Mawson Joint Ventures Into the Whroo Goldfield, Victoria, Australia

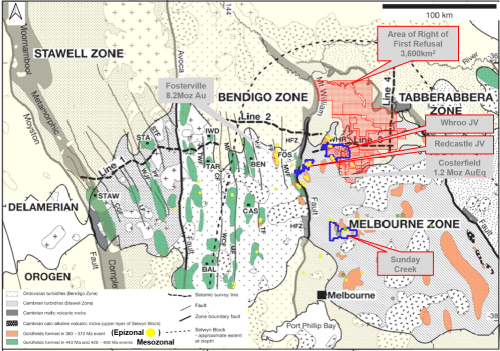

Vancouver, Canada — Mawson Gold Limited (“Mawson” or the “Company”) (TSX:MAW) (Frankfurt:MXR) (PINKSHEETS: MWSNF) is pleased to announce that, further to its news releases dated January 29 and March 23, 2020, it has entered into an Amended and Restated Option Agreement (the “Amended and Restated Agreement” or “Whroo JV”) with Nagambie Resources Limited (NAG:ASX) (“Nagambie”) covering 199 square kilometres of exploration tenure in the Victorian Goldfields of Australia (Figure 1).

Key points:

- Mawson’s area under tenure and option in the Victorian Goldfields increases by 73%;

- The Whroo JV comprises 199 square kilometres covering the 9 kilometre long Whroo goldfield trend containing both the White Hills and Balaclava Hill mining areas, comprising one of the most significant historic epizonal goldfields in Victoria, Australia;

- Mawson has the option to earn up to a 70% joint venture interest in the Optioned Property (as defined herein) by incurring exploration expenditures of A$4.0M over 6 years and making cash payments of A$250,000 over 4 years; and

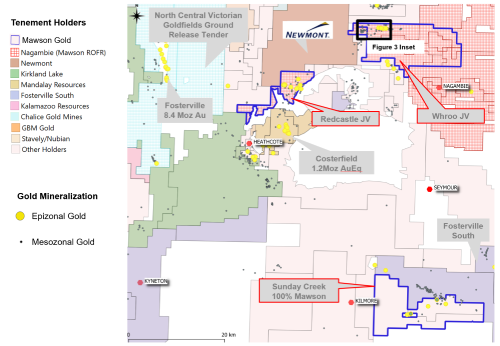

- Mawson now holds interests in three significant epizonal historic goldfields (Sunday Creek, Redcastle and Whroo) within 471 sq km of granted tenements and applications in Victoria (Figure 2).

Michael Hudson, CEO states: “The Whroo JV adds another significant epizonal goldfield (to join Redcastle and Sunday Creek) and increases our Victorian portfolio by 73% to 471 sq km. The Whroo historic goldfield extends over 9 kilometres, and was mined during the mid-1800s to early 1900s with minimal modern-day exploration. Furthermore, little or no exploration has been undertaken on the large 199 sq km land package that the Whroo JV provides. Given the exploration success at Fosterville we now understand that epizonal systems can develop extremely high-grade zones at depth. We look forward to rapidly unravelling the geological opportunity at Whroo by undertaking geophysics to determine structural controls and early diamond drilling.”

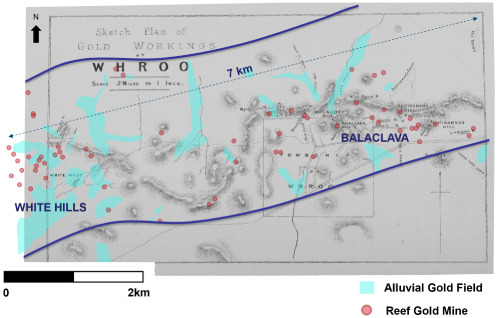

Alluvial gold mining commenced in Whroo during the initial gold boom of the 1850s and a settlement was quickly established. Significant alluvial workings are present throughout the field (Figure 3). Hard rock mining commenced in 1855. Whroo consists of the Balaclava Hill area which contains thirteen named reefs, while shallow workings extend the trend over 9 kilometres to the White Hills mining area. Production at Whroo is estimated to be 40,000 oz of gold. At White Hills, 21 historic hard-rock gold showings and mines occur within a larger alluvial gold field.

The largest producers at Whroo were the Balaclava Open Pit (23,600oz gold), Albert Reef (1,170oz gold) and Carrs Reef (913oz gold). Balaclava Hill, Albert Reef and Stockyard Reef are associated with stibnite veins. At Balaclava Hill, a 137 metre deep shaft and an open pit (80 x 40 metres across and 30 metres deep) were developed in 1855 and although the main stratigraphic and structural orientation was east-west, mineralization was observed in both E-W, NNE and flat veins with average widths of 3.5 metres. Outside of Balaclava, veins averaged 0.5 metres width and ran multiple ounces. The Mary Reef was 2.1 metres wide on average. The Peep-o’-Day Mine, a small antimony/gold mine had workings to 61 metres depth. The Happy-go-Lucky Mine averaged 128 g/t gold. The vertical Albert Reef ranged from 0.03-3.7 metres thickness and averaged over 94 g/t gold.

Doctors and Black shafts were the main zones at White Hills, located 4 kilometers west of Balaclava (Figure 3). The Black Reef was opened in 1859 with an average thickness of 0.9 metres. The highest yield was 500 g/t gold, with an average head grade of 47 g/t gold to 1874. Welch’s Reef was opened in 1873 and was mined to 91 metres. Mineralization averaged 0.5 metres @ 72 g/t gold. The lowest yield was reported as 31 g/t gold and the highest 2,737 g/t gold. Jerry’s Reef was opened in 1861 and averaged 0.5 metres width, with the highest yield 172 g/t gold and lowest 10 g/t gold. The maximum depth of workings was 15 metres. Woodward’s Reef was opened in 1874 and averaged 0.5 metres and at surface averaged 195 g/t gold, but the quartz mineralization got weaker with depth. The Rose of Denmark opened in 1874 and averaged 0.3 metres width with the highest yield 687 g/t gold and the lowest 39 g/t gold, but was not worked below 12 metres depth.

Since historic mining took place, modern exploration at Whroo has been relatively limited with few drill holes and a paucity of geophysical exploration aimed at understanding the structural setting. In the early 1970’s ICI Australia and Newmont diamond drilled one of the few holes ever drilled at depth in the field and intersected 60 metres @ 0.35 g/t gold from 133 metres beneath the Balaclava Hill mine. The most significant exploration at White Hills was undertaken by Gold Mines of Kalgoorlie (“GMK”, also working as Metals Exploration Ltd) mapped and drilled the area in 1988. A total of 1,734 metres of RC drilling was conducted in 29 holes across the prospect. The results from this drill program have never been followed up. None of the drill data has been independently verified at this time. Compilation of available data and 3D geologic modeling are in progress. The true thickness of the mineralized intervals is not known at this stage. Better drill intersections from this program included 7 metres @ 4.1 g/t gold from 40 metres (WHP7) and 8 metres @ 3.2 g/t gold from 40 metres (WHP26) and 1 metre @ 14.6 g/t gold from 62 metres (WHP26). Previous workers have exclusively focused on heap leachable near-surface gold at the Whroo goldfield and the project remains untested at depth. Further south at Reedy Lake, Nagambie have defined coherent soil anomalies that require follow up.

In early 2017, Nagambie’s geological consultant, Geoff Turner, began to articulate his intersecting-faults concept for the Waranga Domain. He had recognized that the known gold deposits at the Nagambie Mine, Wandean discovery, Whroo and White Hills and several gold anomalies, including Nagambie’s Reedy Lake soil anomaly that falls within the Whroo JV area, are all at or near to the intersections of gravity-inferred deep crustal faults and aeromagnetic-inferred or visually-outcropping nearer-surface thrust faults.

Summary of Amended and Restated Agreement

The Amended and Restated Agreement amends and restates the option agreement dated March 24, 2020, between Mawson and Nagambie relating to the Doctors retention licence (the “Original Agreement”). The Whroo JV substantially expands the area under option from that contained in the Original Agreement from 4 square kilometres to 199 square kilometres of mineral tenure and includes the 9 kilometre long Whroo gold mineralized trend. The Whroo JV consists of four granted exploration licences – EL6158 (Rushworth, 46 sq km), EL6212 (Reedy Lake, 17 sq km), EL7205 (Angustown, 69 sq km) and EL7209 (Goulburn West, 34 sq km), two exploration licence applications ELA7237 (Kirwans North 1, 20 sq km) and ELA7238 (Kirwans North 2, 9 sq km), and one granted retention licence RL2019 (Doctors Gully, 4 sq km) (collectively, the “Optioned Property”).

Under the Amended and Restated Agreement, Mawson has the option to earn an up to 70% joint venture interest in the Optioned Property by:

1. incurring exploration expenditures of A$400,000 in year 1 and an additional A$500,000 in year 2, and making cash payments equal to A$150,000, to earn an initial 25% interest; and

2. incurring additional exploration expenditures of A$1,600,000 on or before the end of year 4 (cumulative A$2.5M over 4 years) and making cash payments of A$50,000 in each of year 3 and 4, to earn a 60% interest.

Upon Mawson earning a 60% interest, either party may elect by notice to the other to form a joint venture (“JV”) under which the percentage ownership of each of Nagambie and Mawson will be 40% and 60%, respectively. Should the parties not elect to form a 40/60% JV, Mawson will then have the option to earn an additional 10% interest in the Optioned Property (for an aggregate 70% interest) by incurring an additional A$1.5M of exploration expenditures on or before the end of year 6 (cumulative A$4.0M in years 1 to 6). Once Mawson earns a 70% interest, a JV between the parties will be automatically formed. Nagambie may then contribute its 30% ownership with further exploration expenditures or, if it chooses to not contribute, dilute its interest. Should Nagambie’s interest be reduced to less than 5.0%, it will be deemed to have forfeited its interest in the JV to Mawson in exchange for a 1.5% net smelter return royalty (“NSR”) on gold revenue. Should Nagambie be granted the NSR, Mawson will have the right to acquire the NSR for A$4,000,000.

Mawson will have the option to accelerate its spending to achieve its various percentage ownership interests in the Optioned Property. Mawson retains its right of first refusal to take up or match proposals being considered over the remainder of Nagambie’s 3,600 square kilometre tenement package in Victoria.

The Amended and Restated Agreement is subject to Toronto Stock Exchange acceptance. In addition, pursuant to Australian Stock Exchange, Listing Rule 10.1, as Mawson holds 10.00% of Nagambie’s issued shares and the consideration to be paid by Mawson under the Amended and Restated Agreement (including exploration expenditures) will equate to greater than 5.0% of the value of Nagambie’s net assets, approval of Nagambie’s shareholders is also required.

The entering into the Amended and Restated Agreement is considered a “related party transaction” pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Mawson is exempt from the requirements to obtain a formal valuation or minority shareholder approval in connection with the transactions contemplated by the Amended and Restated Agreement in reliance of sections 5.5(a) and 5.7 (1) (a) of MI 61-101.

Qualified Person

Mr. Michael Hudson (FAusIMM), Chairman and CEO for the Company, is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure or Mineral Projects and has prepared or reviewed the preparation of the scientific and technical information in this press release.

None of the historic drill and mine data have been independently verified by Mawson at this time. The historical data pre-dates the implementation of NI 43-101 and are quoted for information purposes only.

About Mawson Gold Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic Arctic exploration company with a focus on the flagship Rajapalot gold-cobalt project in Finland. More recently it has acquired three significant epizonal goldfields with a large tenement portfolio of 471 sq km in the Victorian Goldfields of Australia, which provides a strategic and diversified portfolio of high-quality gold exploration assets in two safe jurisdictions. The company will have nine drill rigs turning in four global gold projects during the remainder of 2020.

|

On behalf of the Board, "Michael Hudson" |

Further Information |

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, “forward-looking statements”). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to, approvals of the Amended and Restated Agreements by TSX, ASX and the shareholders of Nagambie, the Company’s expectations regarding the potential of the Whroo JV, timing and successful completion of the geophysics and drill programs planned at Redcastle, Sunday Creek and Whroo, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises, including the current outbreak of the novel coronavirus known as COVID-19 on the Company’s business, planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading “Risk Factors” in Mawson’s most recent Annual Information Form filed on www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Figure 1: Plan of Mawson’s Victorian tenements (blue), the 100% owned Sunday Creek and the Redcastle and the new Whroo option and joint venture areas, showing location of shallow orogenic (epizonal) Fosterville-style mineralization. Red hatched areas shows the 3,600 square km area where Mawson has secured a first right of refusal. Modified from Willman et. al, 2010: Economic Geology (2010) 105 (5): 895–915)

Figure 2: Plan of Victorian tenement holders around the shallow orogenic epizonal mineralization goldfields of Victoria including Fosterville (8.4Moz), Costerfield (1.2Moz gold equivalent) showing location of shallow orogenic (epizonal) Fosterville-style mineralization. Mawson’s Victorian tenements (blue), the 100% owned Sunday Creek and the Redcastle and the new Whroo option and joint venture areas.

Figure 3: Plan of Whroo Gold Workings (from Bradley 1869), showing alluvial gold workings and reef gold mines. The field extends more than 9 kilometres in an east-west direction (beyond the limits of this map) and has seen very little modern exploration.

Click here to see more from Mawson Gold Ltd.