Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

The Gold Rush Heats Up as Sub-Zero Yields Spread

Gold, once mocked for its lack of yield and practical use, offers something the growing pile of negative-yielding bonds doesn’t -- inflation protection. Plus, it makes a great doorstop.

As holders of promissory notes issued by sovereigns and companies watch the real value of their savings drain away amid central bankers’ efforts to kick-start growth, the allure of one of the oldest investment assets has become ever stronger. These five charts show just how popular gold has become -- and how closely it’s linked to the downward spiral in yields.

The Breakthrough

For five years, resistance above $1,350 an ounce was too much for bullion to overcome. That changed in June, as it became clear the Federal Reserve was heading for a round of interest-rate cuts. Spot prices touched $1,453.09 on Friday, the highest level since May 2013 as global factory output slows and the market debates whether Chairman Jerome Powell will cut rates by as much as 50 basis points in July. The metal traded near $1,440, with silver climbing.

For a look at the history of gold’s ups and downs, click here

Really Yielding

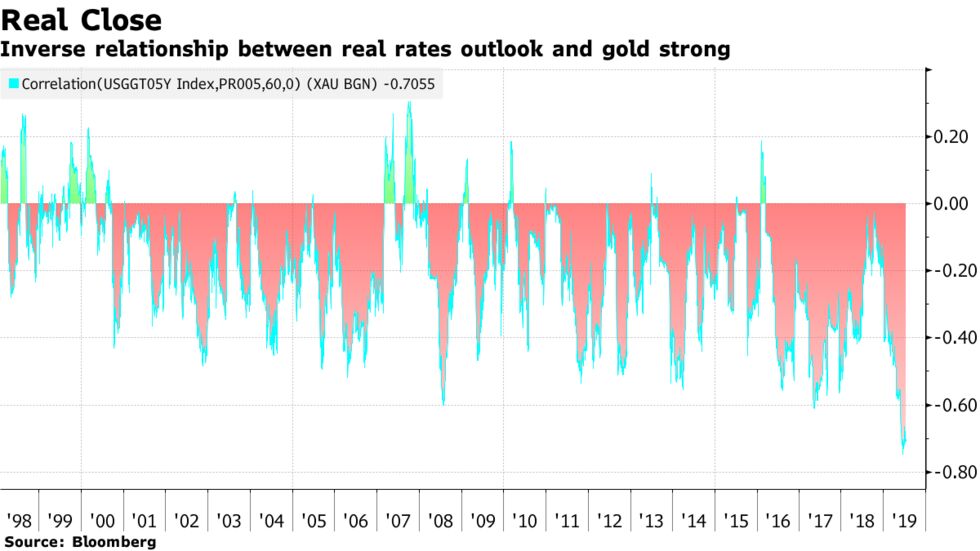

Gold’s inflation-busting properties and low opportunity cost when interest rates drop have never been as important as now. The inverse relationship between bullion’s price and U.S. real rates expectations, as measured by the yield on five-year inflation-linked Treasuries, is the strongest it’s ever been. The correlation measured over 60 days hit -0.7 as bullion climbed.

Below Zero

Even before accounting for the effects of inflation, the universe of bonds yielding less than nothing hit a record $13 trillion this month. Add in the corrosive effect of general price rises, and that number swells to $25 trillion. It could even top $30 trillion if the Fed cuts rates twice this year, according to data compiled by Bloomberg.

Not Zero

Of course, gold doesn’t yield nothing -- it yields less than nothing. In fact, it’s probably the original negative-yielding asset. Storing gold in a vault costs money. Some firms in London, a city known as a gold-storage hub, charge private clients between 12 and 20 basis points of the value of the metal for a year’s storage in secure vaults. Big clients, like central banks, may be able to secure deals closer to 8 basis points. Similarly, holding metal in an exchange-traded fund costs money. Nevertheless, the amount of metal stored in high-security facilities registered with the London Bullion Market Association started rising in October and continued doing so through March, the last date for which data was available. That’s probably because even at -0.2%, it looks a better deal than many bonds.