Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

The Lithium Sector Surge Is Poised to Ignite a Deals Bonanza

The tripling in lithium prices over three years is poised to fuel a multi-billion dollar rush of deals as major players jostle for dominance to supply the metal needed for the electric vehicle battery revolution.

China’s expected to lead a mergers and acquisition bonanza as companies seek to wrest more control of the market from Western rivals. The Asian nation accounted for more than half of global electric vehicle sales last year, which exceeded 1 million for the first time. And that’s just a taster of what’s to come as the government targets 7 million vehicles by 2025.

“You’ll see elevated activity this year driven mainly by the Chinese,” Chris Berry, a New York-based analyst on energy metals, and founder of House Mountain Partners LLC, said in an email. “The consolidation necessary in the space will start to happen now.”

China’s biggest supplier, Ganfeng Lithium Co., aims to deploy proceeds from a planned Hong Kong listing to extend an acquisition spree. It could raise about $1 billion, according to a person with knowledge of the details, who asked not to be identified because the information is private. The number of shares and proceeds haven’t been finalized pending approvals from the regulators, a company official said Tuesday.

Suitors including Tianqi Lithium Corp. are weighing offers for Nutrien Ltd.’s $4 billion stake in South America’s lithium giant Soc. Quimica & Minera de Chile SA. Tianqi has been considering a a Hong Kong share sale that could raise as much as $500 million, people with knowledge of the matter said earlier this month. Shaanxi J&R Optimum Energy Co. has held talks on a potential takeover of a new Australian miner.

Albemarle Corp., the world’s top producer, said this month it also has the firepower for potential purchases. Philadelphia-based FMC Corp. is planning to spin off its lithium business, a top five producer of the metal, in the third quarter of this year in a deal the company has said could value the unit at $3 billion.

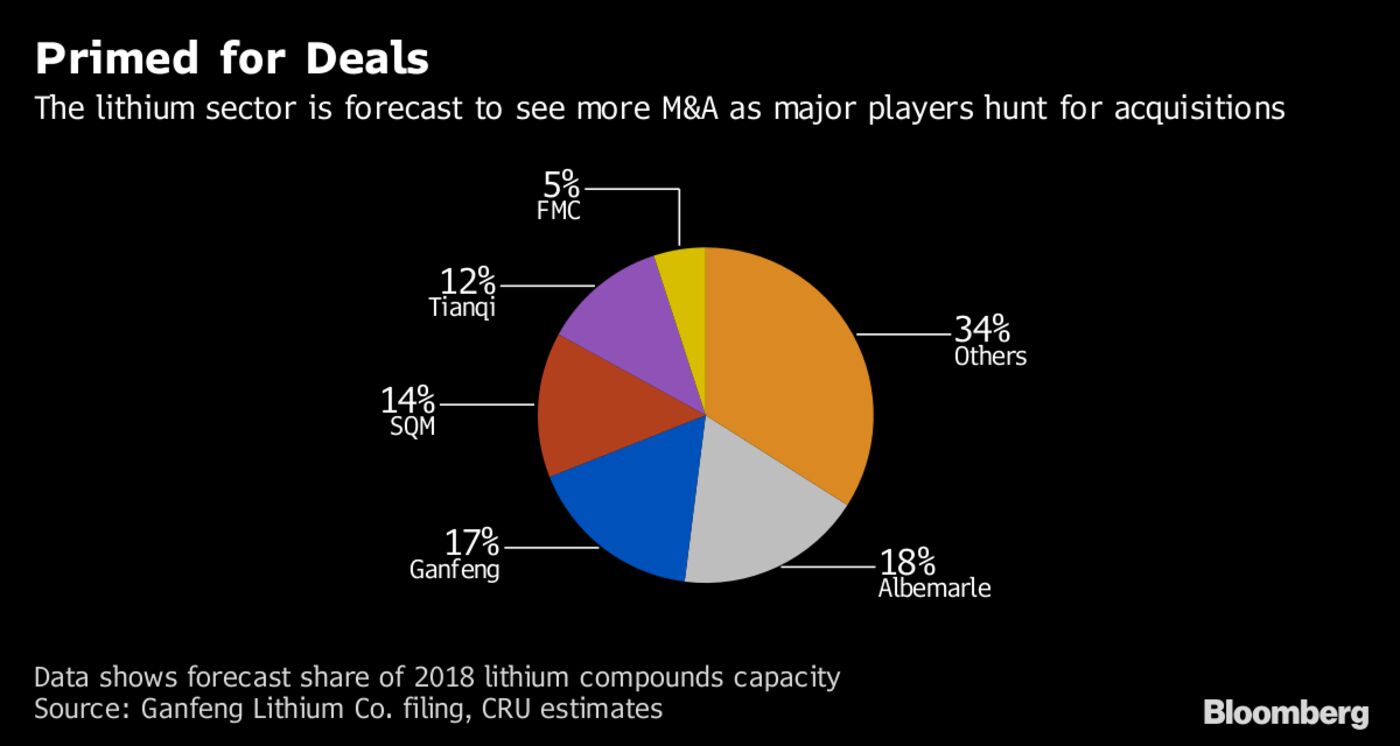

Already, China’s Ganfeng and Tianqi have grown rapidly in recent years to challenge the trio of producers that have long dominated the market -- Albemarle, SQM and FMC. “There will be one or two new players in the oligopoly,” said Tom Hodgson, chief executive officer of Vancouver-based Lithium Americas Corp.

The chase for deals is raising competition concerns. Earlier this month, Chile’s government agency Corfo filed a request with the National Economic Prosecutor asking antitrust authorities to block the sale of the SQM stake to any Chinese state-owned company.

End-users are also entering the fray. Toyota Group’s trading unit in January took a 15 percent stake in Orocobre Ltd., which produces lithium in Argentina, while Australia’s Pilbara Minerals Ltd. has won investments from South Korea’s Posco and China’s Great Wall Motor Co.