VANCOUVER, BC / ACCESSWIRE / March 23, 2020 / Mawson Resources Limited ("Mawson" or the "Company") (TSX:MAW)(Frankfurt:MXR)(OTCPINK:MWSNF) is pleased to announce that further to its news release of January 29, 2020, the Company has executed multifaceted agreements with Nagambie Resources Limited (NAG) ("Nagambie"), which holds tenements in the central Victorian goldfields of Australia. Closing, including issuance of all shares and payments, will take place in the near term.

Key points:

- Mawson has subscribed for 50.0 million ordinary shares or a 10% shareholding in Nagambie, which will provide Mawson with a right of first refusal to take up or match proposals being considered over a competitive 3,600 square kilometre tenement package;

- Mawson will acquire 100% of the Clonbinane project, for consideration of A$500,000 cash and the issuance of 1.0 million shares of Mawson. Clonbinane is a shallow orogenic (or epizonal) Fosterville-style deposit located 56 kilometres north of Melbourne. Clonbinane is developed over 11 kilometres and has been historically drill tested over 800 metre of strike, down to a maximum depth of 80 metres. Selected drill results with a 0.5 g/t gold lower cut include 17 metres at 7.0 g/t gold from 66 metres (VCRC022);

- Mawson will have the right to earn up to a 70% joint venture interest in each of Nagambie's Redcastle and Doctor's Gully gold properties located in Victoria, Australia by expending A$1M over a 5-year period into each project. Redcastle and Doctor's Gully are both shallow orogenic (or epizonal) Fosterville-style historic high-grade mineral fields.

Mr. Hudson, Chairman and CEO, states: "Our Finnish drilling continues to produce impressive results and provides a solid base for the Company, while the new Australian acquisition offers an incredible optionality to three new Fosterville-style gold projects and the right of first refusal over 3,600 square kilometres. This is the largest continuous land package in one of the most exciting global gold provinces. Mawson is now well placed to continue to grow its strategic and diversified gold portfolio in two safe, Tier 1 jurisdictions."

Strategic 10% equity investment into Nagambie

Mawson has entered into a subscription agreement with Nagambie dated March 24, 2020 (AEDT-time zone), under which Mawson has subscribed for 50.0 million ordinary shares of Nagambie (the "Nagambie Shares"), which represent a 10.0% shareholding in Nagambie. As a result, Mawson has become a new insider of Nagambie, pursuant to Australian Stock Exchange policies. As consideration for the acquisition of the Nagambie Shares, Nagambie has received 8.5 million common shares of Mawson (the "Mawson Private Placement Shares"), which represent approximately 4.7% of the total issued Mawson Shares (after including the 1.0 million Mawson Acquisition Shares from the Clonbinane Acquisition, as defined below). The Mawson Private Placement Shares are subject to a statutory four month hold period and voluntary trading restrictions to be released from such restriction in four equal tranches (being 2,125,000 Mawson Private Placement Shares per tranche).

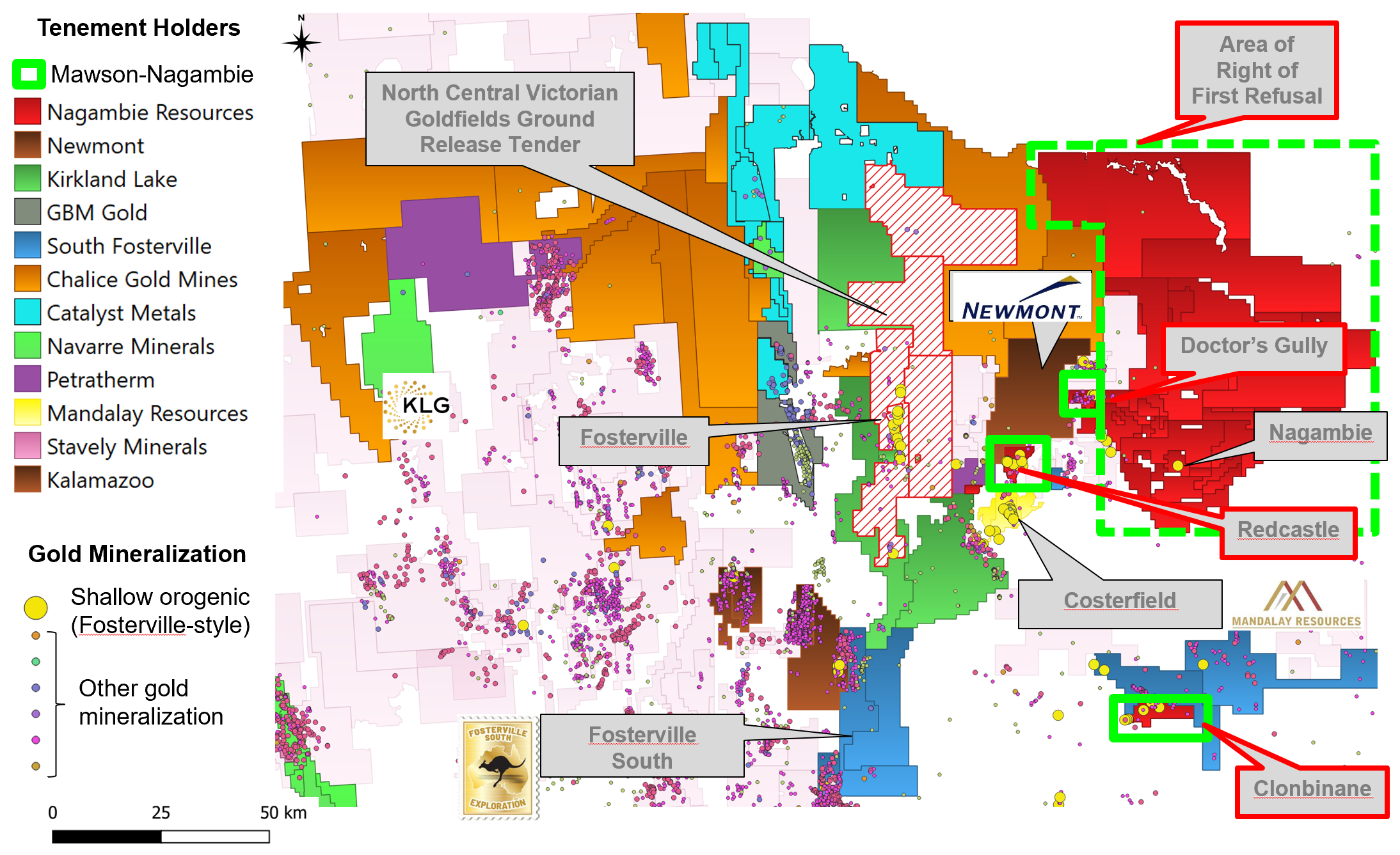

Mawson has also secured a right of first refusal to take up or match proposals being considered over a competitive 3,600 square kilometre tenement package held by Nagambie (Figure 1). This package includes the Nagambie Gold Mine and provides Mawson with a pipeline of potential new projects. In addition, Mawson has a pre-emptive right on future issuances of Nagambie Shares to avoid dilution.

Acquisition of 100% of Nagambie's Clonbinane Tenements

Mawson has entered into an acquisition agreement dated March 24, 2020 with Nagambie pursuant to which Mawson has acquired 100% of the shares in Clonbinane Goldfield Pty Ltd (the "Clonbinane Acquisition"), a 100% subsidiary of Nagambie and the holder of 62 square kilometres of mineral tenements at Clonbinane, for consideration to Nagambie of A$500,000 cash and the issuance of 1.0 million shares of Mawson (the "Mawson Acquisition Shares"). Mawson will also pay Nagambie A$28,000 to replace environmental bonds. The Mawson Private Placement Shares are subject to a statutory four month hold period and to voluntary trading restrictions to be released from such restriction in four equal tranches (being 2,125,000 Mawson Private Placement Shares per tranche).

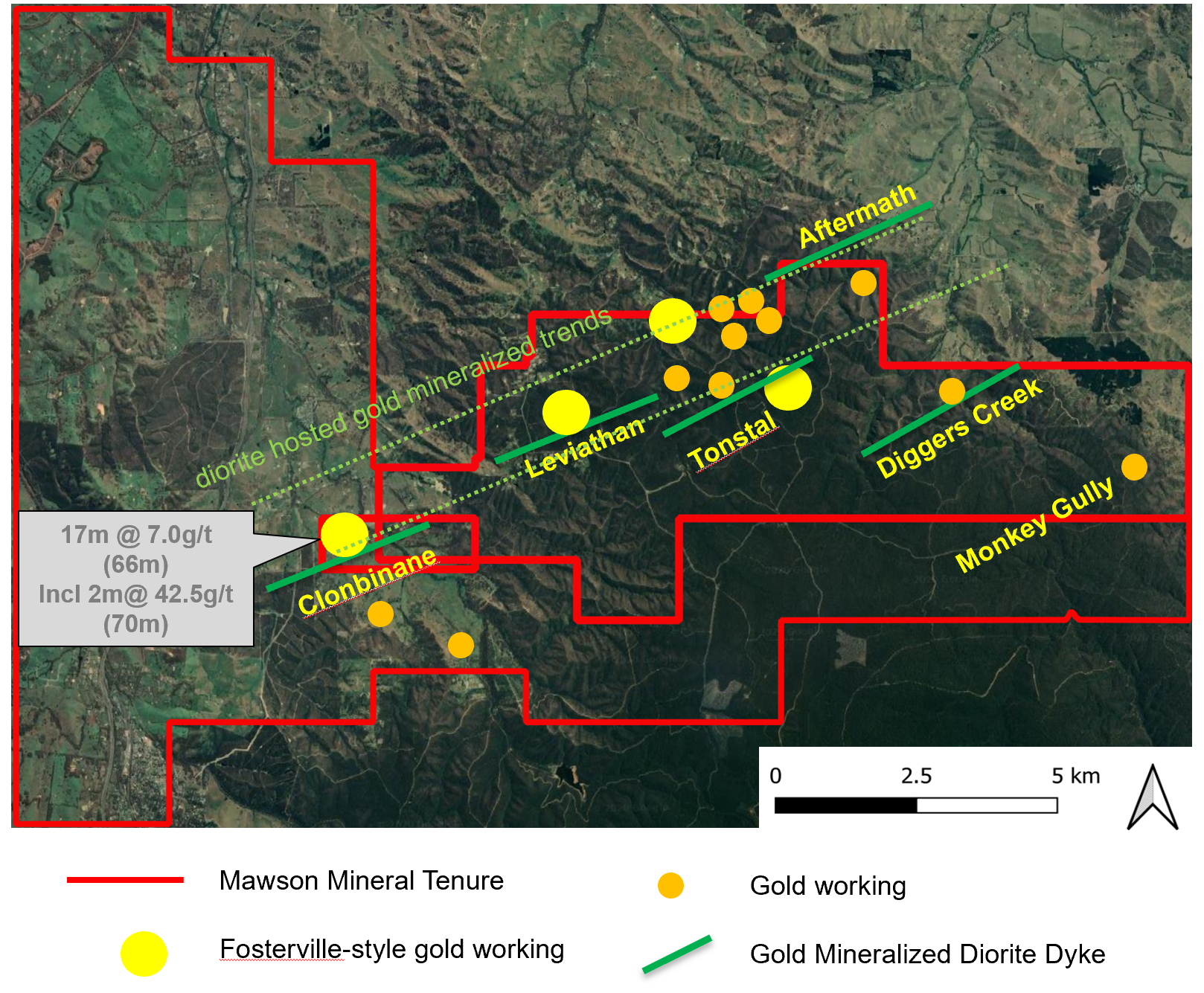

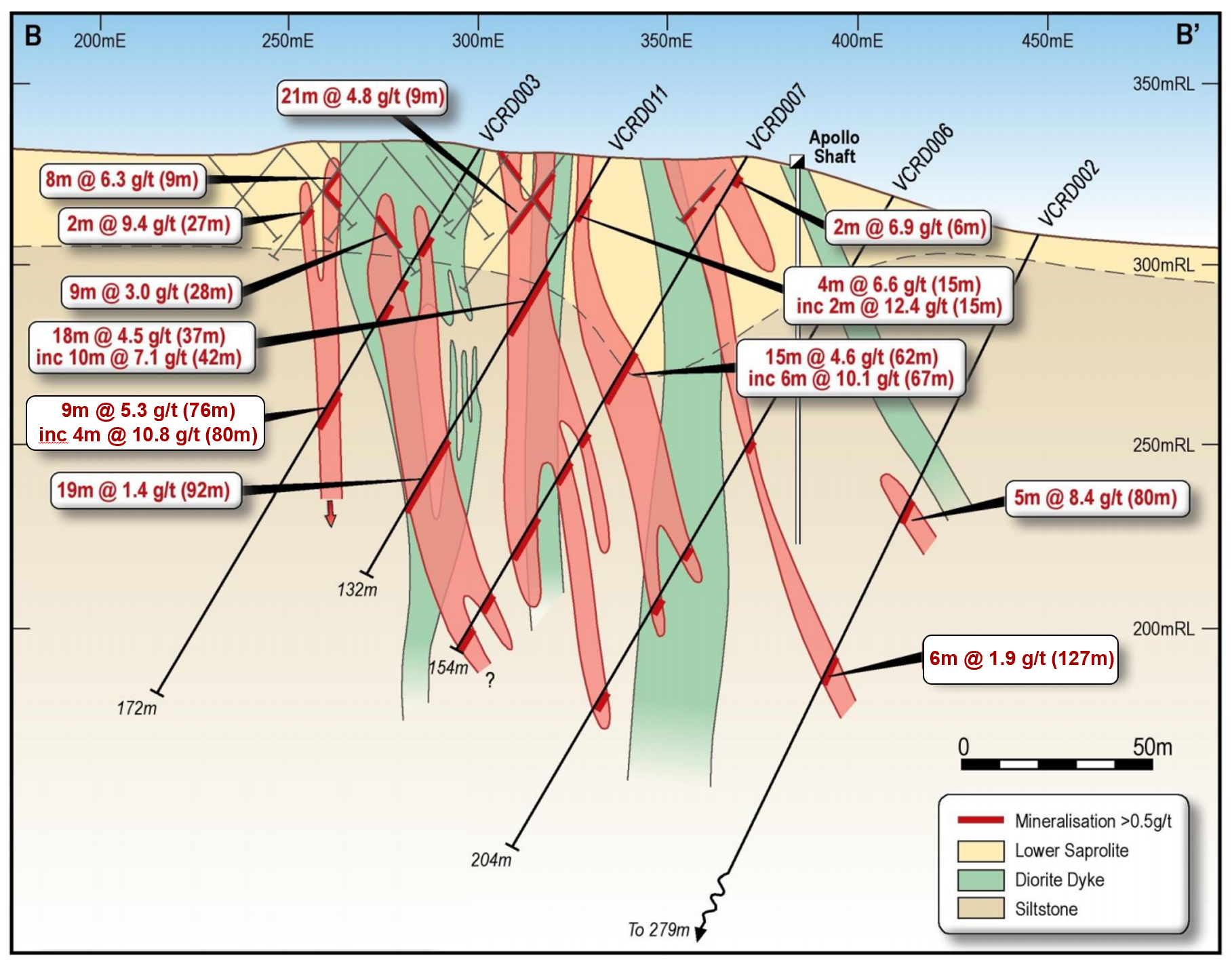

Clonbinane is a shallow orogenic (or epizonal) Fosterville-style deposit located 56 kilometres north of Melbourne. Small scale mining has been undertaken in the project area since the 1880s with total production being reported as 41,000oz gold at a grade of 33 g/t gold. Gold mineralization is hosted within, or proximal to, dykes with mineralization continuing along structures that extend into the sedimentary country rock. The diorite dyke and historic working trend continues for 11 kilometres and remains undrilled (Figure 2).

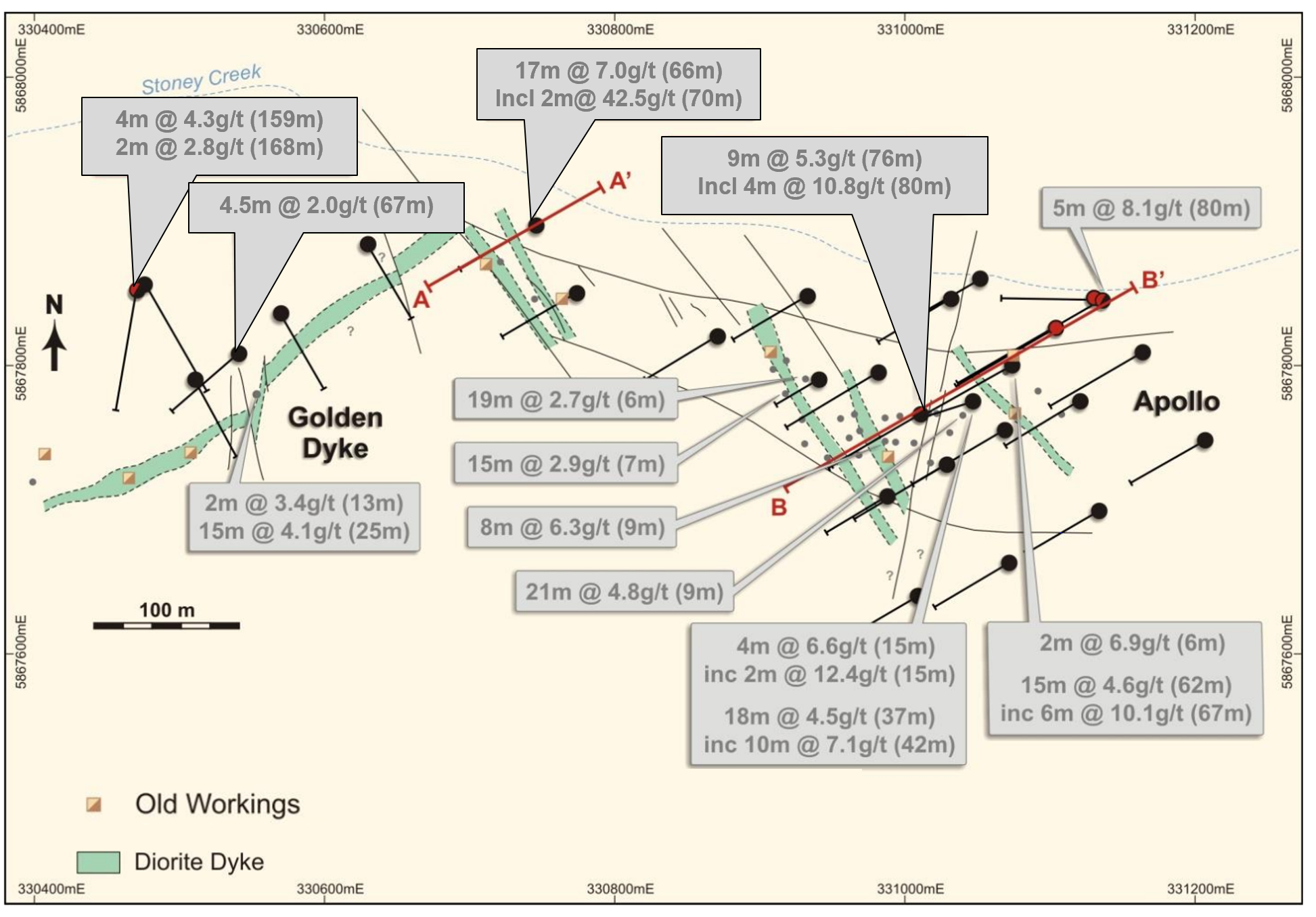

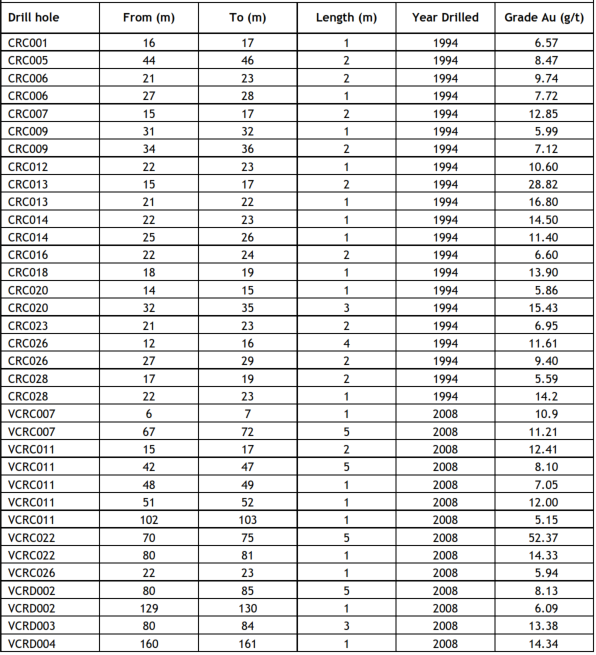

Two small drill campaigns have tested the Clonbinane mineralized system to 40-100 metres vertical depth over an 800 metre strike. In 1986, Ausminde Pty Ltd and Ausminde Holdings Pty Ltd (collectively "Ausminde") were granted mineral tenure at Clonbinane. Ausminde's completed soil and rock chip sampling and undertook RC drilling in 1993 (29 RC drill holes). Beadell Resources Limited subsequently drilled at Clonbinane in 2008 (30 RC holes with 7 diamond drill tails). Drilling results from both these programs greater than 5g/t gold are shown in Table 1. None of the drill data has been independently verified at this time. Compilation of available data and 3D geologic modeling are in progress. The true thickness of the mineralized intervals is not known at this stage. Selected drill results with a 0.5g/t gold lower cut from these two drill programs at Clonbinane included:

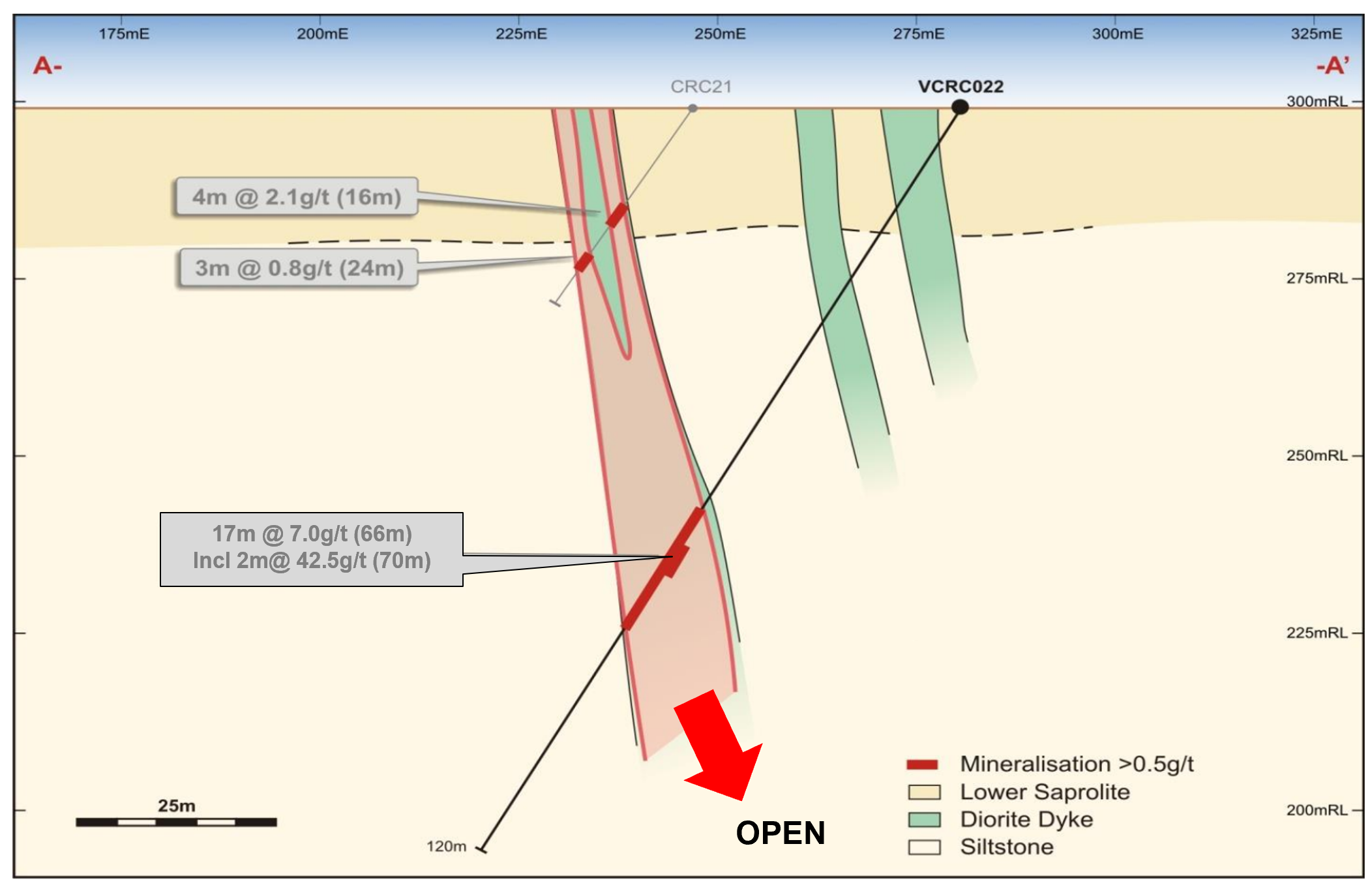

- 17 metres at 7.0 g/t gold and 0.8% antimony from 66 metres (VCRC022),

- 38 metres at 2.8 g/t from 15 metres (VCRC011),

- 27 metres at 3.7 g/t gold and 0.46% antimony from 3 metres (CRC013),

- 2 metres at 42.5 g/t gold and 1.0% antimony from 70 metres (VCRC022),

- 10 metres at 7.0 g/t gold from 42 metres (VCRC011), and

- 5 metres at 11.2 g/t gold and 0.78% antimony from 67 metres (VCRC007).

Clonbinane is open at depth and along strike and is considered a high value exploration project with affinity to the Fosterville Mine (Figures 3-5). Mawson will compile all historic mining and exploration data into a 3D model, and look to apply large scale, deeper seeking geophysical methods to identify large mineral systems below 40-100 metres depth.

Option and Joint Ventures

Pursuant to Option and Joint Venture Agreements entered into on March 24, 2020, between Mawson and Nagambie, Mawson has the right to earn an up to 70% joint venture interest in each of Nagambie's Redcastle and Doctor's Gully gold properties located in Victoria, Australia by incurring the following exploration expenditures on the each of the properties: A$100,000 in the first year and an additional A$150,000 in year 2 to earn 25%, an additional A$250,000 in year 3 to earn 50% and an additional A$500,000 by year 5 to earn 70%. Once Mawson earns 70% a joint venture between the parties will be formed. Nagambie may then contribute its 30% share of further exploration expenditures or, if it chooses to not contribute, dilute its interest. Should Nagambie's interest be reduced to less than 5.0%, it will be deemed to have forfeited its interest in the joint venture to Mawson in exchange for a 1.5% net smelter return royalty ("NSR") on gold revenue. Should Nagambie be granted the NSR, Mawson will have the right to acquire the NSR for A$4,000,000 per property.

i. Redcastle Option and Joint Venture

Redcastle is located in central Victoria 45 kilometres east of Bendigo and 18 kilometres north of Heathcote (Figure 1). Redcastle was discovered in 1859, and named the Balmoral Diggings. ‘Redcastle' a name of Scottish origin, displaced Balmoral sometime later. Underground mining continued until 1902.

Redcastle is a shallow orogenic (or epizonal) Fosterville-style historic high-grade orefield held within a tenure area of 51 square kilometres. It is located 7 kilometres along strike from Mandalay Resources' Costerfield mine and on a parallel north-south structure, 24 kilometres east of Kirkland Lake Gold's Fosterville mine. The northern margin of the claim is surround by a Newmont Corporation exploration licence.

There are few historic reliable production records of the early mining at Redcastle, however very high grades of gold and associated stibnite were recorded from nearly all mines, which were only worked to an average of 55 metres depth within a 5 kilometre by 4 kilometre area. The Redcastle Gold Mining Company is reported to have produced 35,000 ounces of gold from Clarke's Reef at a grade of 33 g/t gold.

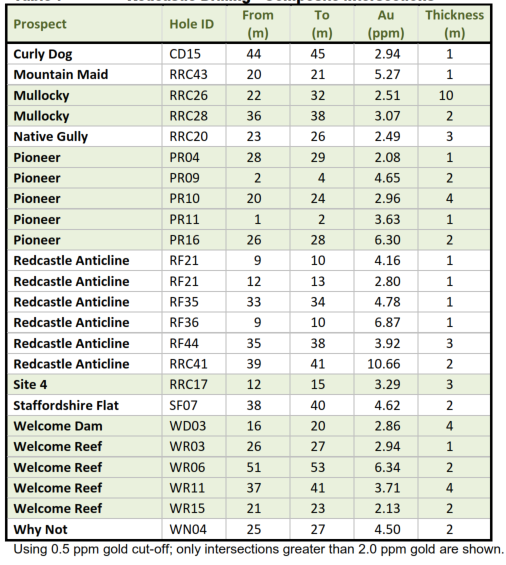

Today six principal prospects or target areas have been identified at Redcastle: Reservoir, Mullocky, Laura, RFZ, Why Not and Pioneer. An RC drill program in 2007-08 by Nagambie totaled 239 holes for 10,169 metres. The average depth of drilling was 42.6 metres with the deepest hole being 81.0 metres and the shallowest hole being 5 metres deep. Of the 14 prospects drilled, 10 intersected gold greater than 1.0 g/t gold in 1 metre sample intervals. Composite intersections with an average weighted grade greater than 2.0 ppm gold, using a 0.5 g/t gold cut-off are presented in Table 2. None of the drill data have been independently verified at this time. Compilation of available data and 3D geologic modeling are in progress. The true thickness of the mineralized intervals is not known at this stage. Selected drill results from this drill program at Redcastle included: 10 metres at 2.5 g/t gold from 22 metres (RRC26), 2 metres at 10.7 g/t gold from 39 metres (RRC41) and 2 metres at 6.3 g/t gold from 26 metres (PR16).

Previous workers have exclusively focused on heap leachable near-surface gold at Redcastle and the project remains untested to depth. Mawson will compile all historic mining and exploration data into a 3D model, and look to apply large scale, deeper seeking geophysical methods to identify large mineral systems below 50 metres depth.

ii. Doctors Gully Option and Joint Venture

Doctor's Gully is a shallow orogenic (or epizonal) Fosterville-style historic mining district. The Doctor's Gully retention license covers a smaller area of 4 square kilometres with 21 historic gold showings and mines (Figure 1). In modern times it has been mined for oxide gold. It is located 13 kilometres northeast of Redcastle.

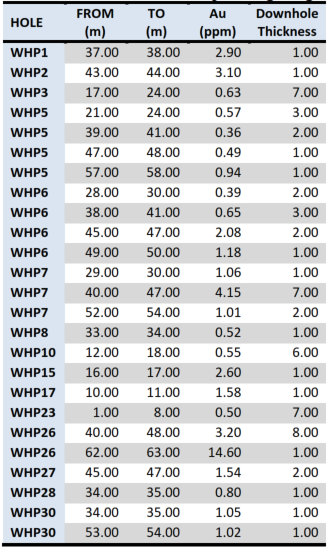

Gold Mines of Kalgoorlie ("GMK", also working as Metals Exploration Ltd) mapped and drilled Doctor's Gully in 1988. A total of 1,734 metres of RC drilling was conducted in 29 holes across the prospect. The results from this drill program have never been followed up. Composite intersections are presented in Table 3. None of the drill data has been independently verified at this time. Compilation of available data and 3D geologic modeling are in progress. The true thickness of the mineralized intervals is not known at this stage. Better drill intersections from this program included 7 metres @ 4.1 g/t gold from 40 metres (WHP7) and 8 metres @ 3.2 g/t gold from 40 metres (WHP26) and 1 metre @ 14.6 g/t gold from 62 metres (WHP26).

Like Redcastle, previous workers have focused on heap leachable near-surface gold at Doctors Gully and the project remains untested at depth. Mawson will compile all historic mining and exploration data into a 3D model, and look to apply large scale, deeper-seeking geophysical methods to explore for a large mineral system below 50 metres depth.

The securities offered have not been workers, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor in any other jurisdiction.

Update on Finnish Activities and COVID-19 Response

The 2020 winter drill program in Finland is now complete for 14,142 metres. Strong news flow is anticipated to continue over the coming months with only 13 holes reported to date from a total 37 holes drilled. The program concluded approximately 850 metres earlier than planned due to Mawson's commitment to provide a safe work environment during the global response to COVID-19. Staff are now working from home, or via shifts in the Company's Rovaniemi core facility where appropriate physical distancing can take place.

Resignation of Director

Mawson announces that Mark Saxon, a Bendigo resident and professional geologist, has resigned as a Director of the Company to focus his efforts on the new Victorian acquisition. Mark was a founding Director of Mawson and has been instrumental in the development of the Company since 2004. The Company looks forward to continuing to work with Mark in his new capacity.

Qualified Person

Michael Hudson, Chairman and CEO for the Company, is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure or Mineral Projects and has prepared or reviewed the preparation of the scientific and technical information in this press release.

None of the drill data have been independently verified at this time. These historical data have not been verified by Mawson and are quoted for information purposes only. Drilling information from Clonbinane by Ausminde and Beadell Resources, at Redcastle by Nagambie and at Doctor's Gully by GMK had a variety of assays and check assays reported in historical reports. It is believed that the primary analysis for gold was completed by fire assay with an atomic adsorption finish by NATA registered laboratories. Assay techniques for antimony are unknown at this stage.

About Mawson Resources Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Resources Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic Arctic exploration company with a focus on the flagship Rajapalot gold project in Finland. The Australian acquisition provides Mawson with a strategic and diversified portfolio of high-quality gold exploration assets in two safe jurisdictions.

About Nagambie Resources Ltd (ASX: NAG)

Nagambie Resources Ltd ("Nagambie") explores for Fosterville-style, structural-controlled, high-grade sulphide-gold underground deposits within 3,600 sq km of Waranga Domain tenements. Exploration is carried out using geophysical targeting techniques, diamond drilling and analysis for hydrothermal alteration of the sediments.

Nagambie is also evaluating:

- Underwater storage of sulphidic excavation material in the two legacy gold pits at the Nagambie Mine, capable of storing 5 million tonnes of spoil from major infrastructure projects for Melbourne such as Metro Tunnel, West Gate Tunnel and North East Link.

- Recycling of the tailings and overburden dumps to produce aggregates for concrete and gravel products respectively.

- Quarrying and screening of sand deposits at the mine to produce various sand and quartz aggregate products is planned.

On Behalf of the Board, | Further Information |

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson's most recent Annual Information Form filed on www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Figure 1: Plan of Victorian tenement holders, showing location of shallow orogenic (epizonal) Fosterville-style mineralization. Green outlines highlight the 3,600 square km area where Mawson has secured a first right of refusal, the 100% purchase of Clonbinane and the Redcastle and Doctor's Gully option and joint venture areas

Figure 2: Plan of the Clonbinane project. The dyke and historic working trend extend for 11 kilometres and remains undrilled.

Figure 3: Drill plan of the Clonbinane drilled area showing the best results from two small drill campaigns in 1994 and 2008 that tested the system to 40-100 metres vertical depth over an 800 metre strike. Gold mineralization is located within, or proximal to, the dykes with mineralization continuing along structures that extend into the sedimentary country rock with gradually diminishing grades. (modified after Beadall 2008).

Figure 4: Cross section A-A' (refer to Figure 3) from Clonbinane. The prospect remains open at depth below drillhole VCRC022 which intersected 17 metres at 7.0 g/t gold and 0.8% antimony from 66 metres (modified after Beadall 2008).

Figure 5: Cross section B-B' (refer to Figure 3) from Clonbinane (modified after Beadall 2008).

Table 1: Clonbinane Project: Significant results from drilling (>5g/t gold) (from Ravensgate, 2013)

Table 2: Redcastle Project: Significant results from drilling (from Nagambie Resources, 2017)

Table 3: Doctor's Gully Project: Significant results from drilling (from Nagambie Mining Ltd, 2011)

SOURCE: Mawson Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/582173/Mawson-Announces-Execution-of-Agreements-for-Central-Victorian-Goldfields-Investment-and-Acquisition-in-Australia