Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Silver Poised for a Breakout

Technical analyst Clive Maund discusses why he believes silver is amazingly cheap and a sure sign that a major precious metals sector bull market is starting.

We have already been over the reasons why a major precious metals (PM) sector bull market is starting, and remarked on how undervalued silver is compared to gold, and how this is typical at the start of a major sector bull market. But it is worth "thumping the table" over this, because silver and silver investments may well be the best place of all to put your money at this time.

Many silver investors are manic-depressive and fanatical, which is a reality that we can turn to our advantage, for if we can figure when they are just starting to emerge from the depths of despair, it is the time to move into the sector in a big way.

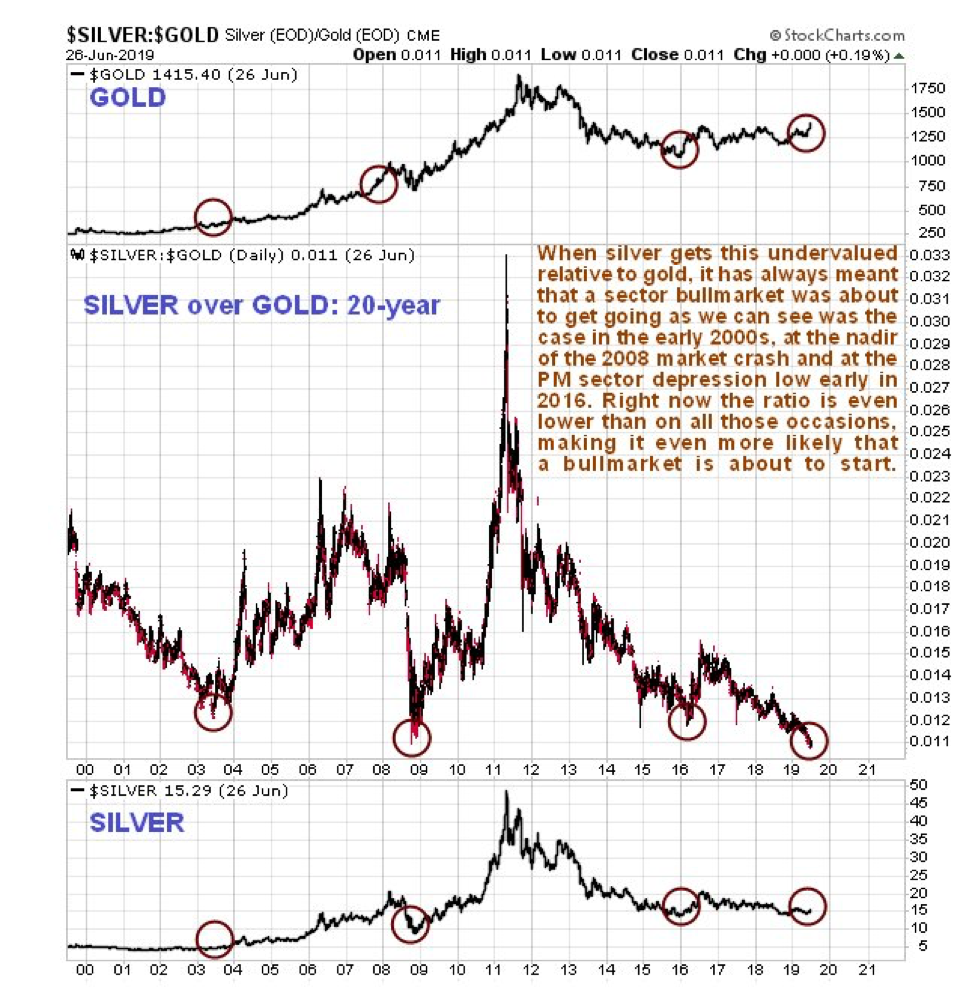

They are just starting to emerge from the depths of despair right now as it happens, which is shown graphically by the silver-to-gold ratio, the basis of which is that when investors in the sector are at their most risk-averse, they tend to favor gold over silver. This is hardly surprising, as gold conjures up images of solidity and security to a much greater extent than silver, which is also known as "poor man's gold."

It is thus most illuminating to observe a long-term 20-year chart of the silver-to-gold ratio. Here we see that the rare occasions where it has dropped to the extremely low levels it is now at have always preceded a major sector bull market, except early in 2016, which preceded a big rally. What is remarkable right now is that this ratio has even exceeded its earlier record lows, which makes a new sector bull market even more likely. This indicator, just by itself, is a strong sign that this is what's brewing.

Now to examine silver's latest charts to see how it is shaping up.

On the six-month chart we can see that although silver has reversed, breaking out of its preceding downtrend into a new uptrend, it has still only risen by a meager $1 from its late May lows—big deal!! Rather than being upset by this, we should be thankful that it hasn't risen more, because otherwise silver investments would have gone through the roof. Silver's restrained performance so far is giving us more time to buy investments across the sector before it really gets moving. An important point to note before leaving this chart is the strong volume on a big up-day last week, which was the second biggest up-day volume in history, which is a very bullish sign.