Manning Ventures Updates Phase One Exploration at the Copper Hill Project, Nevada, USA

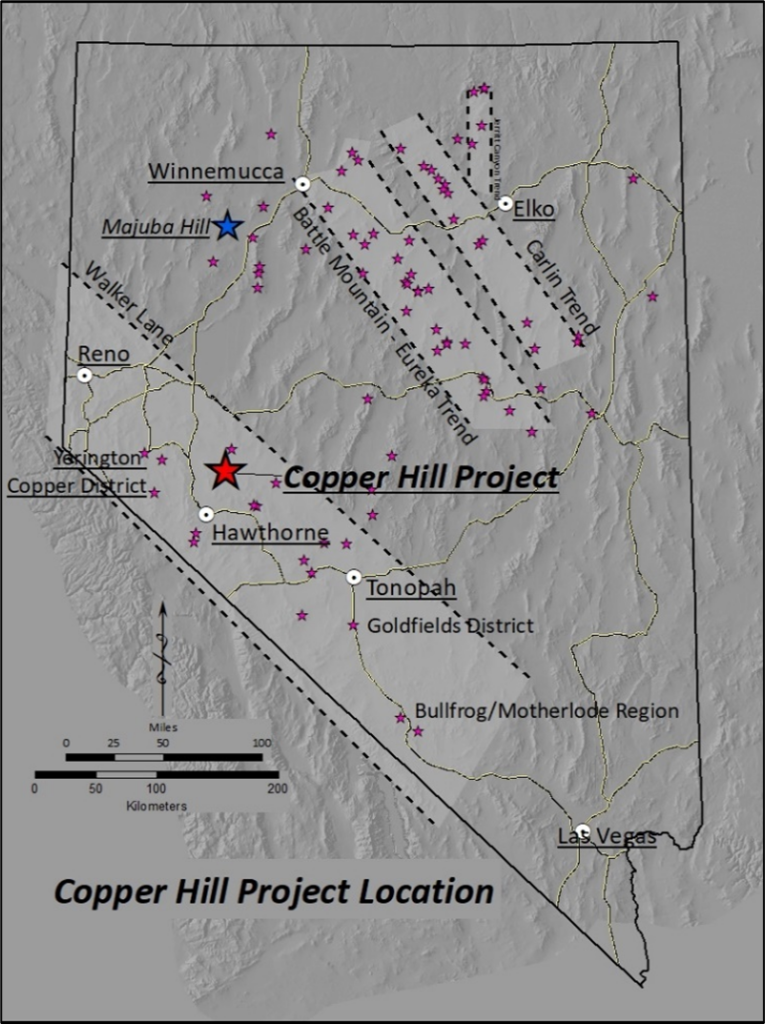

Vancouver, British Columbia, March 5, 2024 – Manning Ventures Inc. (the “Company” or “Manning”) (CSE: MANN; Frankfurt: 1H5) is pleased to announce that it has entered into an Option Agreement (the “Option Agreement”) with Claremont Mines Nevada, LLC (the “Optionor”) who is the legal and beneficial owner of 66 unpatented lode mineral claims located in the State of Nevada (the “Copper Hill Project”) whereby the Optionor has granted the Company the right to acquire a 100% interest in the Copper Hill Project, located within the Walker Lane Trend, Nevada, USA.

The Company is eager to expand its energy metals exposure, and increasing its footprint in copper at this time is strategically significant. “Supply deficits, declining grades, and geopolitical instability combined with a widening supply imbalance and increased demand are fueling what appears to be a very strong copper market in the years ahead,” said Alex Klenman, CEO. “New supplies from proven geopolitically sound jurisdictions must be secured to meet demand estimates over the next few decades. We like this project in Nevada, which has seen strong historical results. This is an excellent addition to our portfolio, and we’ll announce phase one exploration and drilling plans shortly,” continued Mr. Klenman.

About the Copper Hill Project

Copper Hill hosts copper-gold-molybdenum mineralization in both porphyry and skarn styled deposits in Mineral County, Nevada. The property consists of 66 mineral claims covering an area of 2.3 miles. The property is located 22 miles north of Hawthorne, Nevada and is accessible using well-maintained County Roads.

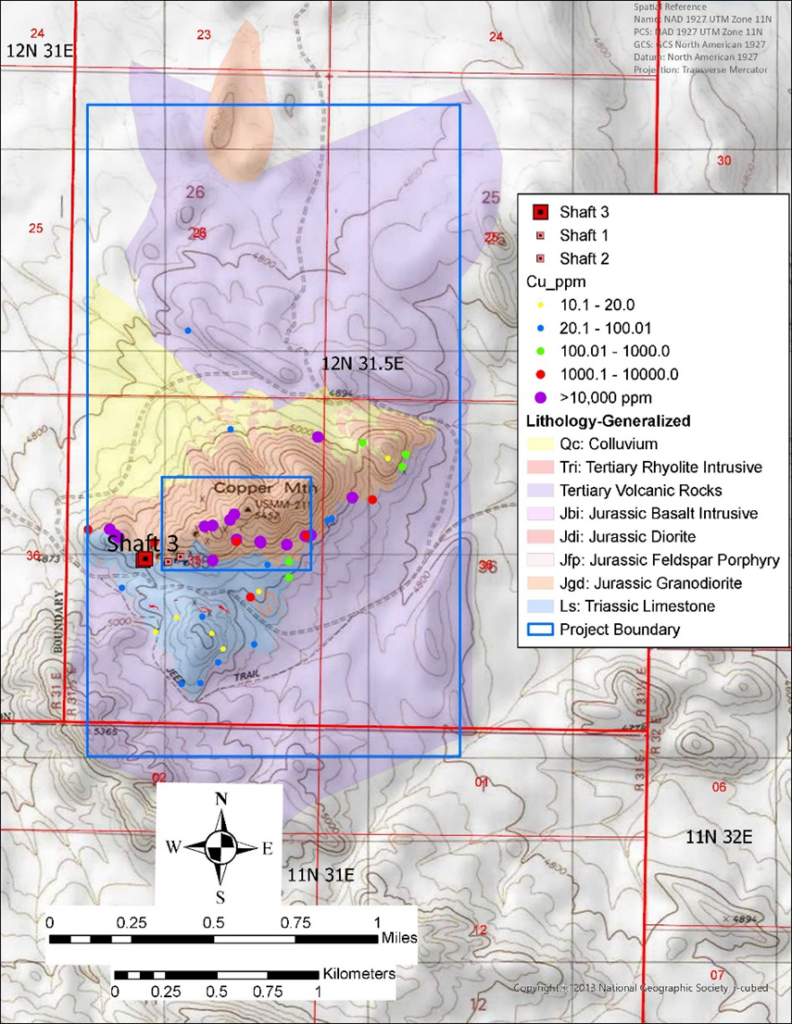

The Project is centered on a Jurassic Age quartz monzonite porphyry intruding Triassic age Luning Limestone. The claims cover 2.3 sq miles and are 33 miles east of the Yerington Copper District which hosts the Yerington Copper Mine (Anaconda 1952-1978), Ann Mason Deposit, Bear Deposit, MacArthur Deposit, and the Pumpkin Hollow Mine.

Historically at Copper Hill, reported high-grade copper was mined from underground shafts from skarn and porphyry-copper-styled mineralization at the Copper Mountain Mine. Between 1914 to 1926 mining from the “Copper Mountain Mine” produced an estimated 1,000,000 pounds of copper from shallow underground workings. Historic reporting from the period of production describes ore zones of contact skarn-type and porphyry-type mineralization with shipping grades ranging from 3.5 to 11.0% copper*.

*Historic Minning information was summarized from an “Unpublished Report on the Carson Sink Area, Nevada by F.C. Schrader, U.S. Geological Survey (Fieldwork 1911-1920) 1947”. Manning Ventures cautions investors that the historic exploration and production information is believed to be accurate but has not been verified by a qualified person.

The Copper Hill mineralizing system forms a topographic high surrounded and partially covered by younger volcanic rocks. Mineralization identified at Copper Hill are bornite, chalcocite, chalcopyrite, chrysocolla, copper-native, covellite, cuprite, gold, malachite, molybdenite, silver, sphalerite (rare), and tetrahedrite.

The Copper Mountain area was explored between 1959 to 1979 by Idaho Minning Corp. and Walker-Martel who conducted ground geophysics, underground mapping, prospecting and reported 6000 feet of Rotary drilling. Since that time ground magnetics were conducted in 2007.

Rock sampling collected at this time returned values from select samples of 7.2% and 12.7% copper and 1.06 g/t gold and 1.19 g/t gold respectively.

The target being sought at Copper Hill is a porphyry-styled copper-molybdenum-gold deposit.

Terms

Pursuant to the terms and conditions of the Option Agreement dated February 27, 2024, and in order to acquire a 100% interest in and to the Copper hill Project, the Company must pay the Optionor an aggregate of USD $1,500,000 in cash (the “Exercise Price”) on or before the thirteenth anniversary following the execution of the Option Agreement (the “Option Term”) (the date of execution being referred to herein as the “Effective Date”).

During the Option Term, the Company shall pay the Optionor annual minimum payments, which shall each constitute partial payment of Exercise Price, on or before the following dates: I) USD $15,000 on the Effective Date of the Option Agreement; ii) USD $25,000 on or before the first anniversary of the Effective Date; iii) USD $50,000 on or before the second anniversary of the Effective Date; iv) USD $60,000 on or before the third anniversary of the Effective Date; v) USD $80,000 on or before the fourth anniversary of the Effective Date; vi) USD $100,000 on or before the fifth anniversary of the Effective Date; and vii) after the fifth anniversary of the Effective Date, USD $100,000 on or before each subsequent anniversary of the Effective Date.

Upon exercise of the Option, the Optionor will retain a royalty equal to two percent (2%) of net smelter returns from the Copper Hill Project, which may be reduced at any time from two percent (2%) to one percent (1%) by the Company, or its permitted assign, by paying the Optionor an aggregate of USD $1,000,000.

Warren Robb P.Geo., is the designated Qualified Person as defined by National Instrument 43-101 and is responsible for the technical information contained in this release.

About Manning

Manning Ventures is a mineral exploration and development company focused metals and materials critical to the growing Energy Metals space. Manning’s project portfolio includes Lithium/Copper projects in Ontario and Quebec, in addition to multiple Iron Ore projects in Quebec.

For further information contact:

Manning Ventures Inc.

Alex Klenman – CEO

Email: info@manning-ventures.com

Telephone: (604) 681-0084

www.manning-ventures.com

FORWARD LOOKING STATEMENTS:

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this news release.

Certain statements in this press release may contain forward-looking information (within the meaning of Canadian securities legislation), including, without limitation, the Company’s payment of the Exercise Price during the Option Term, the granting of the net smelter return royalty to the Optionor, and the Company’s payment of the annual minimum payments to the Optionor. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties, and other factors, which may cause the actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the statements. Forward-looking statements speak only as of the date those statements are made. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include regulatory actions, market prices, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by applicable law, the Company assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions, or changes in other factors affecting the forward-looking statements. If the Company updates any forward-looking statement(s), no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.