TORONTO, June 24, 2024 (GLOBE NEWSWIRE) --

Premier American Uranium Inc. (“PUR

”

or “Premier American Uranium”) (TSXV: PUR) (OTCQB: PAUIF)

and

American Future Fuel Corporation

(“AMPS” or “American Future Fuel”

)

(CSE: AMPS, OTCQB: AFFCF, FWB: K14, WKN: A3DQFB)

are pleased to announce a current mineral resource estimate and the filing of a Technical Report (the “

Technical Report

”) for the 100% owned Cebolleta Uranium Project located in Cibola County, New Mexico, US (the “

Project

”) prepared in accordance with National Instrument 43-101 –

Standards of Disclosure for Mineral Projects

(“

NI 43-101

”). The Technical Report is being filed under both PUR and AMPS’ respective profiles on SEDAR+ at

www.sedarplus.ca

, in connection with the previously announced Plan of Arrangement involving the companies (the

“Arrangement”

) which is expected to close later this week. The Technical Report, prepared by SLR International Corporation (“

SLR

”) with an effective date of April 30, 2024, includes a current Mineral Resource Estimate (“

MRE

”) for the Project and in line with recommendations, lays the foundation for future exploration to support a planned Preliminary Economic Assessment (“

PEA

”).

Highlights of the Technical Report

-

The MRE is based on a commodity price of US$80.00 per pound of U

3

O

8

using an underground mining cut-off grade of 0.072% eU

3

O

8

and an open pit mining cut-off grade of 0.024% eU

3

O

8

, reported as an:

- Indicated Mineral Resource totaling 18.6 million pounds of eU 3 O 8 (6.6 million short tons at an average grade of 0.14% eU 3 O 8 ).

-

Inferred Mineral Resource totaling 4.9 million pounds eU

3

O

8

(2.6 million short tons at an average grade of 0.10% eU

3

O

8

).

-

The MRE underscores the Project’s extensive exploration and operating history, incorporating reliable historical data and previously unaccounted areas such as the St. Anthony North pit, while factoring in depletion from past production (Figure 1).

-

The current MRE exceeds the historical Inferred Mineral Resource that was prepared for Uranium Resources, Inc. (AMPS’ predecessor) in 2014,

upgrading approximately 80% of previous Inferred Mineral Resource to the Indicated Mineral Resource category.

-

Key recommendations outlined in the Technical Report include:

- Exploration to expand the deposit footprint with potentially positive implications to a mining scenario.

- Collection of additional bulk density and chemical assays in future drilling to confirm historical reported density and radiometric equilibrium results.

- Updating the MRE with additional drill hole data and completing a PEA.

-

Strong exploration potential remains at the Project with potential to increase total mineral resources through exploration and expansion drilling in previously untested areas where the mineralized horizons of the Jackpile sandstone are open ended beyond the currently drilled area. Further work to de-risk the Project is expected to include infill drilling to upgrade Inferred Mineral Resource to Indicated Mineral Resource along currently mapped uranium mineralization. The Willie P area, which is not included in the MRE but was the site of previous underground mine operations, is believed to have resource potential which may be augmented by integrating additional historic radiometric logs and grade information into the resource model.

Colin Healey, CEO of PUR, commented, “We are extremely pleased to announce the updated Technical Report on Cebolleta. This asset was identified by our seasoned technical team as “highly attractive” for its resource potential, grade and favourable location on private lands in New Mexico. The new Technical Report represents a significant step forward for PUR and the Project, delivering a current MRE for the first time in a decade, and ahead of plan. The Mineral Resource estimate now exceeds the 2014 historical Inferred Mineral Resource estimate, confirming 18.6Mlb U 3 O 8 in Indicated and 4.9Mlb U 3 O 8 in Inferred (~80% ‘Indicated’, ~20% ‘Inferred’) and our exploration strategy can now transition from confirmation drilling to extension and expansion drilling as we work toward completing a Preliminary Economic Assessment (PEA), as recommended in the Technical Report. We believe that prioritizing our budget around these higher-impact initiatives should deliver enhanced value to shareholders with the potential to add resource pounds in new areas as we build out a mining concept. We thank all the technical staff and contractors for their contribution in achieving this major milestone and we are excited for the next phase of work at Cebolleta.”

Table 1: Summary of Mineral Resources – Effective Date of April 30, 2024

| Classification | Zone |

Grade Cut-off

(% eU 3 0 8 ) |

Tonnage

(Million st) |

Grade

(% eU 3 0 8 ) |

Contained Metal

(Million lb eU 3 0 8 ) |

AMPS

Basis (%) |

Recovery

U 3 0 8 (%) |

| Underground | |||||||

|

Indicated

|

Area I | 0.072 | 0.8 | 0.168 | 2.6 | 100 | 95 |

| Area II | 0.072 | 2.3 | 0.193 | 8.7 | 100 | 95 | |

| Area III | 0.072 | 0.7 | 0.192 | 2.7 | 100 | 95 | |

| Area IV | 0.072 | 0.0 | - | 0.0 | 100 | 95 | |

| Area V | 0.072 | 0.4 | 0.208 | 1.6 | 100 | 95 | |

| Subtotal Indicated | 4.1 | 0.189 | 15.6 | 100 | 95 | ||

| Depletion JJ#1 | -0.9 | 0.123 | -2.2 | ||||

| Total Indicated | 3.2 | 0.208 | 13.4 | ||||

|

Inferred

|

Area I | 0.072 | 0.2 | 0.118 | 0.4 | 100 | 95 |

| Area II | 0.072 | 0.3 | 0.131 | 0.8 | 100 | 95 | |

| Area III | 0.072 | 0.2 | 0.156 | 0.6 | 100 | 95 | |

| Area IV | 0.072 | 0.1 | 0.105 | 0.3 | 100 | 95 | |

| Area V | 0.072 | 0.2 | 0.161 | 0.5 | 100 | 95 | |

| Total Inferred | 1.0 | 0.135 | 2.6 | 100 | 95 | ||

| Open Pit | |||||||

|

Indicated

|

St. Anthony North Pit

|

0.024 | 3.3 | 0.081 | 5.4 | 100 | 95 |

| 0.024 | 0.1 | 0.084 | 0.2 | 100 | 95 | ||

| Subtotal Indicated | 3.4 | 0.081 | 5.5 | 100 | 95 | ||

|

Depletion

Climax M6 |

-0.1 | 0.205 | -0.3 | ||||

| Total Indicated | 3.3 | 0.078 | 5.2 | ||||

|

Inferred

|

St. Anthony North Pit

|

0.024 | 1.3 | 0.070 | 1.8 | 100 | 95 |

| 0.024 | 0.3 | 0.078 | 0.5 | 100 | 95 | ||

| Total Inferred | 1.6 | 0.072 | 2.3 | 100 | 95 | ||

Notes:

1. CIM (2014) definitions were followed for Mineral Resources.

2. Mineral Resources are estimated at a cut-off grade of 0.072% eU3O8 for underground based on Deswik MSO stope

shapes and 0.024% eU3O8 for open pit using Whittle pit optimization.

3. Mineral Resources are estimated using a long-term uranium price of US$80/lb U3O8.

4. Mineral Resources have been depleted based on past reported production numbers from the underground JJ#1 and

Climax M6 mines.

5. A minimum mining width of two feet was used.

6. Tonnage Factor is 16 ft

3

/st (Density is 0.625 st/ft

3

or 2.00 t/m

3

).

7. Numbers may not add due to rounding.

Mineral Resources are not Mineral Reserves, and do not have demonstrated economic viability. The authors of the Technical Report were not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the MRE.

Technical Report

Mineral Resources have been classified in accordance with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) definitions).

The MRE was completed using a conventional block modelling approach. The general workflow used by SLR included the construction of a geological or stratigraphic model representing the Jurassic Morrison Formation in Seequent’s Leapfrog Geo (Leapfrog Geo) from mapping, drill hole logging, and sampling data, which was used to define discrete domain and surfaces representing the upper and lower contact of the Jackpile Sandstone Member. The geologic models were then used to constrain resource estimation completed using Seequent’s Leapfrog Edge (Leapfrog Edge) software. The MRE used a regularized, unrotated whole block approach, inverse distance cubed (ID 3 ) interpolation methodology, and one-foot uncapped composites to estimate the eU 3 O 8 grades in a three-pass search approach. Hard boundaries were used with ellipsoidal search ranges, and search ellipse orientation was informed by geology and mineralization wireframing. Density values were assigned based on historical bulk density records.

Estimates were validated using standard industry techniques including statistical comparisons with composite samples and parallel inverse distance squared (ID 2 ), ordinary kriging (OK) and nearest neighbor (NN) estimates, swath plots, and visual reviews in cross section and plan. A visual review comparing blocks to drill holes was completed after the block modelling work was performed to ensure general lithologic and analytical conformance and was peer reviewed prior to finalization.

Rotary and diamond drilling (core) on the property was the principal method of exploration and delineation of uranium mineralization. From 1951 to 2014 and 2023, AMPS and its predecessors completed a reported total of 3,644 drill holes, of which 3,594 drill holes totaling 1,868,457 ft of drilling are contained in the drilling database provided to SLR. Of the 3,594 drill holes, 2,713 drill holes totaling 1,380,041 ft of drilling were used in the MRE. Historic surface holes missing collar information, lithology information, or corresponding radiometric logs, i.e., assay data, were excluded. A summary of the available data used in the modeling of mineralization is presented in Table 2.

Table 2: Summary of Drill Hole Data used in Mineral Resource Estimation

|

Area

|

No. Holes

|

Total Depth

(ft) |

Avg Depth

(ft) |

Number of Records | ||

| Survey | Lithology | Probe | ||||

| Area I | 296 | 115,364 | 390 | 1,337 | 361 | 292,349 |

| Area II | 380 | 243,232 | 640 | 1,205 | 415 | 478,456 |

| Area III | 234 | 116,021 | 496 | 447 | 1,439 | 207,699 |

| Area IV | 125 | 81,464 | 652 | 247 | 112,191 | |

| Area V | 223 | 139,712 | 627 | 1,720 | 250,023 | |

| Area Sohio_1 | 23 | 9,486 | 412 | 23 | 9,459 | |

| Area Sohio_2 | 16 | 8,354 | 522 | 16 | 8,252 | |

|

St. Anthony

North Pit |

1,198 | 550,854 | 460 | 1,298 | 98 | 5,737 |

|

St. Anthony

South Pit |

215 | 113,679 | 529 | 216 | 40 | 367 |

| Exploratory | 3 | 1,875 | 625 | 3 | 2,692 | |

| Grand Total | 2,713 | 1,380,041 | 509 | 6,512 | 1,953 | 1,367,225 |

The Cebolleta Uranium Project

The Project is located in the northeastern corner of Cibola County, approximately 40 miles west of the city of Albuquerque, NM, and approximately 10 miles north of the town of Laguna, NM. The property encompasses 6,717 acres (2,718 hectares) of privately held mineral rights (fee or deeded) and approximately 5,700 acres (2,307 hectares) of surface rights owned in fee by La Merced del Pueblo de Cebolleta (Cebolleta Land Grant). The Project is in a region that has a lengthy history of uranium exploration and mining activity dating to the 1950’s and is close to necessary infrastructure and resources.

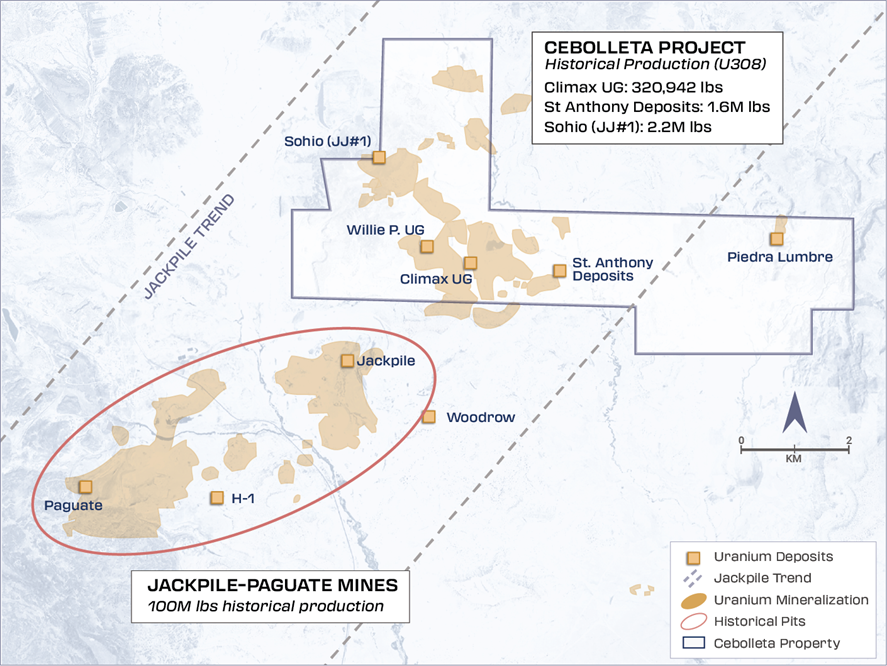

Figure 1: Plan View Map of the Cebolleta Uranium Project and Uranium Deposits

As described below and depicted above in Figure 1, the deposits that comprise the Project are classified as sandstone hosted uranium deposits with eight deposits occurring as a series of tabular bodies within the Jackpile Sandstone Member of the Upper Jurassic Morrison Formation within the boundaries of property.

These deposits are part of a broad and extensive area of uranium mineralization, including the Jackpile-Paguate deposit, located adjacent to the southern boundary of the property, which was one of the largest concentrations of uranium mineralization in the United States (Moran and Daviess, 2014). The L-Bar occurrence area contains five distinct deposits, including Areas I, II, III, IV, and V. The historical JJ#1 Mine is situated in the northwest corner of the Area II Deposit area. In addition to the L-Bar deposits, three distinct deposits occur in the St. Anthony area of the property.

The production history of the Project is as follows:

- Climax M6 Mine (1956 to 1960): 78,722 short tons (71,415 tonnes) that averaged 0.20% uranium oxide (U 3 O 8 ) and contained 320,942 pounds of U 3 O 8 .

- St. Anthony Mine Complex (1975 to 1979): 1.6 million pounds of U 3 O 8 .

-

Sohio JJ#1 Mine (1976-1981): 898,600 short tons averaging 0.123% U

3

O

8

and yielding 2,218,800 pounds of U

3

O

8

.

Significant exploration potential is believed to remain on the Project. The mineralized horizons of the Jackpile sandstone are open ended and potentially trend beyond the external limits of the drill hole grid. Potential exists to extend mineralization into previously untested areas of the Project, where this mineralized zone is present but not drill tested in a comprehensive manner.

Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Mark Mathisen, CPG, SLR International Corporation, Denver, CO, an independent geological consultant to the Company, who is a “Qualified Person” (as defined in National Instrument 43- 101 -

Standards of Disclosure for Mineral Projects

).

Technical Report

A Technical Report prepared in accordance with NI 43-101 for the Project is being filed under PUR and AMPS’ respective profiles on SEDAR+ at www.sedarplus.ca. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

About Premier American Uranium

Premier American Uranium Inc. is focused on the consolidation, exploration, and development of uranium projects in the United States. One of PUR’s key strengths is the extensive land holdings in two prominent uranium-producing regions in the United States: the Great Divide Basin of Wyoming and the Uravan Mineral Belt of Colorado. With a rich history of past production and historic uranium mineral resources, PUR has work programs underway to advance its portfolio.

Backed by Sachem Cove Partners, IsoEnergy and additional institutional investors, and an unparalleled team with U.S. uranium experience, PUR’s entry into the market comes at a well-timed opportunity, as uranium fundamentals are currently the strongest they have been in a decade.

About American Future Fuel

American Future Fuel Corporation is a Canadian-based resource company focused on the strategic acquisition, exploration, and development of alternative energy projects. AMPS holds a 100% interest in the Cebolleta Uranium Project, located in Cibola County, New Mexico, USA, and situated within the Grants Mineral Belt, a prolific mineral belt responsible for approximately 37% of all uranium produced in the United States of America.

For More Information, Please Contact:

Premier American Uranium Inc.

Colin Healey, CEO

Toll-Free: 1-833-572-2333

Twitter: @PremierAUranium

American Future Fuel Corporation

David Suda, CEO and Director

info@americanfuturefuel.com

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to activities, events or developments that PUR and AMPS expect or anticipate will or may occur in the future including, but not limited to, the anticipated timing for closing of the Arrangement, mineral resource estimates, future work programs and the interpretation of exploration results, expectations with respect to advancing the Project, expectations regarding completion of a PEA. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including the satisfactory completion of the Arrangement and the timing thereof, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct PUR and AMPS' planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by PUR and AMPS in providing forward-looking information or making forward-looking statements are considered reasonable by management of, as applicable, PUR and AMPS at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: the failure to obtain regulatory or stock exchange approvals in connection with the Arrangement, material adverse change in the timing of completion and the terms and conditions upon which the Arrangement is completed, inability to satisfy or waive all conditions to complete the Arrangement as set out in the arrangement agreement, failure to complete the Arrangement, negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to Premier American Uranium set out in PUR’s annual information form in respect of the year ended December 31, 2023, AMPS’ management information circular dated April 25, 2024 and in PUR and AMPS’ other filings with the Canadian securities regulators which are available under their respective profiles on SEDAR+ at www.sedarplus.ca

Although AMPS and PUR have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. AMPS and PUR undertake no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1f62fc50-c32b-4844-bcc3-c67300ee902b