Dolly Varden Silver: Sitting on an Undervalued High-Grade Deposit

TSX-V: DV | OTC: DOLLF

Sitting On a 44 Million Ounce High-Grade Silver Deposit

Backed by Eric Srott and Hecla

One of the Earth’s Few Pure Silver

Projects Is Severely Undervalued

Dolly Varden Silver Corp is currently trading below US$0.75.

There's huge upside potential with Dolly Varden given the high-grade nature of its silver asset — the 100%-owned Dolly Varden Project — and the significant institutional and strategic ownership of its shares.

The company is sitting on very high-value silver deposits with a proven history of producing high-grade silver.

- Dolly Varden/North Star Mine produced 1.3 million ounces at an average grade of 1,109 grams per tonne silver from 1919-1921

- Torbrit Mine was the third largest silver producer in Canada in 1956, producing 18 million ounces of silver at 466 grams per tonne.

Dolly Varden’s current silver resources stand at 32.9 million ounces indicated and 11.48 million ounces inferred — making it the largest pure-play silver project in all of Canada.

The majority of the resource is at Torbrit, but there are several other deposits being explored that can add ounces quickly.

Armed with a treasury of C$20 million, and with key shareholders like Hecla and Eric Sprott, the company has drilled over 55,000 meters in 174 holes since 2017 — including positive results outside of the current resource, which means more ounces are on the way.

Metallurgical testing has shown the company can recover 87% of the silver from Torbrit and 86% of the silver from Dolly Varden.

When you combine the company's structural strength with the value of their deposits, you’re looking at an opportunity for significant returns — even if silver prices stay where they are.

Silver in the Golden Triangle

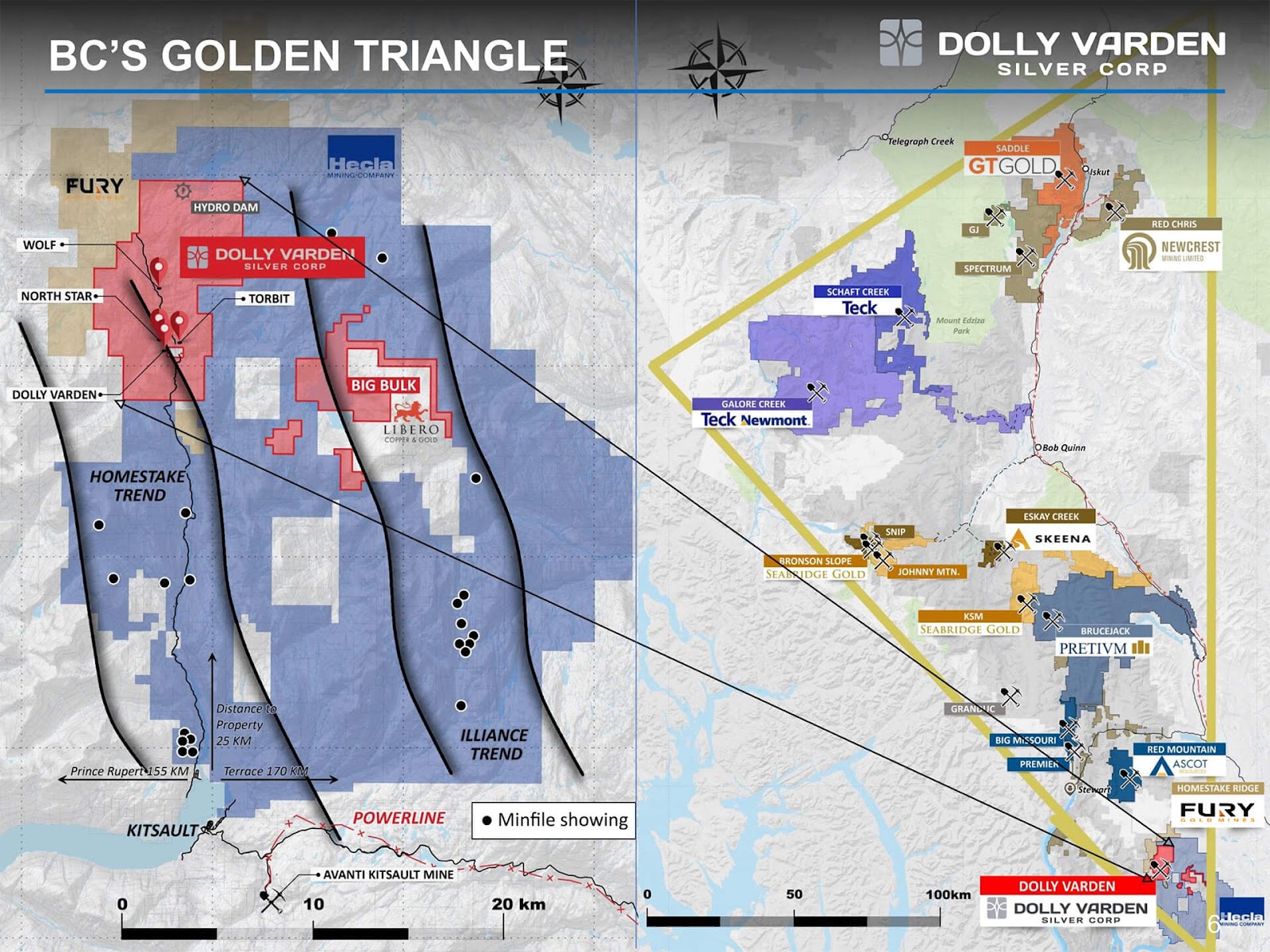

Dolly Varden is exploring for high-grade silver, gold, and base metals in the Golden Triangle District of northwestern British Columbia.

The area of Canada is a powerhouse when it comes to the global mining industry, and hosts multiple mines including Pretium’s Brucejack and Teck/Newmont’s Galore Creek.

The property is 23 kilometers from a deep tidewater port and 30 kilometers from the power grid. There’s also a historical hydro project on the property.

The seven kilometers of underground workings on the project only scratch the surface of the prolific silver occurrences on the property.

Structural re-interpretation and aggressive drill testing in the past three years have yielded new discoveries of high-grade silver mineralization proximal to areas with 100 years of exploration history, including:

- Chance Offset: Hole DV19-165: 385 g/t Ag (399 g/t AgEq) over 24.9m

- Beginner’s Luck: Hole DV17-080: 110 g/t Ag (116 g/t AgEq) over 2.94m

The mineralization, alteration, and rock formation of the Dolly Varden Project have a lot in common with the nearby Eskay Creek deposit.

The Eskay Creek deposit is located north of the Dolly Varden project, at an approximate distance of 100 km. This deposit is known for being rich in high-grade gold and silver deposits. It was formerly operated by Barrick and now Skeena Resources owns it with a C$857 million market cap.

Dolly Varden is following in a similar path, and currently has a market cap below $100 million.

Dolly is a very historic mine in Northwestern, BC with very high production grades of 500 grams per tonne silver in the past.

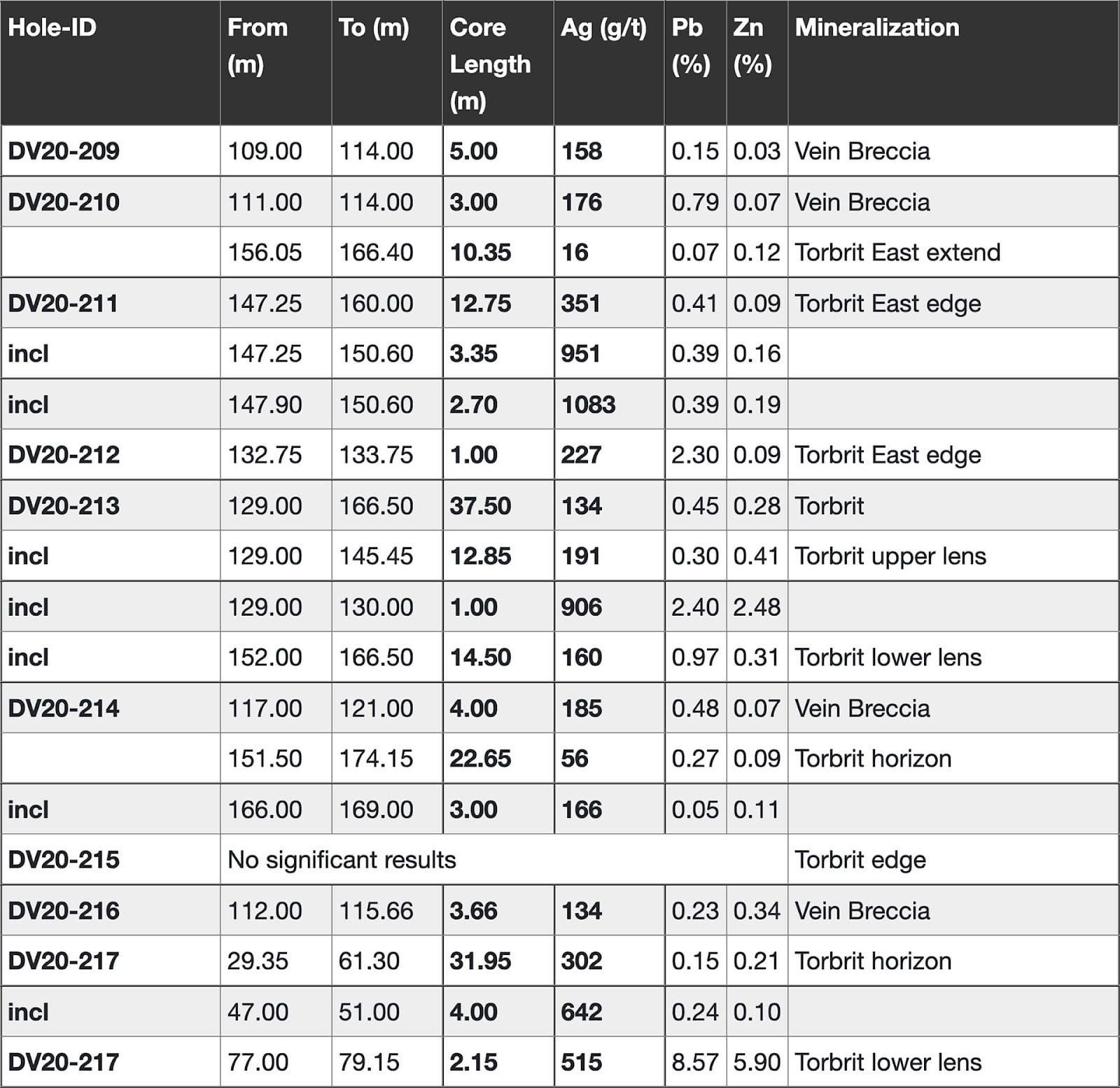

Recent step-out drilling has shown some very exciting results. Multiple silver zones were intersected including 419 g/t silver over 75 meters and 1,240 g/t silver over 16 meters.

The results from the 2020 drilling program of Dolly Varden Silver Corp demonstrated that there is plenty of silver yet to find. The known deposits are open along strike and down dip in some areas. And there is no shortage of exploration targets.

Results out in early 2021 vertically extended the known mineralization via a 45-meter long drill intercept averaging 304 grams per tonne silver [Hole DV20-222] at the Torbrit deposit.

The 2021 dril program is now underway. It’s phase one of a two-year plan to aggressively expand and upgrade the Torbrit deposit, along with multiple silver-rich satellite zones, with the objective of advancing the Dolly Varden Silver Project to become British Columbia’s next high-grade silver mine.

Shareholders have recently been realigned and Eric Sprott has come on as a major backer. And with a strong treasury the company is in a position to continue drilling and adding ounces.

Here with us to talk more about it is Shawn Khunkhun, the CEO of Dolly Varden Silver corp.

Interview with Dolly Varden

CEO Shawn Khunkhun

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the President and CEO of Dolly Varden Silver (TSX-V: DV)(OTC: DOLLF), Mr. Shawn Khunkhun. Shawn, how are you this morning?

Shawn Khunkhun: Gerardo, I'm doing excellent. Very nice to be with you this morning.

Gerardo Del Real: I am excited to help tell this story because I believe we are in the early stages of what will be a historic precious metals market. I know you recently came on and took the reins at Dolly Varden Silver. So I have to ask, can you walk me through what attracted you to the company? And then give us a brief overview of your background and then we'll get into the team and the asset and what we have to look forward to moving forward.

Shawn Khunkhun: Perfect, Gerardo. I'm very happy to be here. I'll start with my background and then I'll go into Dolly Varden. I've been in the mining business for 16 years. I started at a time where we were at the beginning of a really strong gold bull market. I helped build a company that went from inception to about a $1.5 billion dollar valuation. After we saw gold top out at $1,900 and as we moved into a bear market I stayed in the space and got very, very familiar with quality assets and started looking at these assets at these much lower valuations.

Coming around to Dolly Varden, the opportunity in Dolly is I've been made aware of the history on the property. Dolly is a very historic mine in Northwestern, BC with very, very high-grade production grades, 500 gram production out of the Torbrit Mine. About 20 million ounces of gold have been produced on the property. I was aware of Dolly and essentially what led me to take on the reins as CEO was I was watching a company that had some very, very good fundamentals. They controlled the deposit. They had 100% interest. They had a clean balance sheet. There was about $3 million in the bank. But on an enterprise value per ounce they were trading at half the value of their peers. That's where I saw the opportunity.

That's why I joined the company. We've taken the treasury from $3 million to $20 million. We're now in a position where we can go out and we can realize the full potential of the property. We have realigned the shareholders. We've been backed by Eric Sprott. Eric has come in since myself and the new management team has come in and taken a 20% stake in the company. You've got Eric Sprott at 20%, you've got Hecla at over 10%, and then we've got some other notable precious metals investors rounding out another 35%.

We've got just a solid foundation from a structure standpoint. We've got a robust cash position and we're anchored with about a 44 million ounce high-grade silver deposit that used to be a very, very rich producing silver mine. It was only really abandoned due to the price of silver being at $0.85 an ounce back in 1959.

Gerardo Del Real: Let me go over that production profile because within a 10-year period the mine produced, I believe, 18 million ounces of silver at 466.3 grams per tonne. Let's be clear, what you're targeting here is high-grade silver, gold, and then obviously there's some base metal credits that apply as well, right?

Shawn Khunkhun: The way we report is we just report the silver. What makes Dolly very special is it's predominantly a silver mine, but there are some other byproducts. The numbers that you went over are from the Torbrit Mine. If you look at the old Dolly Varden Mine that was a mine that was producing at over 1,000 grams per tonne. Where we have resources is 85% of our resources are at Torbrit but the other 15% are spread amongst three other deposits, including the old Dolly Varden Mine.

One of the big opportunities here, Gerardo, is there's an exploration trend on our property that goes for about 4.5 kilometers where there are many other – whether they're surface showings, whether they're past-producing mines, whether they're new, exciting discoveries. For instance Chance, which yielded some exceptional results last season. The point I'm trying to get across here is there are a lot of rich targets on the property.

Gerardo Del Real: You mentioned the current resource. Can we get into that a bit? Because I know that the metallurgical recovery rates, the testing and the silver recovery rates are pretty robust. I believe 87% and 86%, respectively at Torbrit and Dolly Varden. Correct?

Shawn Khunkhun: That is correct. Yeah. See, what I love about this project is everything is modern. The resource estimate came out in 2019. Every year, the compliance and the governance around these types of reports gets more stringent and more stringent. It should really give investors confidence in our numbers. This is a modern resource estimate that was published in the spring of 2019 and the metallurgical work was also reported at that same time.

Gerardo Del Real: The indicated resource stands at 32.9 million ounces of silver at 300 grams per tonne silver, and the inferred resource at 11.48 million ounces of silver at 277 grams per tonne silver. You mentioned the strong institutional ownership of over 60% and obviously the strategic investment by Eric Sprott and Hecla.

A large part of what has to have attracted those folks to Dolly Varden is the strong team. I mean, you have some of the better, stronger, more well-known names in the space, people that know this region and this area. I've got to believe that's extremely valuable to you as you look to grow the asset base, right?

Shawn Khunkhun: Absolutely. I come from a capital markets background. But really I think one of the things that sets us apart is we've got a director and a technical advisor in Rob McLeod, who's not only had four M&A transactions but is also from the Stewart area and has worked on many mines and discoveries that are in the area. So knowing the nuances of the Golden Triangle and how these different systems are formed and how to efficiently explore and develop them is very, very important.

In addition to myself and Rob, we're supported by a board that has worked with companies like Coeur Mining, Hecla, Anglo. We've got a very, very strong experienced board and management team.

Gerardo Del Real: Excellent. You mentioned the strong mining jurisdiction. How are community relations? We know social license in this day and age is absolutely critical to advancing a project. And I know you would like nothing less than to be able to have a transaction under your belt, a notch on the belt there. How are relationships locally?

Shawn Khunkhun: So we're part of an organization called the BC Regional Mining Association. It's essentially three groups. It's government, it's First Nations – these are the indigenous populations of the region – and it's companies. So the four companies that make up this group are Dolly Varden, Skeena, Ascot and GT Gold. These are four prominent explorer-developers in the area.

What we've done is we've partnered with government and with the First Nations to let the world know that this part of British Columbia, the Golden Triangle, Northwest BC is open for business. We've got a very pro-First Nations group. All the local communities, whether it's Stewart, if it's some of the surrounding areas around the townships of Terrace or Smithers, they're very, very supportive of mining. We're in just a great, great jurisdiction. Particularly during times of COVID-19 we're able to drive to our sites. Being here in BC, it's just been a huge competitive advantage for us.

Gerardo Del Real: You have the robust treasury, $20 million in cash you mentioned. How do you plan on allocating that? What can shareholders and people frankly that are looking for a high-grade silver story in a stable jurisdiction with a lot of upside? How do you plan to allocate those funds and what can we expect the rest of the year, Shawn?

Shawn Khunkhun: Yeah, so let me set the stage here a little bit. The Golden Triangle has been on-fire. You've seen Newmont's acquisition of GT Gold for half a billion dollars. You've seen Yamana come into Ascot. I've never seen the level of interest or activity. We've got a resurgence occurring.

Skeena is up to close to a billion dollar market cap. Ascot has been moving up. The whole area is on-fire. What we've done since our last news release is we've had the busiest offseason. We've been completing several studies; engineering studies, underground mining studies, geological targeting studies and reviews.

We've had the busiest offseason. We've leveraged our treasury. We've got over C$22 million in the bank right now, and we've spent that on the science. We've brought in some new team members. We've got just a flurry of activity occurring.

And now that the snow has melted — we're up at-site. The drill is coming in. We've got a big program planned. It's a two-fold program. So one-fold is focused at the deposit; focused at the past-producing high-grade Torbrit where almost 60 million ounces of silver have been identified at super, super high grades; 18 million [ounces] have been produced.

There's a big endowment there. It's a big, wide ore body. And that's one part of the plan. So upgrade that; bring some of those Inferred ounces into the Measured & Indicated category. And, Gerardo, you've seen this, I've seen this… when you start drilling around a mine — you find more! We saw it last year where we hit almost 50 meters of over 300 grams [per tonne] of silver. These are massive intercepts.

Now that's exciting; that's intense. But the big prize here is that exploration belt. We've got 4.5 kilometers. We've got the targets. And we've got some just really, really, really exciting exploration targets we're going to drill. And that's the two-fold strategy. Grow what we have, upgrade it, move it forward, advance it, get underground. And as we're doing that, look for another Torbrit on the property.

I've got a vision to take this property through a hundred million ounces! You look at what's happening around the world in places like Peru where you're seeing election results sort of make mining less stable. And the opportunity that we have here — with our government, with our First Nations partners, the Nisga'a, with the endowment — is tremendous.

And so we're looking to exploit that opportunity with a very, very aggressive two-phase strategy. And we've got the targets. We've got the endowment. We've got the team. And I can't wait to come back on the program with some results.

Gerardo Del Real: I'm looking forward to it! So just to be clear, you're looking to upgrade the Inferred resource to a Measured & Indicated classification? And then, simultaneously, you're also looking for that high-reward exploration drilling that the market always rewards when you hit, correct?

Shawn Khunkhun: Correct. But further to that, on the first part of that, around Torbrit, what ends up happening is you end up growing by 20%-30% as you go through that upgrading exercise because you start drilling and extending and expanding zones, and you incrementally start adding to the resource in addition to upgrading your confidence and moving categories.

And you know, Gerardo, there's projects out there that look really good on paper. There's projects out there where companies can put a lot of ounces on paper — but they're Inferred. And once you go and tighten up those drill spacings, you end up losing ounces.

Gerardo Del Real: Yeah.

Shawn Khunkhun: This is a project that the bulk of our 43-101 [resource] is already Indicated. So we know from tight space drilling that this one holds together. It's not spotty; there's continuity. It's amenable to bulk mining methods like longhauling.

So this is a project that's a tremendous asset. It's really rare in the sense that this is not a zinc mine or a lead mine dressed up like a silver mine. We only report the silver numbers, and we don't put out equivalents, right? So this is a pure silver play. And it's in a tremendous area that's got — you look at Eskay Creek — that’s 200 million ounces of 2,000 gram [per tonne] silver.

Gerardo Del Real: Yeah, it's phenomenal!

Shawn Khunkhun: That doesn't even sound real! And that's what our neighbors to the north have produced. And then, we've got this — and I never talk about this — but we've got this gold trend that's coming from our neighbor to the west, Homestake Ridge, which is owned by Fury.

They've got a million ounces of gold right coming up on our border. We went out to the western part of the gold belt… and where we've got this gold trend coming onto our property… and we're finding gold and copper — the two most coveted metals under the sun right now — right on our property border.

So we're going to drill some holes there on the southern end of that gold belt in addition to focusing on the high-grade silver. So it's going to be a busy season. It's going to be a season that's full of results. And with C$22 million in the bank — there's no end in drilling for years.

Gerardo Del Real: Shawn, I've got to say, this is probably the most exciting exploration season out of the Dolly Varden Silver Belt for a multitude of reasons, right? One, the silver price and where we think that silver price is headed. But there's a lot of real quality work being done by yourself, by Hecla, nearby — by others. And so I'm excited for it!

I'm looking forward to another update. You're cashed up. You have the team to do it. You already have a pretty robust resource, and it sounds like you're pretty confident you can add to that.

Shawn Khunkhun: Well, you know what… it’s because of the team that I have. It's people like Rob McLeod, like Rob Van Egmond, Jodie Gibson, Ryan Weymark. It's these scientists that have had successful discoveries, successful sale of companies to larger entities, takeovers — it's because of these scientists that they're giving me the confidence.

And it's because of what's been produced and what's there in a 43-101 compliant resource — all the targets. This is a hundred-year-old camp, Gerardo, that every year delivers new discoveries. And at some point we are going to find another Torbrit.

And when we do, you're going to see the same type of share price growth and market cap growth we've seen with others in the neighborhood; companies like Skeena, companies like Tudor, companies like Pretium — we're in giant country here, and it's reawakening these past giants.

And you've got the grade. You've got the endowment. And we've got the team. We've got the treasury. And now, it's the season where we're going to produce a lot of news; a lot of catalyst. This is the time!

Gerardo Del Real: A lot to get to. I'll let you get to it! Thanks again for your time, Shawn.

Shawn Khunkhun: Thank you, Gerardo.

The Opportunity

Dolly Varden is one of the world’s great pure silver mines.

It has produced tens of millions of ounces of silver and was only shut down because of low silver prices.

Now, in a $20+ silver environment, the project has new life.

It already boasts 44 million ounces of silver — with a street value of over $1 billion — yet trades with a market cap below $100 million.

That leaves a runway for the stock of some 10X.

Exploration continues and ounces will add up very fast, meaning the company will be worth even more very soon....

Making now a perfect time to start checking out Dolly Varden Silver (TSX-V: DV)(OTC: DOLLF).

Click here to learn more at the company’s website.

— Resource Stock Digest Research