xiamen Tungsten Co. advancing 3.8%. Both JL Mag and China Minmetals Rare Earth Co. had more than doubled this year.

“Prices and margins rising as a result of a decrease in supply would far outweigh the impact of a dent in demand from the U.S.,” said Wang Daixin, fund manager at Bristlecon Pine Asset Management Ltd. in Guangzhou. “I don’t think the price moves in the sector are anything near rational by this point.”

Rare earths are the latest focus of the escalating trade spat after China raised tariffs to 25% from 10% on American imports, while the U.S. excluded the materials from its own list of prospective tariffs. Xi’s visit to Jiangxi and this week’s salvo of media reports has been seen by some investors as a sign that China could be preparing to impose curbs on exports to the U.S. and bolster its domestic industry.

Dependence

The People’s Daily, a flagship newspaper of the ruling Communist Party, said in a commentary that the U.S. shouldn’t underestimate China’s ability to fight the trade war. The country is “seriously” considering restrictingrare earth exports to the U.S., the editor-in-chief of the Global Times, a newspaper affiliated with the Communist Party, said in a tweet. An official at the National Development & Reform Commission told CCTV that people in the country won’t be happy to see products made with exported rare earths being used to suppress China’s development.

The U.S. relies on China for about 80% of its imports of rare earths, the group of materials that are used in everything from electric cars to high-tech military equipment. Rare earths, which include elements such as cerium and dysprosium, are relatively abundant in the Earth’s crust but mine-able concentrations are less common than other ores.

China produces about 70% of the world’s mined rare earths and its industry is dominated by a handful of producers including China Northern Rare Earth, China Minmetals Rare Earth Co., Xiamen Tungsten and Chinalco Rare Earth & Metals Co. Some of the country’s listed rare earths stocks are small caps, making them easy targets of speculation.