Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Uranium Mining: The Inflection On The Horizon

Summary

Construction of nuclear power reactors underpins a secular growth in the demand for uranium.

The uranium mining industry, however, is a bona fide cyclical industry.

After a 10-year-old downtrend, uranium price may finally see light at the end of the tunnel, with major producers cutting production.

Although the industry still needs to work off a large amount of inventory, it is time to look closer at opportunities in this interesting corner of the energy sector.

This idea was discussed in more depth with members of my private investing community, The Natural Resources Hub.

Do you know that one uranium fuel pellet - about the size of your fingernail - produces the same amount of energy as 17 Mcf of natural gas, 149 bo, or 0.81 metric tons of coal? - Anonymous

Note: This article is the first in a multi-piece treatise on the uranium mining industry. In Part 1, I examine the demand-supply picture to locate where the uranium industry currently is in the cycle. In Part 2, I intend to study the competitive landscape of the uranium mining industry based on a database I have been building. Thereafter, I plan to establish a valuation framework and use it to select a number of investible targets, which will be examined in detail to come up with actionable investment theses.

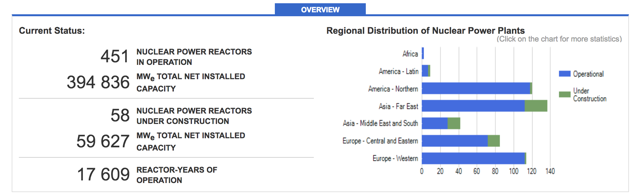

Nuclear Power Generation

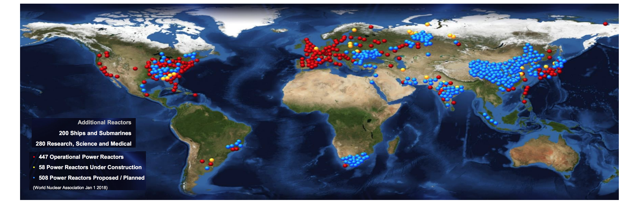

According to International Atomic Energy Agency (IAEA), there are a total of 451 nuclear power reactors currently in operation, with 394,836 Mega Watts electric (MWe) of net installed capacity. There are an additional 58 nuclear power reactors that are under construction (Fig. 1).

Fig. 1. The current status of nuclear power reactors. Source.

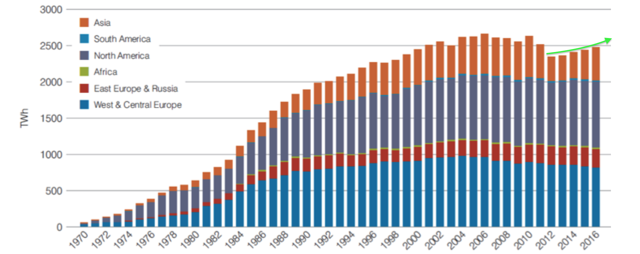

The Fukushima Daiichi nuclear disaster in Japan, initiated by the tsunami following the Tōhoku earthquake on March 11, 2011 (see here), delivered a setback to nuclear power generation.

However, merely one year after the disaster, worldwide nuclear power generation had resumed growth (Fig. 2).

- The Japanese are in the process of restarting the halted nuclear reactors, with seven having been brought back into operation as of March 2018 (see here) and 17 currently in the process of getting restart approval (see here).

- Of Japan's total of 54 reactors, some 42 are currently operable and may restart eventually (here).

Fig. 2. Historical nuclear power generation. Source.

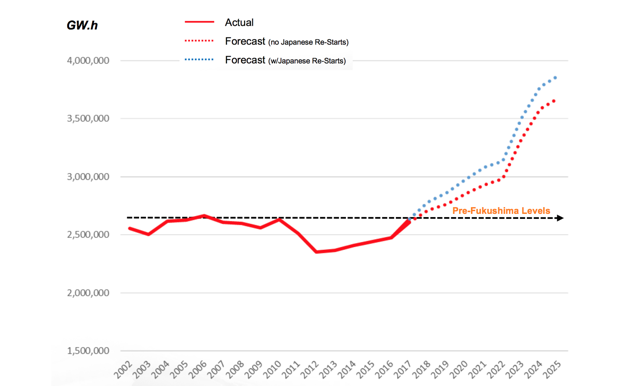

Each year, between 6 and 8 nuclear reactors are constructed, which is anticipated to increase to 10 per year after 2020 (see here). These new builds will significantly increase nuclear power generation capacity over the next few years (Fig. 3).

Fig. 3. Forecast power generation increases with reactors under construction or scheduled for construction considered. Source.

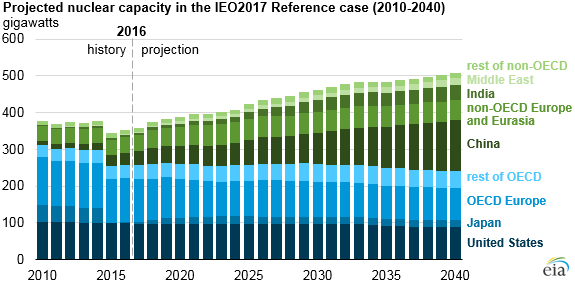

The International Energy Outlook 2017 projects that global nuclear power capacity will grow at an average annual rate of 1.6% from 2016 through 2040. China, India, and Russia are building over half of the new nuclear power reactors in the world (see here). Growth in nuclear power capacity in non-OECD countries is expected to offset declines in nuclear power capacity in the United States, Japan, and Europe (Fig. 4)(see here).

Fig. 4. Projected nuclear power generation capacity. Source.

Long-Term Uranium Demand

Uranium production from mining is used almost entirely as fuel for nuclear power plants. At any rate, the secular growth of nuclear power generation is the driver behind the rising demand for uranium in the long run. To produce 1 GWh of electricity, some 50-90 lbs of U3O8 are required depending on the specifics of the reactor. Global demand for uranium is projected to increase by 1.6-3.1% annually through 2025 (see here and here).

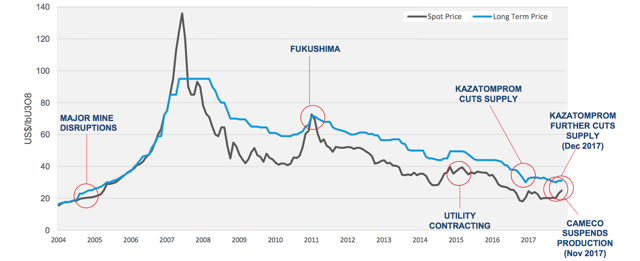

Such a demand growth, nonetheless, has not led to a lot of long-term supply contract signing in recent years because, on the one hand, the nuclear power industry could tap into the spot market where price has been much lower than the long-term contract price since 2008 (Fig. 5); on the other hand, the mining companies resisted locking-in long-term sales commitments at such low prices.

- In 2017, the U.S. nuclear power industry signed 29 new spot deals totaling 3.2 million pounds of U3O8e at a weighted-average price of $20.72/lb and only five long-term contracts totaling 1.5 million pounds of U3O8e at a weighted-average price of $21.03 (see here).

- Worldwide, there are over 1 billion pounds of U3O8 requirements in the decade between 2018 and 2027 which are not under long-term contracts (see here).

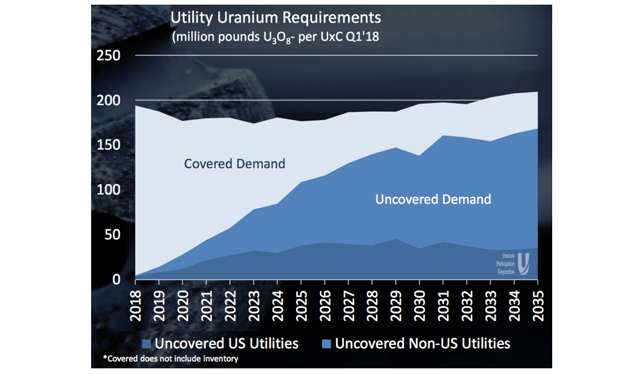

- Approximately 24% of uranium demand will be uncovered by long-term contracts by 2021, and 62% by 2025 (Fig. 6).

Fig. 5. Uranium spot and long-term price. Source.

Fig. 6. Uranium requirements of nuclear power generation (million pounds of U3O8- per UxC 1Q2018). Source.

Cyclical Uranium Mining

A secular growth in demand in uranium has not translated into a sustained high uranium price. After all, uranium is a commodity, undifferentiated from one producer to another. Nuclear power plants can shop from a global market for the lowest spot price. Without any pricing power to fall back on, the uranium miners typically undercut each other while chasing sales volume, thus resulting in production growth accompanied by a falling price.