Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Rush for cobalt, lithium as prices stay on the boil

A little heat has gone from the market for battery materials but the sector's very much still on the boil.

Last week cobalt quoted on the LME retreated from 9-year peaks to finish below $80,000 a tonne for the first time since mid-January. But the price of the metal – now constituting less than 50% of global cobalt production – is still up 64% compared to March last year.

Lithium carbonate prices have also been drifting lower recently but remain comfortably above $20,000 a tonne from $6,450 per tonne at the beginning of 2015. Top producer SQM said last week it expects first half lithium prices to average 20% above Q4 2017, although the Chilean giant forecasts prices will decline in the second half of 2018 compared to H1.

Nickel, where EVs hardly registers on the demand side compared to steelmaking, have also been swept up by the positive sentiment and despite the pullback from February highs above $14,000 a tonne, the metal is still up 9% in 2018 following a 25% jump last year.

Nickel, where EVs hardly registers on the demand side compared to steelmaking, have also been swept up by the positive sentiment and despite the pullback from February highs above $14,000 a tonne, the metal is still up 9% in 2018 following a 25% jump last year.

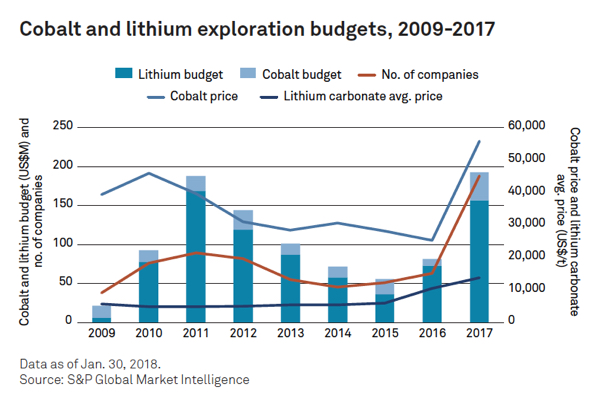

A new report released by S&P Global illustrates the rush now on to secure battery metals. While the number of projects reporting drilll results rose by 14% in Q4 2017, drilling at minor base metals exploration sites tripled to 18 with 14 of them for cobalt. Nickel drill results jumped by 50.