(TheNewswire)

|

|||||||||

|

|

|

|||||||

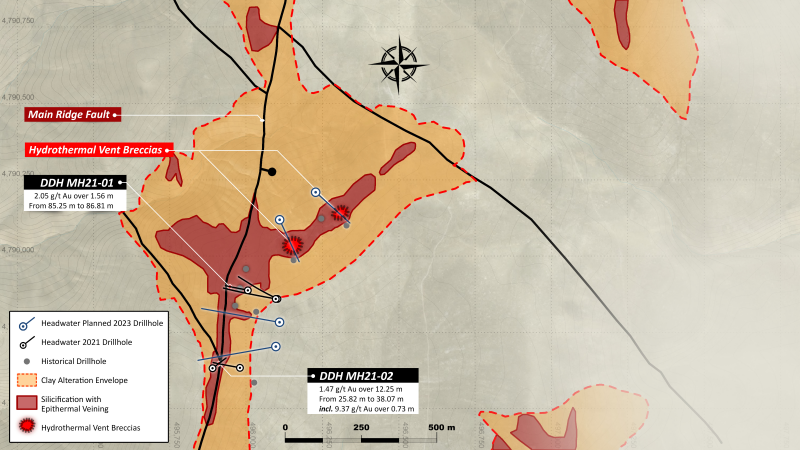

Vancouver, British Columbia - TheNewswire - June 29, 2023: Headwater Gold Inc. (CSE:HWG) (OTC:HWAUF) (the "Company" or "Headwater") is pleased to announce the commencement of an up to 2,000 metre (“m”) drill program at the Mahogany project in Oregon and Idaho, to be wholly funded by Newcrest Mining Limited (“Newcrest”) (ASX, TSX, PNGX: NCM) pursuant to the option and earn-in agreement announced on August 16, 2022. The program is designed to follow-up on Headwater’s 2021 drill results which intercepted 1.47 grams per tonne gold (“g/t Au”) over 12.25 m including 9.37 g/t Au over 0.73 m (see Headwater news release dated January 27, 2022).

Highlights:

-

Approximately 2,000 m of drilling is currently planned, utilizing two rigs and a combination of reverse circulation and core drilling;

-

Mahogany is located along the Oregon-Idaho border, approximately 15 km southeast of Headwater’s Katey project and approximately 20 km northwest of Integra Resources’ (TSX-V: ITR, NYSE: ITRG) DeLamar mine complex

-

The drill program is fully funded by Newcrest through the option and earn-in transaction announced August 16, 2022; and

-

The goals of the drill program are to:

-

Target the source of high-grade vein material within the mineralized Main Ridge Fault, which returned up to 170.0 g/t Au from surface sampling;

-

Test high-grade epithermal vein targets at depth along the Main Ridge Fault below Headwater’s 2021 drilling which intercepted 1.47 g/t Au over 12.25 m including 9.37 g/t Au over 0.73 m; and

-

Drilling will test two hydrothermal vent breccias which outcrop and include clasts of sinter and quartz vein fragments, and have no known drilling at depths greater than 50 m.

-

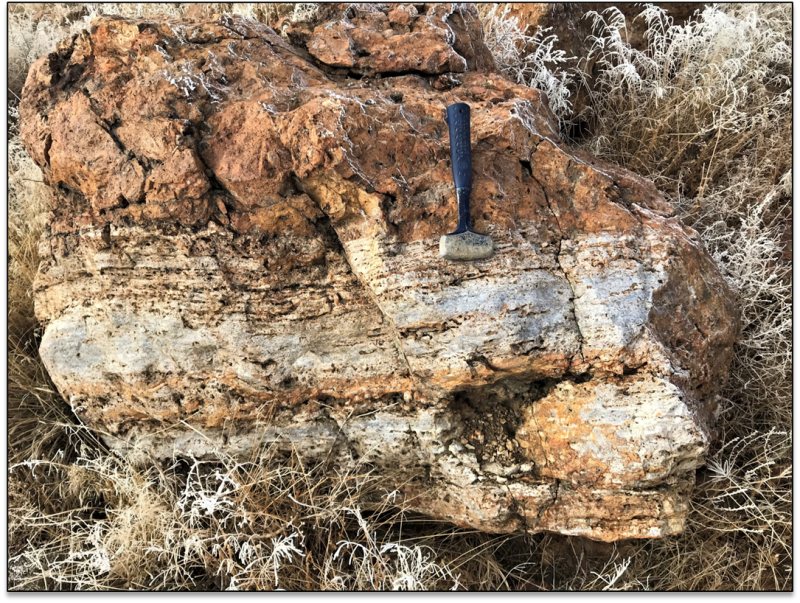

Caleb Stroup, the President and CEO of the Company, states: “We are very excited to begin a busy year of drilling with the Mahogany follow-up drill program. Results from our previous drilling campaign, which was limited in scale, identified several positive indicators of epithermal veining, including fault-hosted banded quartz veins and silica-cemented breccias with gold values up to 9.37 g/t Au. Due to the shallow nature of all previous drilling, we believe the true potential remains untested at depth and the focus of this year’s drilling will be to intersect the prospective feeder structures at Mahogany at depths of between 150 m and 250 m. Additionally, the Vent Breccia area is a new drill target for this year. Headwater geologists interpret the breccias exposed at the surface to be the surface manifestations of a high-energy feeder structure with untested vein potential at depth.”

Figure 1: Angular block of silica sinter entrained in a silicified phreatic breccia at the Vent Breccia target .

2023 Drill Program:

The 2023 drill program is expected to consist of up to 2,000 m to test two target areas.

Main Ridge Fault Target : Drilling will target the source of high-grade vein material within the Main Ridge Fault, which has yielded up to 170.0 g/t Au from surface sampling and 1.47 g/t Au over 12.25 m in drilling, including 9.37 g/t Au over 0.73 m. The current drill program will test depths of approximately 200 m to 250 m along the Main Ridge Fault and at orientations identified during the Company’s initial oriented core program. Drill targeting also leverages results from a controlled-source audio-frequency magnetotelluric (“CSAMT”) resistivity survey totaling 11.3 line-kilometres completed by Headwater in 2022.

Vent Breccia Target : Drilling will target vein-style mineralization in feeder structures inferred from geology and new CSAMT resistivity data beneath intensely silicified hydrothermal breccias containing silica sinter and quartz vein fragments. Results from the Company’s CSAMT survey support the existence of a major northeasterly structure and associated clay alteration envelope surrounding the outcrop exposures of hydrothermal breccia. Shallow historic drilling and trenching was completed on Breccia Hill by Manville Exploration in the 1980’s, but no known drilling exceeded depths of 50 m. Headwater plans to test for high-grade epithermal veins in an inferred boiling horizon approximately 150 m to 225 m beneath the vent breccias.

Figure 2: Alteration map of the Mahogany project area showing existing and planned drill holes and epithermal alteration features.

About the Mahogany Project:

The Mahogany project is located in southeastern Oregon, 20 km northwest of Integra Resources’ (TSX-V:ITR, NYSE: ITRG) DeLamar deposit. Surface alteration at Mahogany is typical of a high-level epithermal system, including silica sinter and adularia within a broader zone of argillic alteration. Headwater’s initial drill program at Mahogany, completed in late 2021, consisted of five diamond core drill holes totaling 810 metres (see Headwater News Release dated January 27, 2022). Drilling confirmed the presence of structurally controlled high-grade gold zones, including a drill intercept that returned 9.37 g/t Au over a drilled thickness of 0.73 metres in hole MH21-02. Multiple priority targets will be tested in the two-rig drill program announced here.

About Headwater Gold:

Headwater Gold Inc. (CSE: HWG, OTCQB: HWAUF) is a technically-driven mineral exploration company focused on the exploration and discovery of high-grade precious metal deposits in the Western USA. Headwater is aggressively exploring one of the most well-endowed and mining-friendly jurisdictions in the world with a goal of making world-class precious metal discoveries. Headwater has a large portfolio of epithermal vein exploration projects and a technical team comprised of experienced geologists with diverse capital markets, junior company and major mining company experience. The Company is systematically drill testing several projects in Nevada, Idaho, and Oregon and in August 2022 and May 2023 announced transactions with Newcrest Mining Limited where Newcrest acquired a 9.9% strategic equity interest in the Company and entered into several option and earn-in agreements on Headwater’s projects.

For more information, please visit the Company's website at www.headwatergold.com .

On Behalf of the Board of Directors

Caleb Stroup

President and CEO

+1 (775) 409-3197

For further information, please contact:

Brennan Zerb

Investor Relations Manager

+1 (778) 867-5016

Qualified Person:

The technical information contained in this news release has been reviewed and approved by Scott Close, P.Geo (158157), a “Qualified Person” (“QP”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Forward-Looking Statements:

This news release includes certain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, exploration activities and the specifications, targets, results, analyses, interpretations, benefits, costs and timing of them, Newcrest’s anticipated funding of the option and earn-in projects and the timing thereof, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as “pro forma”, “plans”, “expects”, “may”, “should”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, risks related to the anticipated business plans and timing of future activities of the Company, including the Company’s exploration plans and the proposed expenditures for exploration work thereon, the ability of the Company to obtain sufficient financing to fund its business activities and plans, the risk that Newcrest will not elect to obtain any additional interest in the option and earn-in projects in excess of the minimum commitment, the ability of the Company to obtain the required permits, changes in laws, regulations and policies affecting mining operations, the Company’s limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading “Risk Factors” in the Company’s prospectus dated May 26, 2021 and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR website at www.sedar.com. In addition, on May 14, 2023 Newcrest and Newmont Corporation (“Newmont”) entered into a binding scheme implementation deed in relation to a proposal for Newmont to acquire 100% of the issued shares in Newcrest by way of an Australian scheme of arrangement. If the proposed merger receives shareholder and regulatory approval and is completed within the budget period outlined above, there is no certainty that the new combined entity will commit to the contemplated exploration activities approved by Newcrest.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements, except as otherwise required by law.

Copyright (c) 2023 TheNewswire - All rights reserved.