Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Why the lithium bears are wrong

Economics has been called “the dismal science” for its conclusions which often suggest miserable outcomes for humanity. The saying was born in the 19th century by Scottish writer and philosopher Thomas Carlyle, who was referring to economist Thomas Malthus. Malthus famously calculated that humanity was trapped in a world where population growth would outstrip resources and lead to widespread misery including starvation – a condition known as “The Malthusian dilemma.”

Economics is dismal for another reason: it often fails to make accurate predictions.

We see this in the monthly US employment figures which are usually wrong, and in the copper supply projections trotted out by commodities analysts. Every year these analysts dutifully tally up the predicted market supply tonnage based on output targets from the major producers, and almost every year they turn out to be wrong. Why? Because these so-called experts failed to account for the gaps in output that occur due to strikes, extreme weather, bans on concentrate shipments, or any other reason why a mine closes temporarily due to “force majeure”.

Now the same thing is happening with lithium, with two recent reports coming up with predictions of a slide in lithium prices due to a glut of new supply overwhelmingly the tiny (by mining's standards) lithium market.

What is puzzling is that both of these reports either gloss over or fail to adequately break down the demand side of the lithium market – something we at Ahead of the Herd did some time ago in a separate article. The conclusion we came to was that lithium demand is skyrocketing, and will continue to do so in coming years, due to the irreversible trend of moving from internal combustion engine-powered vehicles to electric vehicles. The trend is particularly evident in Asia. China is the largest EV market by volume, while Japan is number three behind the US. India is also aggressively ramping up EV targets. Of course we've seen the demand scenario play out through lithium prices, which have doubled in the last two years and are current trading at around $23,000 a tonne for battery-grade lithium carbonate. Still, the lithium bears are coming out from hibernation, and lithium stocks have been taking it on the chin. This article will show why they're wrong.

The lithium bears

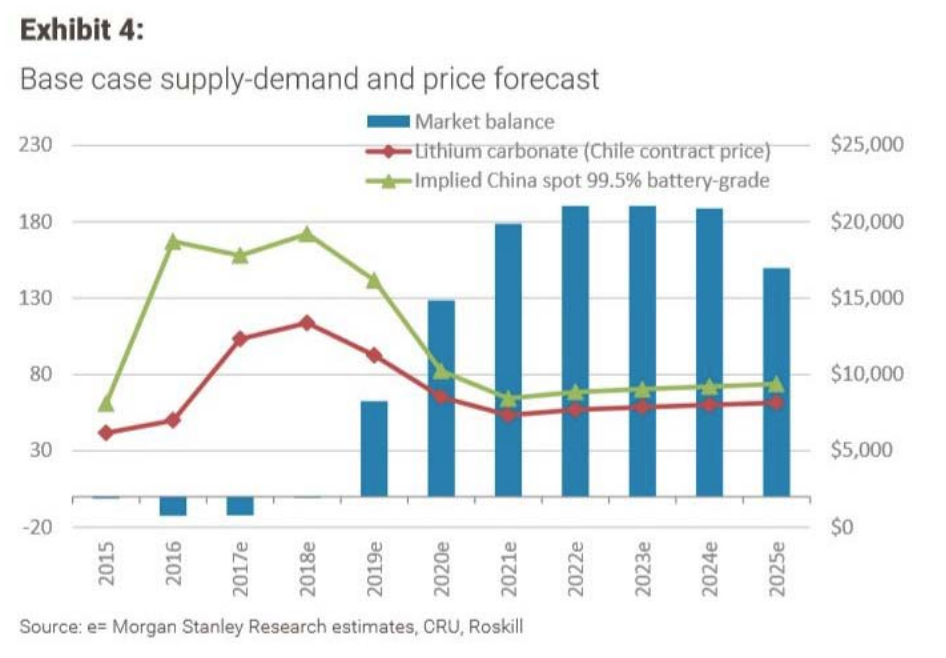

In February investment bank Morgan Stanley was first out of the gate with a damning report on lithium; its research team concluded that an avalanche of lithium was in the works and would put the roughly 200,000 tonnes per year lithium market into surplus. The glut would mean a fall to around US$13,000 a ton in 2018, before halving to $7,000 by 2021.

“A host of lithium projects and expansion plans – including increased production by low-cost Chile brine operator SQM – threatens to add 500 kilotonnes per annum to global lithium raw material supply by 2025, swamping forecast demand growth,” Morgan Stanley said.

The main reason for Morgan Stanley's argument for oversupply was the recent government approval in Chile for mine expansions which would “open up the floodgates” to new lithium product. That is referring to a deal struck in January between Chilean development agency Corfu and SQM, Chile's largest lithium producer, over lithium royalties in the Salar to Atacama, one of the largest and highest-grade lithium deposits in the world. The deal frees SQM to boost its production quota in exchange for higher royalty rates equivalent to those paid by competitor Albemarle. It also permits SQM to work with state copper miner Codelco to start developing the Maricunga lithium deposit – the second largest lithium-bearing salt brine deposit in Chile. In all the agreement allows SQM to produce up to 216,000 tonnes of lithium carbonate a year from the Salar de Atacama. Lithium supply could also increase due to the election of a new president in Chile, Sebastian Piñera, whose National Renewal Party is open to revisiting a law prohibiting lithium production above 80,000 tonnes.

The bank put out a base-case supply-demand and price forecast leading up to 2025, indicating that lithium prices in China and Chile would trend below the market-equilibrium price for the next seven years. Curiously though, the report skewed heavily towards supply with little to no mention of demand.

Morgan Stanley also noted that brine production in Chile has been constrained due to high amounts of magnesium, an impurity in the metallurgical process, but “this is evolving” said the bank, without an explanation how.

Other criticisms levelled at the report:

• It makes no mention of the fact that the new royalty rates on SQM are prohibitive and may impede production.

• The report says new production from brines in Chile and Argentina will be low-cost (under $5,000 a ton), suggesting a pulling away of demand from supply. In fact the lithium market is tight, even with new supplies coming online. According to the USGS lithium supply in 2017 was 236,000 tonnes while demand was 228,000 tonnes. Demand forecasts are expected to increase by 2025 according to the

three major producers, Albemarle, SQM and FMC, who will be pressured to produce enough to meet demand.

• The report states that “A bottleneck in conversion capability will keep a lid on realised carbonate production from hard rock mines in the near term – but this is expanding too.” Presumably referring to the

ability of a miner to convert raw lithium into battery-grade lithium carbonate – this statement is never explained, leaving the reader to wonder how hard rock lithium miners are bettering their metallurgy. Lithium is extremely difficult to process from pegamites and there is currently only one mine doing it – Greenbushes in Australia.

The next lithium bear to wake up was commodities researcher Wood Mackenzie, which forecast a rout in lithium and cobalt – both key ingredients in EV batteries. While Woodmac at least didn't lowball demand growth – expecting it to grow from 233 kilo-tonnes lithium carbonate equivalent (LCE) in 2017 to 330kt in 2020 and 405kt in 2022 – it too forecast an imminent tsunami of lithium supply. Quoting from the report: … the supply response is under way. Yet it will take some time for this new capacity to materialise as battery-grade chemicals. As such, we expect relatively high price levels to be maintained over 2018. However, for 2019 and beyond, supply will start to outpace demand more aggressively and price levels will decline in turn. – Wood Mackenzie

The London-based firm thus predicts prices will average $13,000 per tonne this year, slip to $9,000 by 2019, and keep dropping to $6,500 in 2022.