Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

The New Era

Gold continues to deliver strong relative performance and is up 12.97% on a year-to-date basis through April 27, 2020, versus -10.36% for the S&P 500 Total Return Index.1

Through Close on Monday, April 27, 2020

| Asset | YTD | 1 YR | 3 YR* | 5 YR* |

| Gold Bullion | 12.97% | 33.10% | 10.65% | 7.33% |

| S&P 500 TR Index | -10.36% | -0.11% | 8.52% | 8.59% |

* Average annual total returns. Source: FactSet.

A Pile of Debt

Prior to Covid-19, the financial markets had become dependent on liquidity provided by central banks around the globe. The modest ~2% annual economic growth post the great financial crisis ("GFC") was underpinned by constant monetary accommodation by the central banks, as well as by growing fiscal deficits. That combination served to extend the business cycle into one of the longest expansions on record, but at the cost of incalculable malinvestment and a record pile of debt which can never be repaid without more accommodation and financial repression.

Like over-served party guests, not many investors or voters seemed concerned about the long-term implications of the build-up in debt to record levels against underlying GDP (gross domestic product), the unprecedented debt issuance by most sovereigns or the ballooning budget deficits. The strong suit of democracy has rarely been to encourage elected representatives to make good forward-looking decisions when they involve making present-day sacrifices.

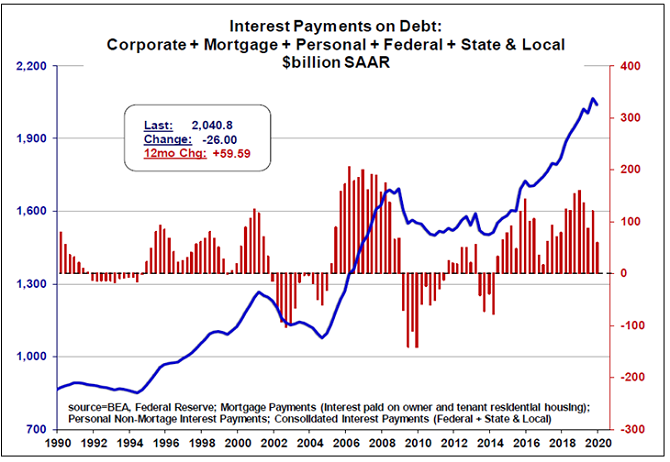

Figure 1. The Cost of Financing the Credit Bubble

Source: Meridian Macro Research LLC. Data as of 3/31/2020.

COVID-19 Pandemic Pulls the Trigger

At the dawn of this new decade, the steady provision of liquidity had priced almost all markets to perfection:

- The S&P 500 was trading at a large premium to long-term valuation multiple ranges;

- There was a record portion of assets in funds managed primarily by computers;

- There was more debt trading at negative yields than at any time in history;

- There had been a 30-year bull market in bonds;

- Investment real estate was traded on the most levered basis and at the lowest cap rates;

- There was record debt at all levels on actual and percentage basis (government, corporate and personal);

- There was a record total of unfunded future liabilities;

- There had been unprecedented, coordinated intervention and accommodation in almost all financial markets by governments around the world over the past 1, 3, 5 and 10 years.

This bubble was popped when lockdowns were required to protect the population, and the vastly under-funded and unprepared healthcare systems, from the COVID-19 pandemic. Neither consumers, businesses, nor governments had the wherewithal to withstand an extended furlough, and the economic shockwaves quickly required emergency actions. The markets did not have enough liquidity to meet the sudden increase in volatility and corresponding de-leveraging, or the need for U.S. dollars for repayment and margin.

The New Era of Big Government

We are now entering a period in which public officials will control many more levers than in the past. Governments globally have pledged unlimited financial support for markets. We know that healthcare spending needs to ramp up significantly. Most governments have committed to supporting the pay of furloughed workers. We await government policies on emerging from this lockdown, which likely involve complicated start-up protocols and, inevitably, the promise of more fiscal stimulus

Super Bank to the Rescue

In the same spirit and once again, central planners have rushed to the rescue of the broader markets, consumers and specific industries. This time around, many economic sectors including retail, real estate, hospitality, travel, energy and high-yield banking all face major challenges. There is no appetite for austerity or consequences, only a tendency to fix every problem with a government-engineered solution.

Accordingly, many programs with new acronyms are forthcoming, a summary of which would be too lengthy to cite. The scale of this money printing, which by some counts will hit $7 trillion in the U.S. alone, is shocking in size and scope. It is difficult to follow how adding more short-term, Fed-guaranteed debt or securities purchases fixes a revenue problem for most businesses, workers and consumers affected by the shutdowns. We concede that one of the biggest problems in printing that much money is how to get it into the right hands.

We are clear on one thing: the Federal Reserve has been thrust into a new mandate with broadened scale and scope. Specifically, using its emergency authority under Section 13 (3) of the Federal Reserve Act, the Fed will now (a) indirectly lend to municipalities, companies and consumers, and (b) indirectly purchase securities of specific companies and (b) cooperate with the U.S. Treasury to provide virtually unlimited funding to the Treasury, bank, corporate and consumer markets. Two weeks ago, the Fed struck a new note by announcing that its 19 appointed officials will now pick securities for purchase, including "fallen angel" high-yield bonds.

Based on overwhelming odds that recovery will take some time, we have little doubt that the trillions of dollars already approved for stimulus will require hefty increases in the coming months.