Aztec Minerals Has Two Discoveries

Hunting for Gold-Copper Elephants in North America

Aztec Minerals

(TSX-V: AZT)(OTC: AZZTF)

Has TWO Discoveries

Follow-Up Drilling Is Underway With More Being Planned

If history is any indication…

There could be billion-dollar implications

Aztec Minerals (TSX-V: AZT)(OTC: AZZTF), is discovering porphyries in the southwestern United States and Mexico with a proven team.

Brad Cooke is Chairman. He is the founder of the NYSE-listed Endeavour Silver. He and his team are looking for large polymetallic porphyries that a major miner would be interested in acquiring.

Brad grew Endeavour into a billion-dollar mining company. Aztec trades with just a $15 million valuation, but has already found something that could transform it into something much larger.

President and CEO Simon Dyakowski has 13 years of corporate development and capital markets experience, with expertise in strategic planning and execution, financing, and marketing of exploration companies

Director Mark Rebagliati managed several major porphyry discoveries for Hunter-Dickinson and is a member of the Canadian Mining Hall of Fame.

Immediate-Term Drilling for Giants

Aztec controls 75% of the Tombstone project in southwest Arizona — the heart of a world-class porphyry district.

Tombstone is a historic silver district that produced 32 million ounces from 1878 to 1939, followed by a small open pit heap leach gold-silver operation in the 1980s.

It is on 164 hectares of patented land with road access, full services, water, and power.

There are two targets at Tombstone:

-

Shallow, bulk tonnage, epithermal gold-silver mineralization

-

Deeper, high grade, CRD lead-zinc-silver-copper-gold mineralization

The epithermal gold-silver mineralization is where mining was previously conducted at the Contention open pit — where previous drilling has returned intersections grading up to 1.61 grams per tonne gold and 91.2 gpt silver over 44.2m. Recent high grade sampling has shown grades up to 3,178 grams per tonne gold and 23.5 grams per tonne silver.

Gold and silver are there. Some modern drilling will remind the market of it.

The deeper target is the carbonate replacement deposit (CRD). Historic deep drilling for this type of mineralization done in the 1980s returned multiple intersections grading up to 32 gpt silver, 0.61% copper, 6.5% lead and 2.6% zinc over 7.2m core length.

That historic drilling, done by Sana Fe, hit narrow, high-grade polymetallic mantos in five of seven holes drilled.

Aztec has used the historic drilling, as well as modern aeromagnetics and Natural Source Audio-frequency Magnetotellurics (NSAMT) to define new targets that could represent Taylor-style massive sulphide replacement systems below the historic mines.

The Taylor deposit was discovered in 2015 by Arizona Mining beneath the historic Hermosa Silver district after a $1.6 million fundraising. It ended up being taken over by South32 for $1.8 billion, delivering over 2,300% gains for early investors.

Tombstone is the nearest historic silver district with similar Taylor-type CRD potential at depth.

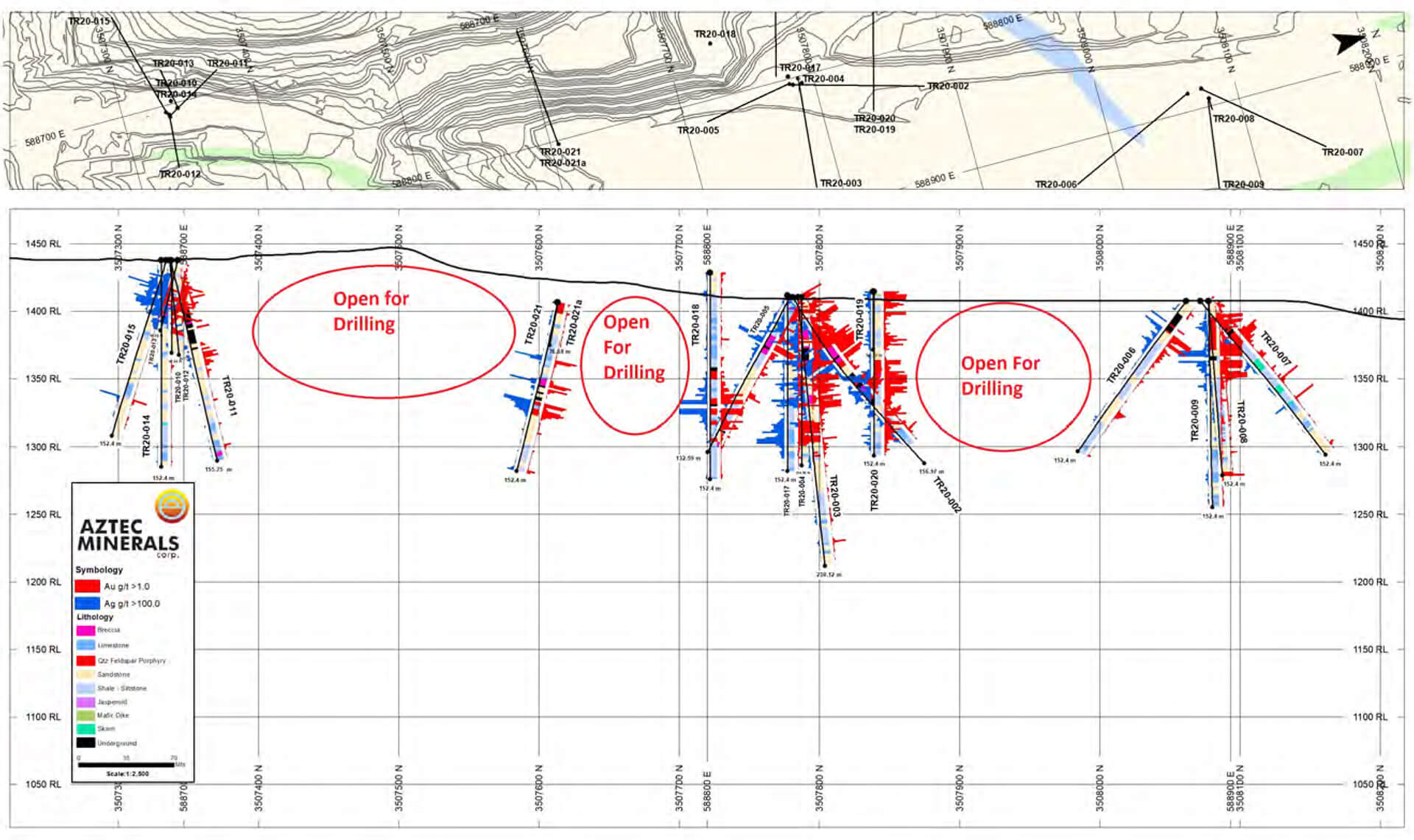

In 2020, 19 of 21 holes drilled in three areas intersected widespread gold and silver mineralization, extending the mineralized zone along 830 meters of strike down to 100 meters depth below the Contention open pit.

Most drill holes intersected old mine workings, dating back to the late 1800’s, although the high-grade bonanza mineralization was previously mined, substantial lower grade mineralization was left behind.

Drill highlights from 2020 include:

High Grade Gold-Silver Highlights

- TR20-09: 15.14 meters of 6.18 gpt gold and 77.2 gpt silver (7.15 gpt AuEq) from 32.0 m

- TR20-02: 13.72 meters of 3.18 gpt gold and 136 gpt silver (4.88 gpt AuEq) over 13.7 m

Bulk Tonnage Gold-Silver Highlights

- TR20-02: 77.72 meters of 0.94 gpt gold and 42.1 gpt silver (1.60 gpt AuEq) from 19.8 m

- TR20-03: 97.53 meters of 0.77 gpt gold and 25.2gpt silver (1.07 gpt AuEq) from 6.1 m

The project is already starting to show extensive and shallow oxidized gold-silver mineralization below an open pit that operated in the 1980s at much lower metals prices.

These results are high-grade in comparison to modern-day open-pit heap leach mines in the region.

Drilling in 2021 has continued to turn up excellent results.

The 23-hole, 3,000 meter reverse circulation program was designed to step along strike and down dip from the Phase 1 drill intercepts in 2020 to expand the shallow, broad, bulk-tonnage gold-silver mineralization discovered around and below the Contention pit.

And it is succeeding in doing that in a big way.

The first holes out in Summer 2021 intersected significant gold and silver mineralization resulting in an extension of the mineralized zones at depth and along strike below and west of the Contention open pit. Significant intercepts include:

-

5.7 grams per tonne (g/t) gold and 40.5 g/t silver (or 6.28 g/t gold equivalent “AuEq”) over 32 meters

-

1.39 grams per tonne (g/t) gold and 56.4 g/t silver (or 2.2 g/t gold equivalent “AuEq”) over 96 meters

A key takeaway from the current drilling is the bottoming in mineralization. That means, in all likelihood, mineralization continues at depth, which is something the Aztec team will be keen to explore in upcoming drill rounds.

Will Aztec follow in the 2,300% footsteps of Arizona Mining?

We will find out soon!

Second Kick: Cervantes

Aztec’s second property is also being explored this year, generating additional news flow and catalysts.

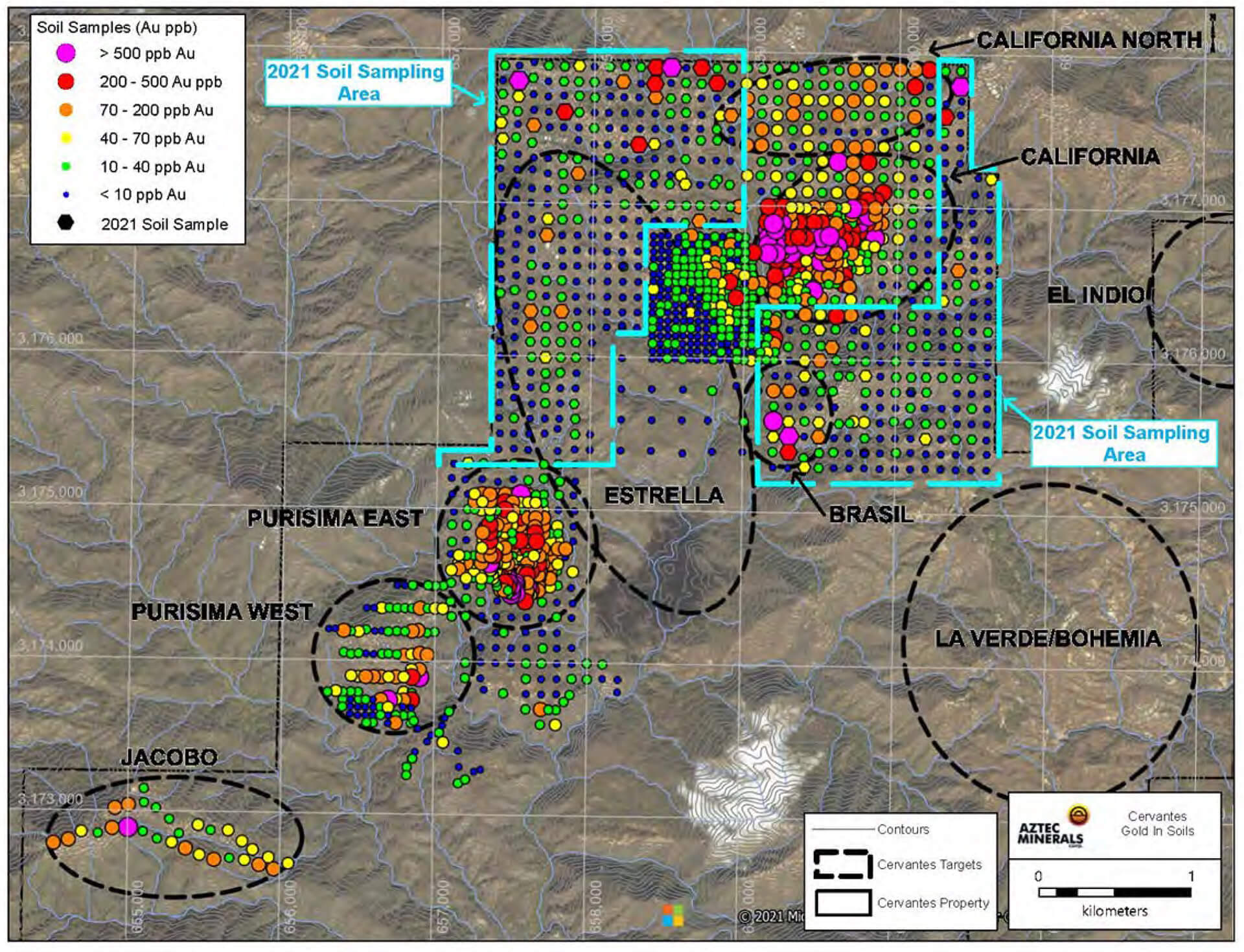

Cervantes is an extremely large, 3,649-hectare project in Sonora, Mexico, where it has made a recent gold-copper porphyry discovery. Aztec Cervantes

The property is 60 kilometers west of Alamos Gold’s Mulatos Gold Mine and 50 kilometers west of Agnico Eagle’s La India Gold Mine. It’s on private land with road access, water wells, and grid power.

Initial results hit 0.77 grams per tonne gold over 160 meters and 0.71 gpt over 139 meters. And there are multiple prospective mineralized zones related to porphyries and breccias along a six-kilometer corridor.

There are distinct magnetic, radiometric, and IP chargeability anomalies at the California target — where gold outcrops at surface and channel samples have shown <0.47 grams per tonne gold over 222 meters.

Aztec has earned into 65% of the project from Kootenay Silver, and the pair now operate it as a joint venture.

A Phase 1 drill program completed 2,674 metres in 17 core holes mainly at the California target. Gold and copper were discovered in 14 drill holes over long and consistent intervals, including:

- 160m @ 0.77 gpt gold incl 80m @ 1.04 gpt gold, 0.11% copper in 18CER010

- 139m @0.71 gpt gold incl 20m @ 2.1 gpt gold, 0.16% copper in 17CER005

- 118m @ 0.63 gpt gold incl 43m @ 1.18 gpt gold, 0.16% copper in 17CER003

- 122m @ 0.60 gpt gold incl 62m @ 0.88 gpt gold, 0.06% copper in 18CER007

- 170m @ 0.42 gpt gold incl 32m @ 0.87 gpt gold, 0.06% copper in 18CER006

A follow-up program is being planned to expand the California target laterally and to depth and to evaluate additional high-priority gold targets.

Aztec Minerals has many exciting catalysts ahead given all the upcoming exploration.

Here to tell us more about them is CEO and President Simon Dyakowski.

Hunting for Gold-Copper Elephants in North America

Interview with Aztec Minerals (TSX-V: AZT)(OTC: AZZTF) CEO Simon Dyakowski

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the CEO of Aztec Minerals., Mr. Simon Dyakowski. Simon, How are you?

Simon Dyakowski: Hey, Gerardo. Thanks for having me on. I am doing great. The big news for us is we have been drilling again at Tombstone! So appreciate the opportunity to come on and speak with you.

Gerardo Del Real: You know, I think your timing is excellent. Rigs are in high demand, in short supply, especially in the part of the country that you're operating in — Arizona. So it's impressive you were able to secure a rig to get going. Timing couldn't be better with gold and silver both in bull markets. I'd love to hear the details of the drill program. I know Tombstone, as you know, is a project I really like. Let's get right into the results from the 2021 drill program.

Simon Dyakowski: We just completed 23 holes, 3,000 meters with a reverse circulation, or RC rig. And it's designed to follow up on the success that we had last year in our phase one drill program, stepping along strike and down dip from the intersections that we had last year to expand the shallow broad bulk tonnage, gold silver mineralization around and below the contention pit. Just to get into some greater detail on that, last year when we drilled, we hit broad intersections of bulk tonnage material, as well as some high-grade. So highlights of that include 15 meters of over six grams of gold and over 70 grams of silver in hole nine in the north of the pit.

And these results definitely exceeded our expectations. You'll recall, last year, we got a good start on our Tombstone drilling project with three spoke patterns that we drilled along the old Contention open pit mine structure. And we hit some very compelling grades of heap leach, bulk tonnage style material.

Highlights were 76 meters of 1.6 grams gold equivalent. In the north of the pit, we hit a high-grade zone with a highlight intersection of 15 meters of just over 7 grams gold equivalent.

So to over double that with this 30 meters of a broad, high-grade interval of over 5 grams gold and over 6 grams of gold equivalent was better than double our best result last year. So we're thrilled.

We're extending the mineralized zone to the west now, and we're putting some size to this project here. So it's an exciting time for us.

Gerardo Del Real: I think it should be pointed that along with the excellent grades, the shallowness of the mineralization; I think that's important to highlight.

Simon Dyakowski: Yeah, absolutely. I mean, this high-grade intersection starts at just… the highest-grade portion, which is 15 meters of over 12.5 grams gold equivalent… that starts at 89 meters down a 45 degree angle hole. So it's about 50 meters (40 - 50 meters) below the surface. So this really bodes well for open pit mining.

You could almost characterize these as strong underground mining grades. And here we have them in the western pit wall of the old Contention Pit and open at-depth, I might add. So a lot for us to follow up on here. Like I said, this project is growing pretty quickly here.

Our follow-up to relate to this program will be to test oxidized gold and silver mineralization to depths below that 150 meter level all the way down to 200 meters. And to tie-in some much deeper 500 to 750 meter holes testing for that Taylor CRD style target.

Exciting results for us all through the summer… really building up to an exciting core drilling program to follow this one up.

Gerardo Del Real: You’re contemplating not only extending the near-surface oxidized gold-silver mineralization to 150 to 200 meters but you also talk about potentially drilling some much deeper 500 to 750 meter holes to test for Taylor-CRD polymetallic massive sulfide mineralization that you believe is underlying the near-surface epithermal mineralization.

Can you speak to that Taylor-type mineralization that you plan to look for in a Phase 3 drill program, because I think it's important for people that may be new to the story and are just starting to get a grasp of what it is you're exploring for?

Simon Dyakowski: Yeah, certainly. So the background here is that the Tombstone silver district is the next nearest past-producing silver district in Arizona to the Hermosa silver district. And if we look back about six years, a company there called Arizona Mining was drilling-off a near-surface silver deposit before they decided to drill deeper beneath that deposit to test for massive sulfide-style polymetallic mineralization or a carbonate replacement deposit.

Now, Arizona Mining, in 2015, ended up drilling over the next three years underneath their shallow silver deposit what is now one of the largest zinc primary deposits in the world at over 100 million tonnes of zinc equivalent. And that company was purchased in 2018 for almost C$2 billion in one of the biggest mining transactions in recent memory; very rapid share price appreciation after making that discovery.

So at Tombstone, we have been working on our shallow gold-silver deposit; drilling that off over the summer. And we now plan to integrate the mineralization that we've discovered in the top 150 meters of the silver district with these deeper CRD-style targets, of which we have three primary drill hole targets that we've discussed before; one in the north end of the pit and then two underneath the south end of the pit. And as you mentioned, these are deeper. They're about 600 meters beneath the surface. And we do already have an indication that this Taylor-style CRD mineralization might be there.

There's one historic drill hole drilled under the north end of our pit in 1989 that returned 7 meters of a combined 9.1% lead-zinc, 32 grams silver, and 0.6% copper, which would be indicative of a Taylor-style grade. Now, that deep intersection underneath the north end of our Contention open pit has never been followed up on.

So our next steps will be to drill-test deeper under the southern portions of our pit where we have recent geophysical data that suggests there are conductive bodies lying beneath that pit. And again, they've never been drilled.

Now, what's really interesting here is that we've had good success in our shallow drilling that's still open at-depth. So we now have an opportunity to drill-test deeper under the shallow portions of our already made discovery and integrate that with the deeper model, or killing two birds with one stone, if you will.

So we look forward to showing investors the details of that plan over the coming weeks and getting to work as soon as we can.

Gerardo Del Real: Excellent. Tombstone is 75% owned by Aztec. And I noticed that you acquired a couple of extra patents. I believe it was two additional patents, if I remember correctly to add to the land position. What's the thinking behind that?

Simon Dyakowski: The historic Tombstone Silver District is mostly patented ground. We have most of the original patents of the district. But there are some that are to the east and west of us that we didn’t have. So any time there's an opportunity to acquire private land, you have to jump on it. There was an opportunity to grab two patents to the southeast of the main Contention structure, about 35 acres in total. We were able to strike a deal to acquire those and closed that back in March.There's geological targets on the land and if the Contention Pit ever gets back into production, you always need land to build facilities on.

Gerardo Del Real: That's smart execution, Simon. It's always better and easier, I should add, to do that early on in a program than later on when, you know, we're hitting all time highs and gold and silver and copper and all of a sudden there's a premium for everything. Right?

Simon Dyakowski: Yeah, exactly. You really want to get ahead of it. I mean, you want to be buying things before the discoveries are made and, you know, hopefully we will have some discovery news.

Gerardo Del Real: And it’s not just Tombstone results that could send Aztec shares much higher. You’re also planning a very robust exploration program at your Cervantes gold-copper project in Sonora, Mexico. You actually made a discovery there last year that the market totally missed. I would love for you to provide an overview on your plans at Cervantes, because I think it's really going to catch the market's attention this year.

Simon Dyakowski: Absolutely and a good question. We have been working all summer on preparing that property for drilling. We have previously announced plans to drill 5,000 meters at Cervantes. That is subject to financing, I’ll point out. However, it will be the first drilling to follow up from the discovery that Aztec made back in 2018, which tested just one of the more than 10 porphyry targets that we have on the property.

And to remind your listeners, Gerardo, that discovery was seen in 14 drill holes at the California Zone. They have not been followed up on so we will drill 14 holes at the California Zone target stepping out from that initial discovery that had very consistent mineralization highlighted by a 160 meter intersection of 0.77 grams gold equivalent.

An excellent indication of a gold oxide cap to a deeper porphyry system has not been drill-tested since. And we have a 5,000 meter program teed up, ready to start this autumn once we have funded.

Gerardo Del Real: You mentioned the California zone and it's important to note that you've done preliminary metallurgical work already. And I believe the tests there, the oxide gold recoveries in bottle roll tests came back right in the range between 75% and 87%? Nearly 90%?

Simon Dyakowski: Yeah, that's right. So the initial met work was very positive, so obviously that's a key component, especially when you're looking at a gold-copper porphyry system. We can see quite clearly in the main California zone that a lot of the copper has leached out and there's an oxide cap that looks to be up to 150 meters in vertical depth. We plan in the fall or after the rainy season in the summer to drill about 5,000 meters, 2,800 meters of those are budgeted for the California zone for infill, step-out drilling to get the drill spacings along that initial discovery up to something that might give us the confidence to start looking at an initial resource estimate. So that's very exciting, just on the basis of the California zone alone. I think investors have good exposure there to potentially defining an open-pit heap leach gold deposit.

Then we've got some meterage budgeted for some other targets on the property. We plan to drill a hole in the California north zone, so exploration upside there. There's a very strong target known as Purisima in the southwest of the property. That's another target for about four to six drill holes. And Jacobo, as well, will be drill tested. Those are all shallow gold oxide targets.

And we have some deeper porphyry copper targets that we intend to test as well. We have two 500-meter holes planned to test those deeper porphyry targets. So all in all, a solid program where we'll have developments we're drilling leading up to potentially a look at a resource as well as testing numerous targets that represent pure exploration upside.

Gerardo Del Real: Fantastic Simon. That was a good update. I'm looking forward to having you back on. Anything else to add to that?

Simon Dyakowski: Just that really there's going to be a lot to look forward to. We will have a lot going forward, and we'll have the kind of news that gets investors excited with potentially discovering more mineralization.

Gerardo Del Real: Excellent. Looking forward to it. Thanks for your time.

Simon Dyakowski: Thank you, sir.

Drilling Underway

Why You Need to Check Out Aztec Minerals Now

Aztec Minerals (TSX-V: AZT)(OTC: AZZTF) has 59.1 million shares outstanding with 14% of them held by insiders and 20% of them closely held.

Those shares currently trade below US$0.30, giving it a tiny market capitalization below US$15 million.

Remember, Arizona Metals made a discovery nearby at this stage in its lifecycle… and ultimately went on to get bought out for$1.8 BILLION.

To give you some sense of what opportunities like this can turn into upon successful drilling… that is some 120X higher than Aztec Minerals currently trades.

Aztec has a proven team with a clean share structure and multiple projects with many catalysts ahead.

Q3 2021:

- Tombstone – Results and interpretation of Phase 2 RC drilling program testing shallow epithermal gold-silver mineralization

- Cervantes – Plan and permit a substantial phase 1 RC drilling program on the California and Purisma targets

Q4 2021 – Q1 2022:

- Tombstone – Phase 3 Core Drill program to target deeper epithermal gold-silver mineralization below the Contention pit and deep CRD silver-lead-zinc-copper-gold mineralization in Paleozoic limestones underlying the Bisbee Sediments

- Cervantes – Phase 2 RC drilling program on the California, California Norte, Jasper and Purisima East targets

With targets on each wide open for expansion…

You’ll want to take a deeper look at Aztec Minerals now.

— Resource Stock Digest Research