Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Zinc Outlook 2019: A Year That Has to Be Better

Zinc has had a bruiser of a year, with prices for the unloved metal racing fellow base metals to the bottom of the pile since the trade war kicked off in earnest over June and July.

While supply continues to dry up and stockpiles continue to fall, prices haven’t responded in any meaningful way, leading zinc to fall over 24 percent year-to-date (as of December 14).

Zinc experts — both analysts and company leaders — think there’s a light at the end of the tunnel though, with a short-term recovery in the cards.

Zinc outlook 2019: Price performance review

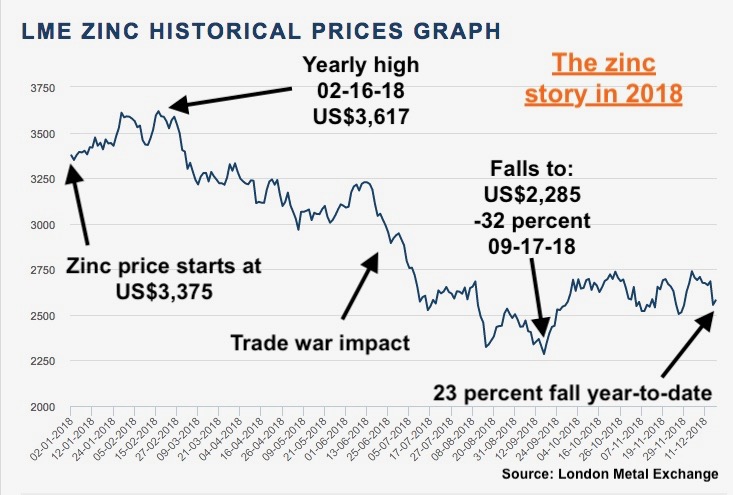

Over 2018 zinc has languished well below its base metal compatriots, falling as low as 32 percent under its starting point of US$3,375 a tonne to US$2,285 in mid-September.

Compare that to copper on the same day (September 17), down 18 percent year-to-date, and nickel, down 3.5 percent (though nickel rose partway through the year, while other base metals did not).

Looking at the LME chart below, as of mid-December zinc has recovered somewhat, up to US$2,555 — though still 24 percent below its January 1 price.

Various analysts through the year have stood by the claim that zinc’s fundamentals are solid, and negative sentiment is to blame for the metal’s price in 2018 — which was perhaps more of a correction.

Helen O’Cleary, senior analyst at CRU Group, told the Investing News Network (INN) that the zinc price had been “buoyed by investors front running the deficit story, and had been outperforming the rest of the LME metals for some time.”

The trade war still got slapped with blame for bearish sentiment though.

“Galvanized sheet trade has been directly affected by Section 232 tariffs on steel products, and although US galvanized sheet prices increased to cover the 25-percent duty, buyers have become more cautious,” she said.

Andrew Thomas, research director at Wood Mackenzie, said much the same, saying prices for zinc had been ahead of fundamentals.

“By the February peak the concentrate market had been tight for 15 months, but the metal market was still adequately supplied,” he commented.

Thomas said that the US$3,600 value for zinc prices reached in mid-February 2018 was the peak, and “profit taking [and] short selling lent momentum to the retreat” from there.

He said that the biggest story of 2018 (and heading into 2019) was smelter capacity in China. A combination of poor economics and an ongoing environmental crackdown has resulted in Chinese smelter production falling in 2018.

“Whilst economics should improve next year, the big question will be: will smelters be able to complete environmental upgrades [to] increase production levels in excess of those seen in 2015 and 2016, and prevent the tightness in the metal market from becoming too extreme,” he said.

Stefan Ioannou of Cormark Securities said that zinc shaped up through 2018 to be in line for a supply crunch, with large projects drying up and inventories falling.

Ioannou noted that as with other base metals, “the trade war is really what was sailing the boat.”

Feeding into previous comments about a supply crunch, Ioannou pointed to an early 2018 fall in treatment charges as a sign of turbulence.