Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

The Electric Vehicle Future Is Already Boosting Miners’ Earnings

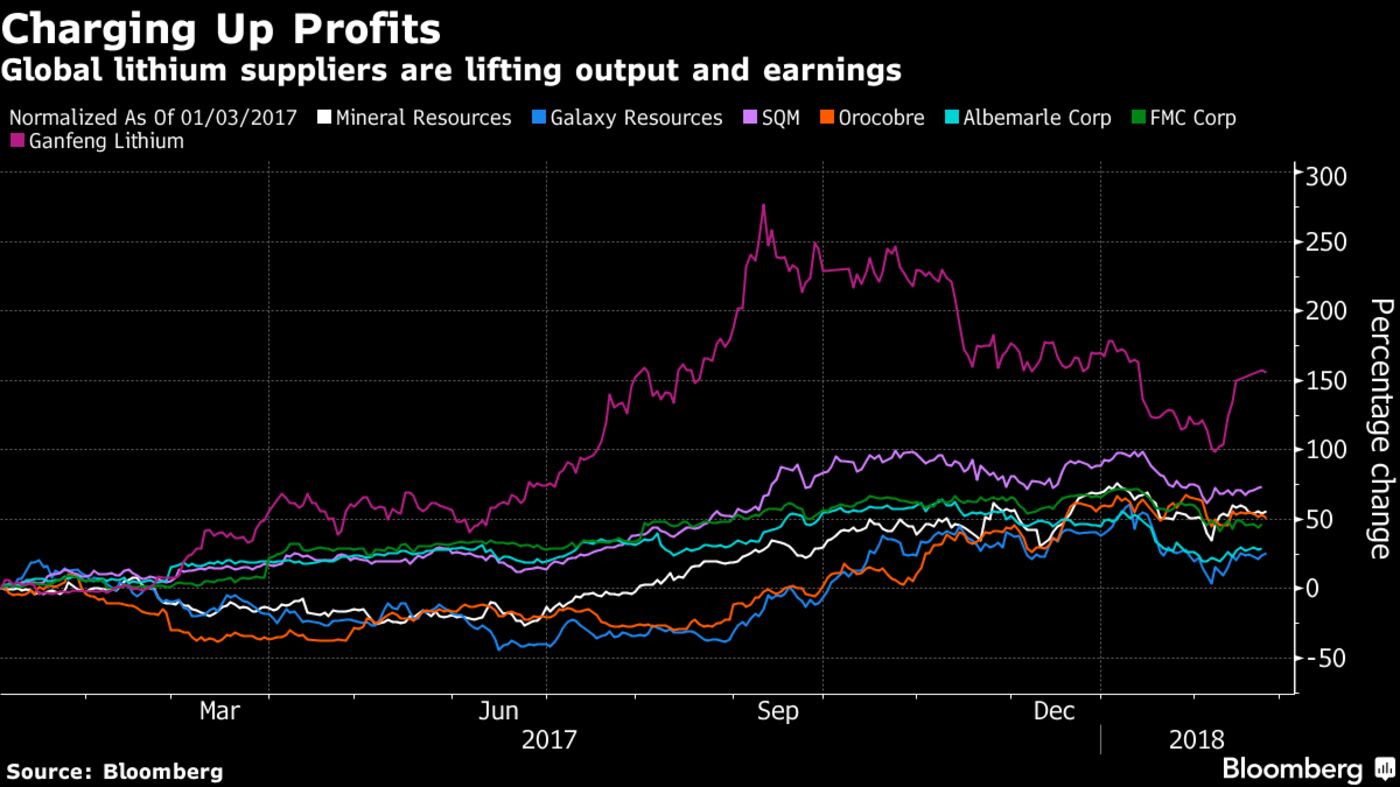

The booming electric vehicle revolution is flowing through to the bottom line of a growing list of global miners, who are reaping higher profits from rising demand for battery raw materials.

Orocobre Ltd. reported Friday that net income rose 11 percent in the December half and forecast lithium prices to gain about a quarter this half. The supplier, with an operation in Argentina, follows miners from the U.S. to Australia, including FMC Corp. and Mineral Resources Ltd., in posting earnings gains on firming prices and higher volumes.

“All of the international producers will have had increases in their contract pricing for this year’s deliveries,” Orocobre Chief Executive Officer Richard Seville said in a phone interview. The outlook for further price gains is strong as rivals add higher-cost supply to meet accelerating demand, he said.

Prices of key ingredient lithium are continuing to gain on tight markets and as auto makers including Daimler AG to Ford Motor Co. set out ambitious plans to expand EV production. Average global lithium carbonate prices jumped 9 percent last month, according to Benchmark Mineral Intelligence data.

The lithium industry is also beginning to showcase stronger earnings as miners, including Albemarle Corp. and Sociedad Quimica y Minera de Chile SA, look to bolster production, according to Seville. “They are all delivering profit growth in this sector.”

Philadelphia-based FMC, a top five producer, said this month annual revenue from the battery material jumped about a third in 2017. Albemarle and SQM, the No. 1 and No. 2 suppliers last year, are scheduled to report earnings next week.