Categories:

Base Metals

/

General Market Commentary

/

Precious Metals

Topics:

General Base Metals

/

General Market Commentary

/

General Precious Metals

Zinc and cobalt look good; gold and silver are consolidating, says Elysee Development

As Elysee Development Corp (ELC.V) has released its financial results for the first half of this year, we thought it was a good opportunity to catch up with Guido Cloetens, Elysee’s Executive Chairman.

We were curious to hear about Elysee’s investment plans, and we were excited to hear about the company’s two investments (HIVE Blockchain and Pentanova) which are about to go public. This sets Elysee apart from other investment companies as it offers its shareholders exposure to private deals and the subsequent re-rating when they go public. Additionally, it does give you exposure to less common commodities such as vanadium. The vanadium price seems to have bottomed out and appears to gain momentum again, and Elysee Development is in an excellent position to capitalize on this as it owns a stake in Largo Resources.

Caesar Report: Guido, what has changed in ELC’s portfolio since the last time we spoke?

During the first 6 months of this year we reduced our overall investment in junior gold and silver mines. After last year’s strong performance we expected some kind of consolidation and that’s exactly what happened.

That being said, the precious metal prices are under pressure and as a result of this, some miners are once again trading at relatively attractive levels. The re-allocation of assets at a major gold mining ETF (GDXJ) during Q2 provided an opportunity to buy quality gold miners at a discount.

Elysee decided to take advantage of this situation by selling some of our holdings that weren’t affected by this action and by buying high quality producers that were sold off. This basically was just an asset rotation.

Caesar Report: Is the portfolio still focused on mining and commodities? Do you have any non-commodity investments in the portfolio?

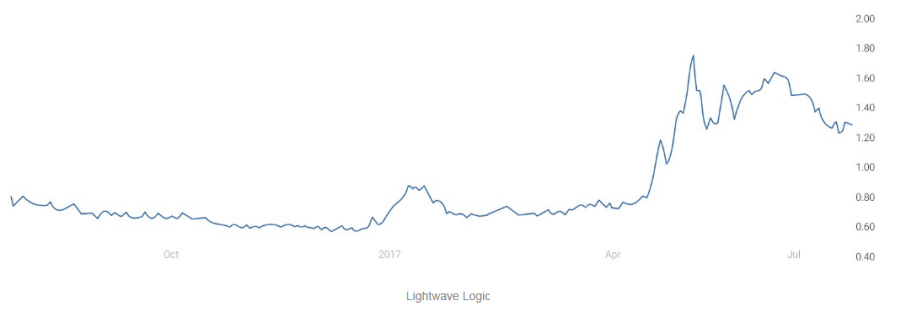

Yes, the core part of Elysee’s portfolio still consists of mining companies with a specific focus on precious metals. However, we absolutely do own shares in other sectors as well. Lightwave Logic (OTCQB: LWLG) for example is a technology company focused on the development of photonic devices and optical polymer materials systems for applications in high-speed fiber-optic data communications and telecommunications. The company has recently made great progress resulting in its stock price doubling since the beginning of the year.

Another company in the technology sector we recently bought a modest position in is HIVE Blockchain Technologies. The company currently is in the process of going public through an RTO on the TSX-V (with Leeta Gold). Blockchain technology is going to have a tremendous impact not only on the financial sector but on any sector where goods or services are exchanged.

Caesar Report: Elysee has limited exposure to the oil market. Do you have a specific opinion about the current situation on the oil (and gas) market? Do you see any opportunities for Elysee Development Corp in the energy sector?

We have two positions in the oil space: Jericho Oil (JCO.V) and Pentanova Energy (PNO). Pentanova owns significant oil assets in Colombia and is currently also completing an RTO and should be listed soon.

Whilst we are happy with these two investments we are reluctant to invest too much in oil right now. On the short term there’s still a lot of potential to quickly increase the production of crude oil worldwide when prices go higher. And in the longer term there’s no doubt that cleaner and economically viable alternatives for oil and coal will come on-stream. So while there’s still plenty of potential supply on the short term, demand on the longer term might grow at a slower pace than some anticipate and that’s why we are very careful about deploying money in this sector.

Any other significant investments?

Elysee increased its ownership in IBC Advanced Alloys (IB.V) by participating in the recent private placement. The company is experiencing a turnaround as we speak. As reported by the company, sales in both the copper alloys and beryllium alloys divisions are increasing. At the same time the recent investments in more efficient furnaces and other equipment increases the capacity and should lead to significantly higher margins starting this year.

We notice an increased interest in the ‘specialty metals’ space, as for instance the Department of Defense has also announced it’s considering to start a strategic stockpile of Scandium. Whilst Beryllium and Scandium perhaps aren’t the most obvious commodities from an investor’s point of view, it sure looks like there’s a lot going on in the background as for instance Niocorp Development (NB.TO) has entered into a joint venture agreement with IBC Alloys to investigate and develop applications for new alloys using Scandium. This could be important for both companies as IBC would be a front-runner using these new alloys whilst NioCorp could see the demand for Scandium increase when new applications are being developed.

Caesar Report: 2016 was the year of Zinc, whilst Cobalt seems to be the metal of 2017. Are there any particular commodities you expect to do very well in the next 6-24 months?

First of all I believe that zinc and cobalt prices will continue to perform well over the next couple of years. We are also looking positively towards vanadium (yes, another one of those ‘specialty’ metals), hence our investment in Largo Resources (LGO.TO).

Furthermore I wouldn’t exclude a revival of the uranium price. Some of the world’s largest producers have cut back production. In addition demand out of India and other countries that are building new nuclear plants should start to kick in over the next few years. That’s why we acquired small positions in several junior uranium companies and continue to look for opportunities in this sector.

Your cash position remains relatively stable at C$1.3M. Is there a certain minimum cash position you’d like to maintain to make sure you have enough liquidity to take advantage of opportunities that might pop up?

Generally we like to maintain a cash position of around 1 million dollars. However, if there’s a really good opportunity we might allocate some of that money to take a position.