Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Skyharbour Resources – Advancing on Three Fronts

Life hasn’t been easy for uranium companies and only a handful of investors haven’t lost faith in the prospects of the uranium market and we hope the expression ‘it is usually the darkest right before dawn’ will hold up in this case as the fundamentals of the uranium market remain positive for a bullish set-up. Yes, tough to believe, but in this report, we will provide an updated background of the uranium market to explain why we still believe in higher uranium prices although we wholeheartedly admit it is taking much longer than we expected a few years ago.

Skyharbour Resources (SYH.V) is one of the companies that has been able to raise sufficient amounts of money to keep on advancing its properties. In addition to offering investors high-grade uranium discovery potential, a few years ago as a part of its prospect generator strategy, the company attracted two partners to work on two of its projects. Skyharbour has also now retained full ownership of its flagship Moore uranium project which means the company is advancing on three different fronts.

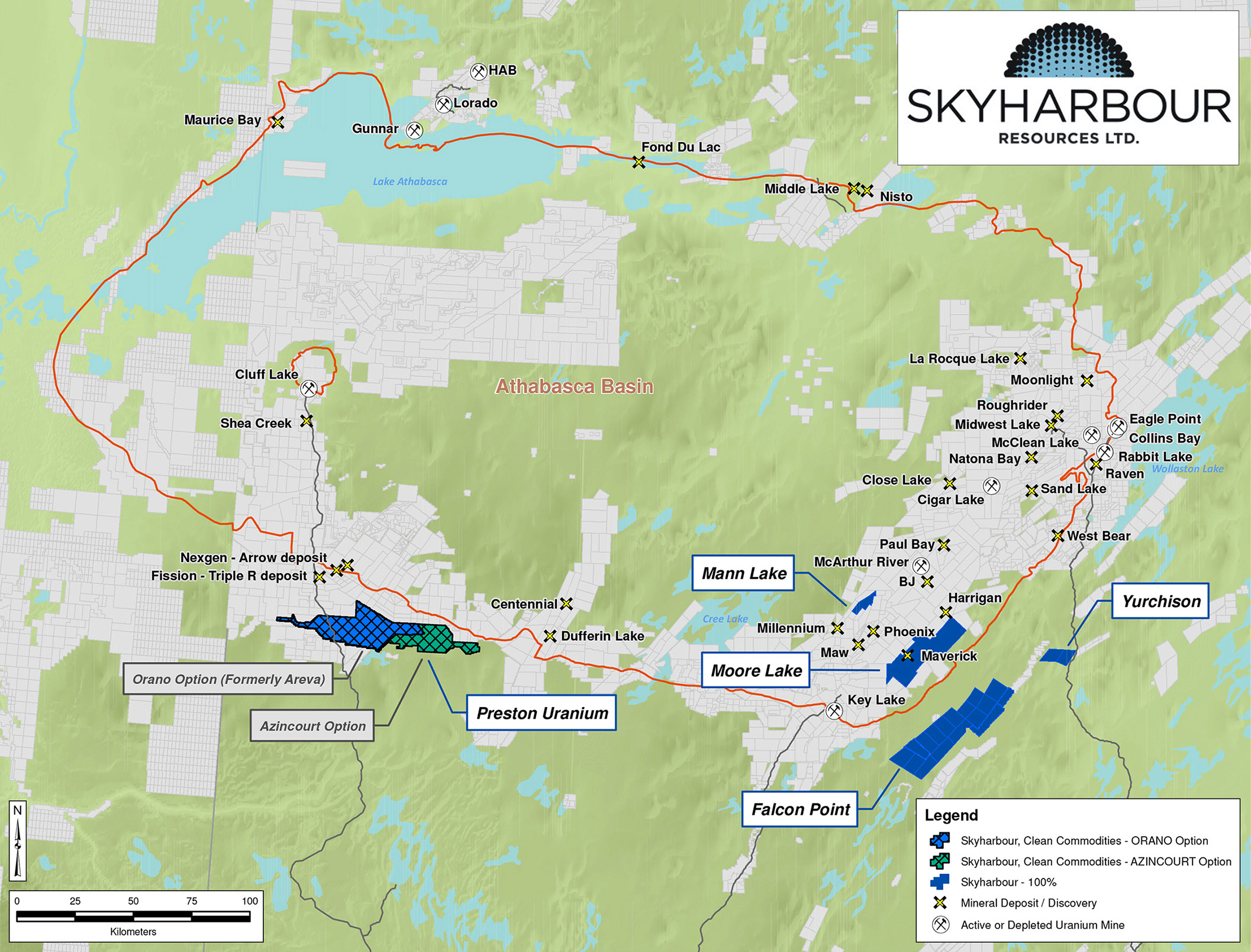

Skyharbour Resources Project Locations

Skyharbour has just announced the commencement of its 2020 winter drill program

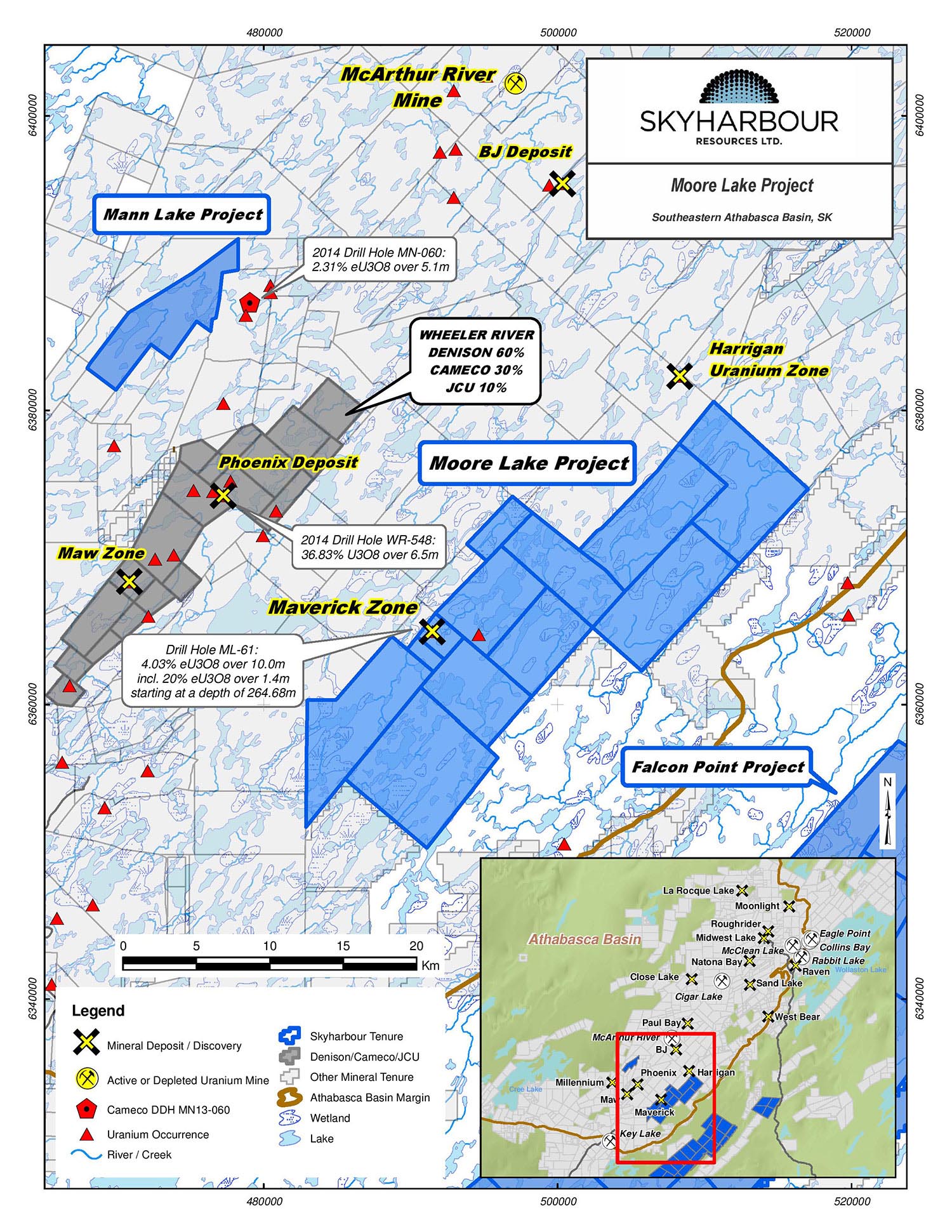

Skyharbour Resources (SYH.V) has announced it has started its winter drill program on its Moore Uranium project in Saskatchewan’s Athabasca Basin proximal to Denison Mines’ (DNN, DML.TO) Wheeler River project. Denison is a large strategic shareholder and partner company of Skyharbour.

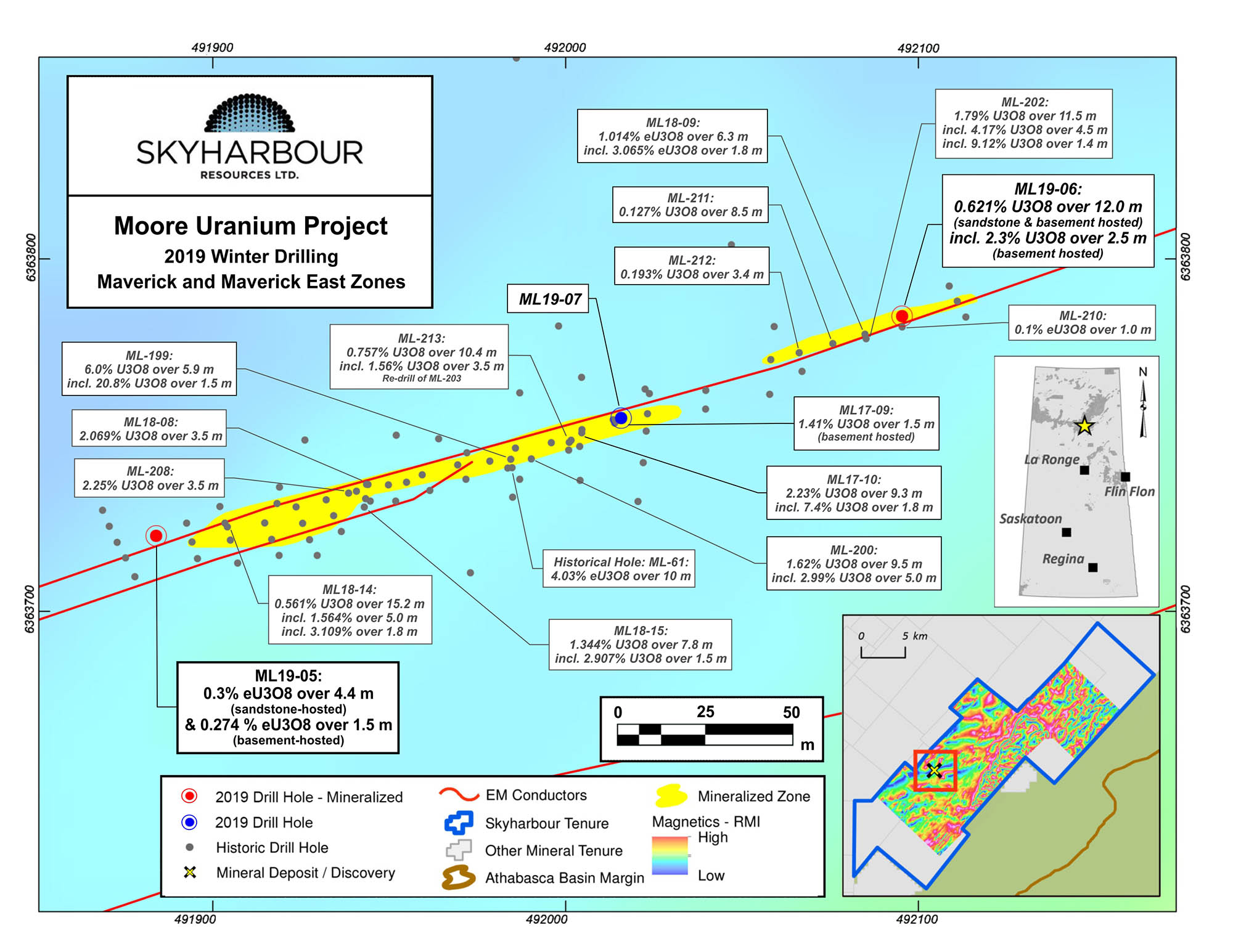

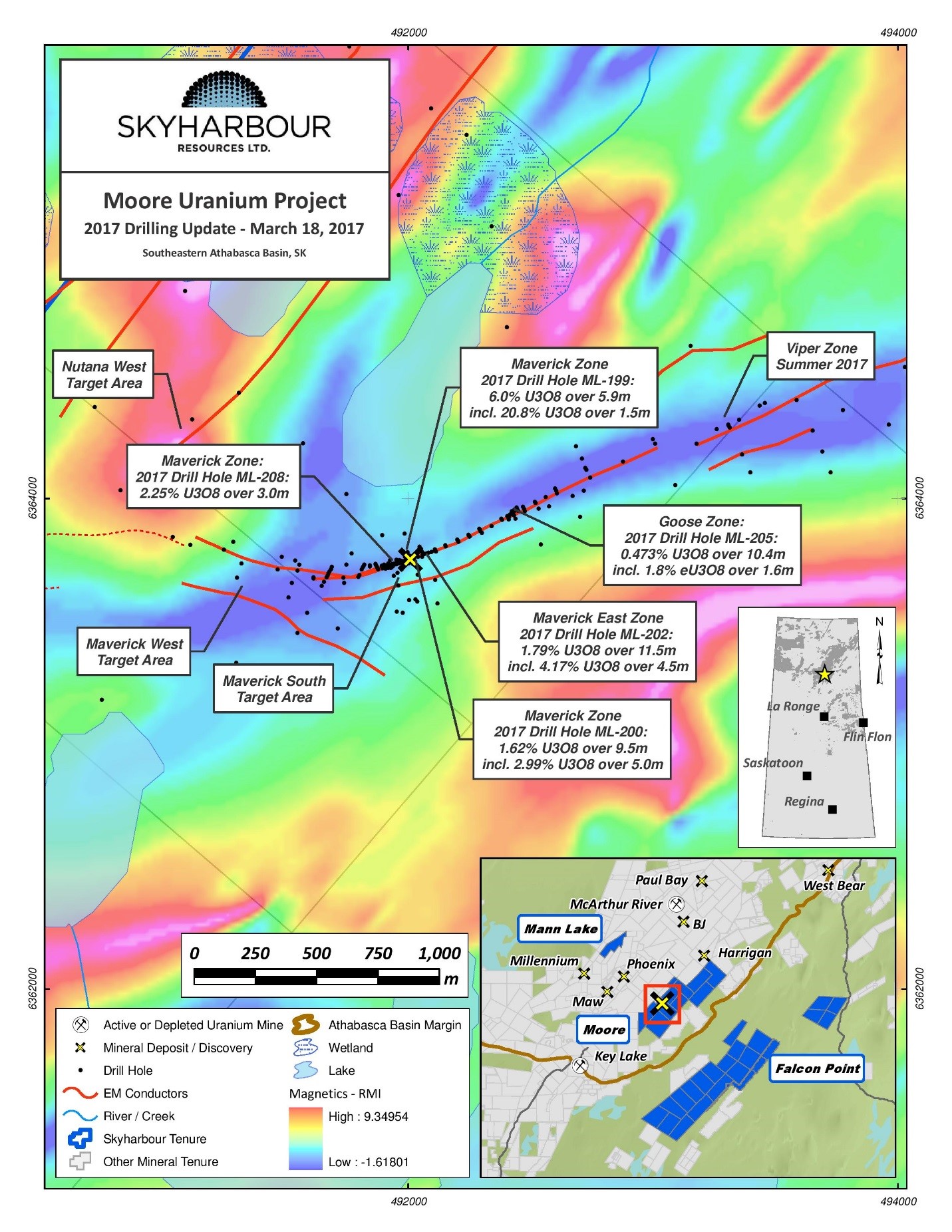

The company plans to drill a total of 2,500 meters in 7-9 holes where Skyharbour has done additional work to upgrade the ‘interesting’ zones to high-priority drill targets. Over the past six-seven months, Skyharbour has done a lot of geophysics and geologically modeling to further refine the targets and this drill program that has just been announced will focus on these high priority drill targets along the four-kilometer long structural corridor at Maverick. With a focus on basement rock hosted targets.

At Maverick East, Skyharbour will follow up on the best hole it has drilled in 2019 which consisted of 12 meters containing 0.62% U3O8 for a gross rock value of $545/t using a uranium price of $40/pound (and about $325/t using the current spot price for uranium) including a narrow but very high-grade interval of 2.31% U3O8 over 2.5 meters. As the exploration season came to an end before Skyharbour was able to follow up on this hole, the company must be very keen to re-test this target and according to its press release, Skyharbour will be focusing on the strike extensions and potential zones down dip of last year’s high-grade basement hosted discovery.

Additionally, Skyharbour will also drill-test the potential north-eastern extension to the Maverick mineralized corridor and the other exploration targets there are 0.5-1.5 kilometers away from the ‘main’ Maverick zone and within the 4 kilometer long structural corridor that hosts the mineralization at Maverick. These other mineralized zones have already been the subject of drill programs but as the spacing between drill holes was quite wide, Skyharbour will now narrow down its focus and zoom in on the most promising areas and we are looking forward to see if the refined exploration targets in the underlying basement rocks will help the company find wider mineralized intercepts (historical drilling did encounter some uranium mineralization but generally in narrow intervals). Most exploration targets that will be drill-tested by Skyharbour are basement-hosted as this is where the feeder zones to the high grade mineralization in the sandstone and at the unconformity are located. Worth noting is that at the current valuation, one high grade drill intercept can change the fortunes of the company and management of Skyharbour clearly recognizes this as they have been accumulating shares over the last 6 months.

Moore Project

The company will be advancing on three fronts – thereby confirming the prospect generator model in the uranium space

Skyharbour’s own 2,500 meter drill program announcement comes hot on the heels of the announcement of option partner Azincourt Energy (AAZ.V) which announced the start of its own 2,500 meter drill program on the East Preston uranium project where it is currently earning a 70% stake. Azincourt aims to drill up to 15 holes and has earmarked C$1.2M for drilling purposes at the East Preston project.

This means Skyharbour will be able to announce drill results from two projects where a cumulative 5,000 meters of drilling will be completed. Its other option partner Orano (previously AREVA) announced a large geophysical field program at Skyharbour’s Preston project which will commence soon followed up by drilling later in the year. Keep an eye out for updates on these programs.

Click here to continue reading...

Click here to see more from Skyharbour Resources Ltd.