Outcrop Silver & Gold Corp.

TSX-V: OCG | OTC: OCGSF

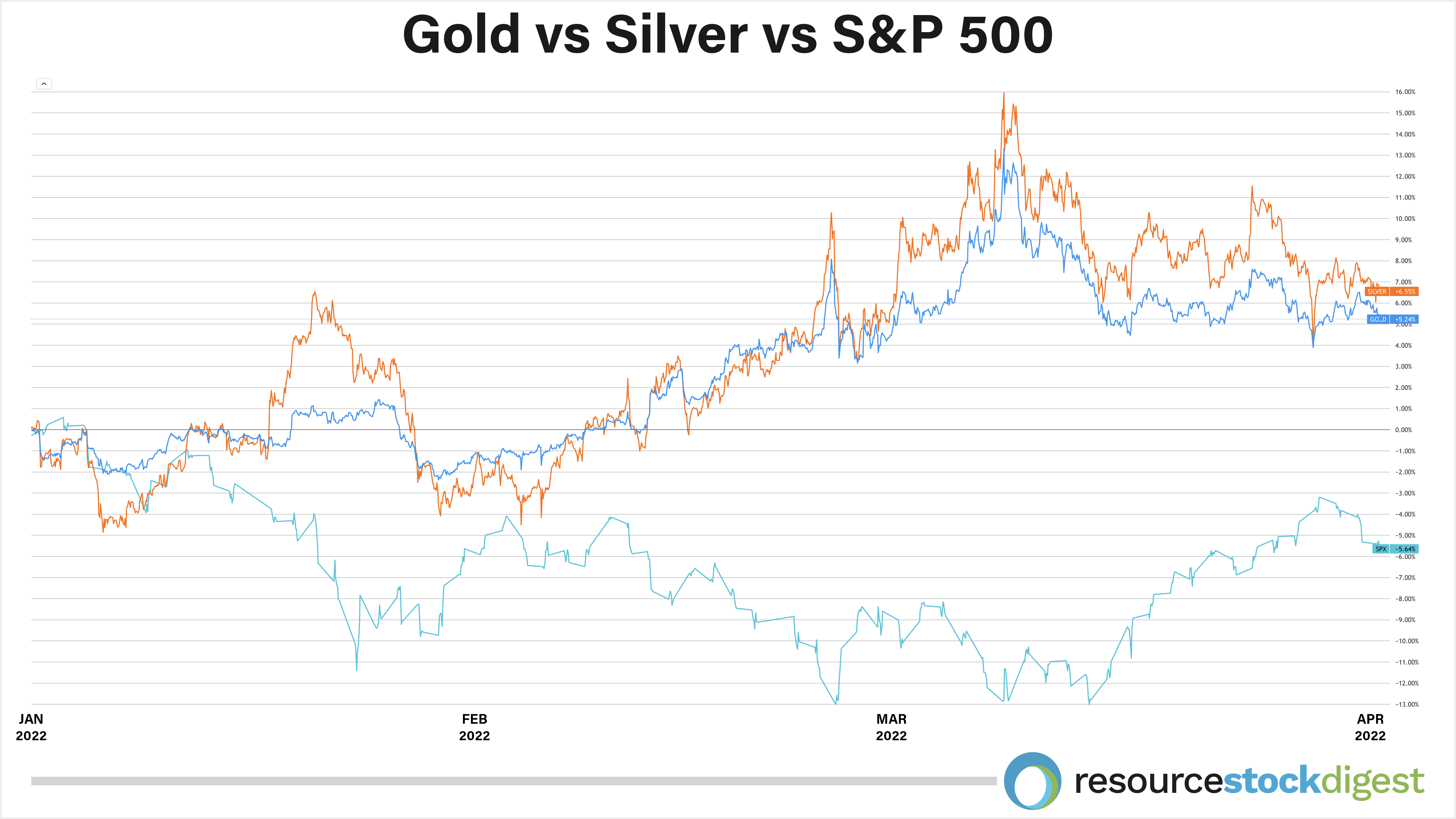

Gold is in a multi-year bull market with no signs of slowing down.

In fact, the yellow metal recently hit US$2,000 and may soon break above its all-time spot high of US$2,075 per ounce.

Silver, which typically trades in tandem with the yellow metal, is also surging toward multi-year highs above US$25 an ounce.

And quality gold-silver stocks are taking off as well. Particularly the small-caps.

Outcrop Silver & Gold Corp. — which is currently trading undiscovered below C$0.30 per share — just added a second and third drill rig at its flagship, 100%-owned Santa Ana high-grade silver-gold project in Tolima, Colombia.

You don’t do that unless the drills are intersecting high-grade silver-gold at a high success rate. And they are!

Now is an opportune time for investors to start looking at Outcrop Silver & Gold:

| Multi-rig, 18,000-meter drill program underway at flagship Santa Ana project with additional assays due soon | |||

| Santa Ana is the highest-grade silver project in all of Colombia | |||

| World-class silver-gold vein system containing 60 km of veins | |||

| Growing discovery with 10 high-grade shoots and less than 10% of projected vein system tested to-date | |||

| Upward scalable NI-43-101 maiden resource planned for year-end 2022 | |||

Outcrop Silver & Gold is led by mine-finder extraordinaire Joe Hebert who boasts over 30 years in practically every aspect of economic geology and who is credited with numerous discoveries, including the first discovery hole at what is now Barrick’s Cortez Mine plus the Mallaha Creek discovery in Nevada and multiple discoveries in Utah’s Goldstrike District.

This is a man who knows his way around a precious metals discovery… and he knows how to get things done for shareholders.

We have an exclusive interview with Mr. Hebert coming right up. Yet, before we get to that, let’s take a closer look at the flagship Santa Ana high-grade silver-gold project where the drills are turning now.

Flagship Property: Santa Ana Silver-Gold Project, Colombia

Outcrop Silver & Gold Corp. (TSX-V: OCG)(OTC: OCGSF) owns 100% of the past-producing Santa Ana high-grade silver-gold project in Tolima, Colombia.

Santa Ana is a district-scale property spanning 36,000 hectares (360 sq km) characterized by multiple regional-scale parallel vein systems across a 30-km-long by 12-km-wide trend.

In total, we’re talking over 60 km of vein zones across the entire silver-gold belt.

The project covers a significant portion of the Mariquita District — the highest-grade primary silver district in Colombia with historic silver grades ranked among the highest in Latin America by way of dozens of mines.

Outcrop is currently in the process of defining a total of 10 high-grade silver-gold vein shoots — via 18,000 meters of drilling — to be included in a maiden resource report slated for release later in 2022.

Outcrop is guiding an initial resource of between 45 million and 55 million ounces silver-equivalent at grades between 550 and 750 grams per tonne silver-equivalent (g/t AgEq).

That initial pending resource — in and of itself — is highly significant in terms of both size and grade.

But it won’t end there! Speculators need to understand that the company’s forthcoming resource is projected to represent less than 25% of the veins mapped and projected from only 6,000 hectares of the total 36,000-hectare property.

That means there’s TONS of room for resource expansion by way of the drill.

Drilling to-date at Santa Ana has proven highly successful at vectoring-in on high-grade, vein-hosted mineralization. In fact, previous drilling by Outcrop has produced a weighted average grade — from 110 out of 183 drill holes — of an impressive 1,380 g/t AgEq.

That figure breaks down to 850 g/t silver and 7.52 g/t gold!

Hence, the exceptionally high precious metals grades — for both silver and gold — are abundantly present. And there’s no shortage of high-quality targets teed up for drilling.

The company’s immediate focus is on completing its in-progress 18,000-meter, multi-rig drill program and then turning those results into an initial maiden resource.

Highlights of Outcrop’s current 18,000-meter drill program at Santa Ana include:

- Confirmation of two additional vein shoots — La Abeja and La Isabela (see above image) — in the first two targets drill-tested within the company’s newly-permitted concessions.

- Drilling in the La Abeja shoot — 300 meters north along the Dorado vein — intercepted 2.2 meters of 2,790 g/t AgEq and 1.2 meters of 1,362 g/t AgEq. La Abeja is characterized by abundant native silver.

- Drilling in the La Isabela shoot — 2 km to the southwest of the San Antonio shoot — intercepted 1.22 meters of 609 g/t AgEq and 0.49 meters of 1,350 g/t AgEq.

- Adding La Abeja and Isabela, Santa Ana now comprises 10 large, high-grade shoots, all of which remain open along-surface and at-depth.

- Drilled silver-gold endowment within numerous vein zones has been expanded to a footprint covering 5 km by 1.2 km.

- Target generation is continuing to the south of the historic Frias Mine along 12 km of untested vein zones; Outcrop owns the Frias Mine, which has historic production of 7.8 million ounces of silver, as part of its Santa Ana mineral concessions.

For speculators, right now is one of the most crucial junctures for the company and its shareholders.

The Outcrop team has the drills turning on a robust 18,000-meter drill program at Santa Ana and has gone two-for-two with the first two targets: La Abeja and La Isabela.

Momentum is building: The company recently added a second rig to test targets to the south of the Santa Ana Mines where drilling to-date has been concentrated. A third rig is now being mobilized to infill known vein shoots to be included in the upcoming maiden resource.

And it really should be called a “first-pass” maiden resource because, as noted, the resource will only include about one-fourth of the known veins on the property.

In other words, the Outcrop team is in the process of proving out the “potential” of the Santa Ana property in the current drill program as a springboard to the next.

Outcrop Silver & Gold CEO, Joe Hebert — whom you’re about to hear from directly in our exclusive interview coming right up — commented on the current drilling progress via press release:

“Outcrop continues to add to its inventory of high-grade shoots by generating and testing high-quality targets on our regional-scale property. Every shoot discovered expands the potential resource area which will be incorporated into a compliant maiden resource report targeted towards the end of 2022.”

Outcrop’s VP of Exploration, Jesus Velador, added:

“Our focused drilling at Santa Ana continues to prove successful. A second rig on newly permitted concessions is resulting in the early definition of additional shoots. With significant intercepts extending El Dorado to the north and identifying La Abeja 300 meters north from El Dorado, and the generation of numerous targets with high-grade at surface to the north and south of the core Santa Ana Mines, we believe numerous new shoots will likely be discovered and are likely to significantly expand the footprint on the Santa Ana Project discovery.”

If the Outcrop field team is able to continue producing significant grades and widths throughout the remainder of the 18,000-meter program, we could realistically be looking at a significant near-term upward rerating in OCG/OCGSF shares.

In other words, this could be one of those rare precious metals momentum plays where the shares you acquire now continue to grow in value as the drill-hits keep coming in rapid succession.

Plus, Outcrop Silver & Gold is far from a one-trick pony… as you’re about to discover.

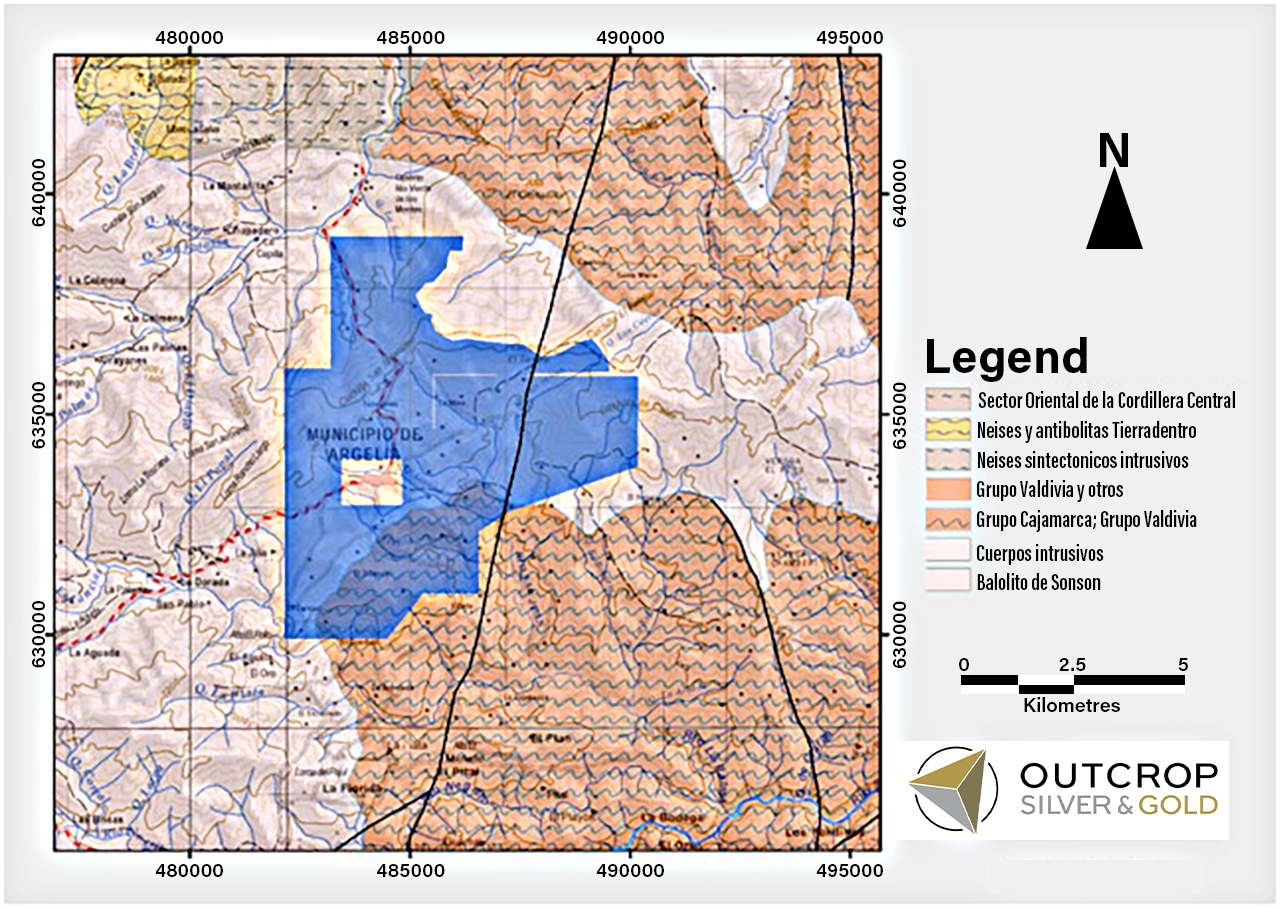

Argelia Gold Project, Colombia

In addition to the flagship Santa Ana project, Outcrop Silver & Gold is advancing the 100%-owned Agelia gold project located near Medellín, Colombia. Outcrop has identified an area of 4-meter veins that run up to 22.5 g/t gold and around 220 g/t silver.

The Outcrop team believes historical findings to-date point to the potential for an epithermal deposit commonly with values above 12 g/t gold. Next steps call for additional surface sampling and potential follow-up scout drilling.

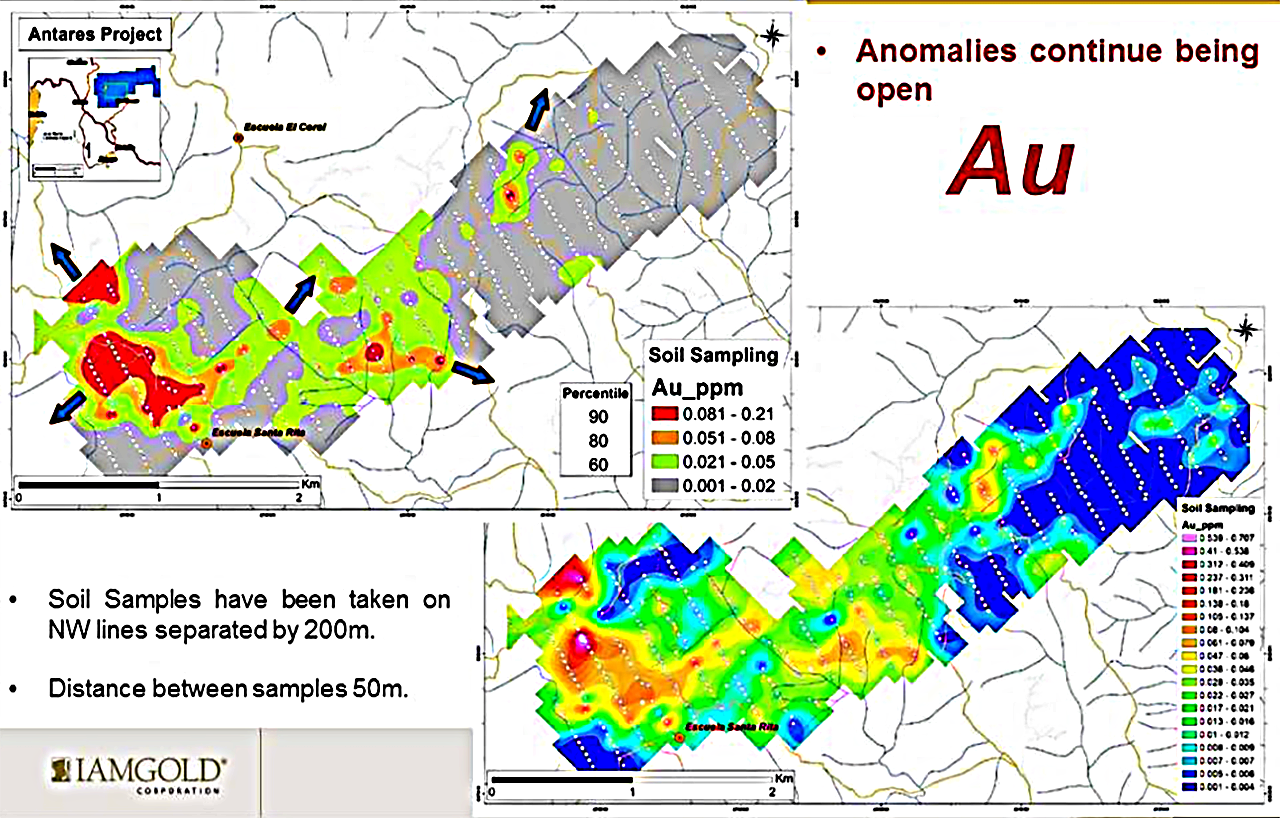

Antares Gold Project, Colombia

Outcrop’s 100%-owned Antares gold project is located in the state of Antioquia, Colombia. The project is a direct analog and immediately adjacent to B2Gold's / AngloGold Ashanti's Gramalote Mine.

In 2017 and 2018, former joint venture partner IAMGOLD conducted surface exploration work on the project. Their work produced a large and significant gold-in-soils anomaly providing a drill-ready target.

Outcrop is currently seeking a new joint venture partner to advance the project.

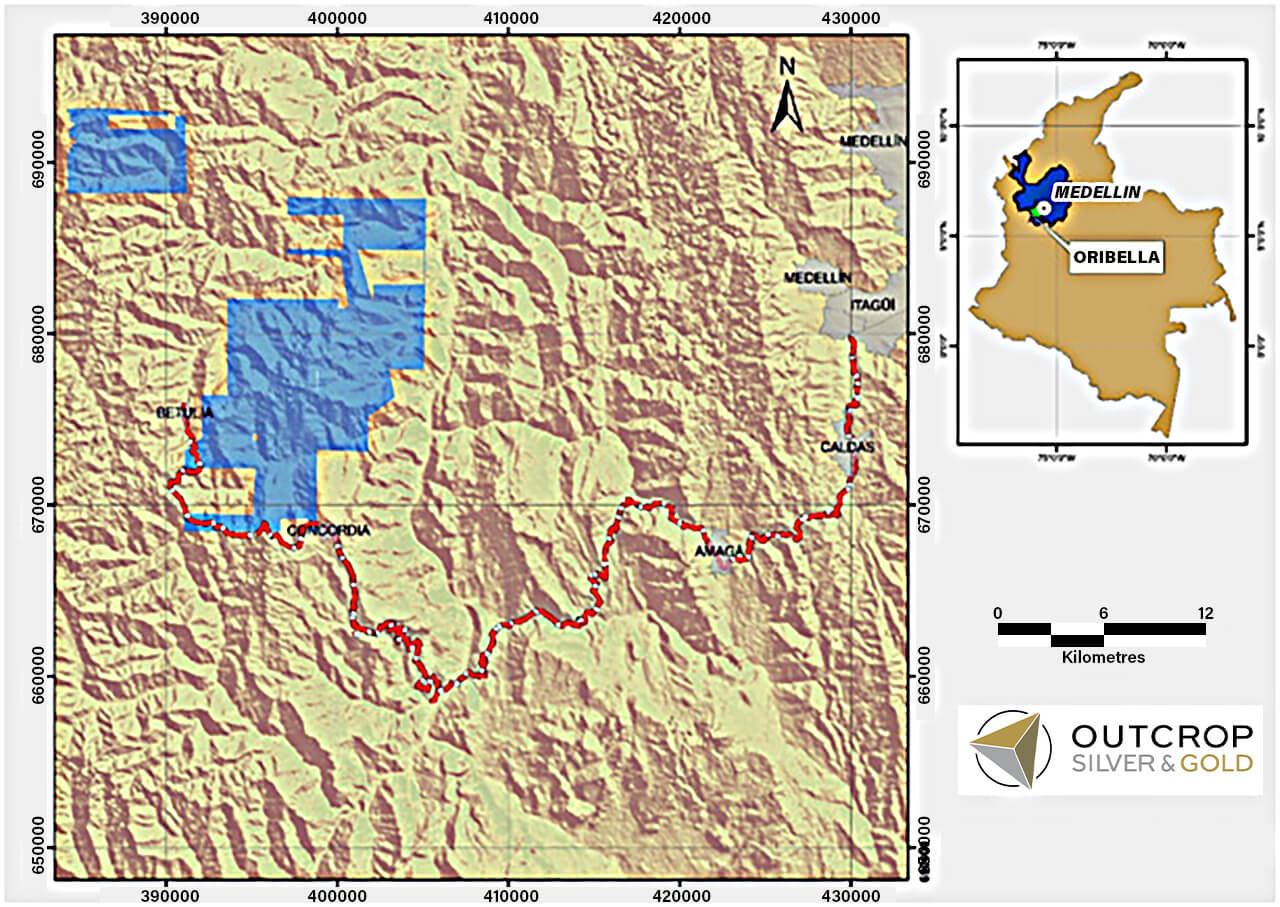

Oribella Gold Project, Colombia

Outcrop Silver & Gold is seeking a joint venture partner to advance the 100%-owned Oribella gold project located near Betulia, Colombia. The project immediately adjoins the Agnico-Newmont joint venture at the Anza gold project.

Soil sampling by Outcrop shows a robust gold anomaly measuring approximately 500 by 250 meters, which is open in two directions and ready for drill-testing.

Mallama Gold-Silver Project, Colombia

Outcrop Silver & Gold is advancing the 100%-owned Mallama gold-silver project located in Colombia’s Piedrancha district — a large, established Miocene district containing more than 35 mapped and projected intermediate sulfidation epithermal veins with strike lengths of up to 5 km.

Outcrop believes significant mineralization and shoots will be identified by exploring and delineating the extensions of current artisan mine workings down-dip and to-surface along the entire 3 km strike of the vein zones.

Exclusive Interview with Outcrop Silver & Gold CEO Joe Hebert

Outcrop Silver & Gold is led by experienced mine-finder and geologist Joseph Hebert who boasts over 30 years in practically every aspect of economic geology and who is credited with numerous discoveries, including the first discovery hole at what is now Barrick’s Cortez Mine plus the Mallaha Creek discovery in Nevada and multiple discoveries in Utah’s Goldstrike District.

Jesus Velador — who leads the exploration at the flagship Santa Ana silver-gold project — brings over 20 years of experience in precious metals exploration, specializing in epithermal environments. He has been instrumental in numerous discoveries including the Valdecañas vein in Zacatecas State, Mexico, and the silver-gold deposit at Ermitano in Sonora, Mexico.

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the president and CEO of Outcrop Silver & Gold — Mr. Joe Hebert. Joe, welcome to the program. Nice to have you on. How are you, sir?

Joe Hebert: I'm very well, thank you, and it's a privilege to be here with you.

Gerardo Del Real: I think your timing is phenomenal. We spoke a bit off air. I think we're in for a heck of a run in the precious metals space. You have yourself one of the most exciting exploration projects in Colombia — the Santa Ana project. And I want to talk about the silver-gold vein system, which stretches for over 60 kilometers.

But before we get into that, I would love for you to share your background a bit and a bit about the team that you've managed to put in place.

Joe Hebert: I've had 31 years in almost all aspects of economic geology. I've been involved in probably six discovery mine cycles, fortunately. And we've been able to put together a great team in Colombia over the last few years. Good, strong VP of exploration with experience in the vein systems like Santa Ana. A strong country manager and all of the support we need to do good social license and fast permitting and continuous programs.

Gerardo Del Real: You have Ian Slater as executive chairman, which, of course, he brings, I think, over a decade of experience in Colombia. And then, you mentioned your country manager. And I want to touch on that and your VP of Exploration [Jesus Velador] because I think those are critical positions, especially when you're working in South America where community relations are so important and it's so important to get it right.

Once you do get it right, things get a lot easier to move forward as it relates to exploration and permits and concessions and, eventually, possibly building a mine. But we both know that if you do it incorrectly, it's pretty consequential, right?

Joe Hebert: Yeah, we can demonstrate our ability to do good social license and good ESG by the fact that, within two months of the transaction closing on Santa Ana, we had a couple of drill rigs turning. We've managed to incorporate a large part of the community in both social benefit programs and, importantly, to the residents of Falan — our nearby community. We have about 80% of our workforce directly from that area, and everyone is Colombian.

Gerardo Del Real: Let's talk about the Santa Ana project. It's 100%-owned. It's over 36,000 hectares. I mentioned the fact that you have over 60 kilometers of silver-gold veins. And look, you've drilled quite a bit on this project and have had some spectacular intercepts.

Tell me about the Santa Ana project, and then let's talk about what the rest of the year looks like because you have some milestones coming up that are going to be pretty important as it relates to the rerating of the stock, which, I believe, obviously, in a perfect world, rerates to the upside, right?

Joe Hebert: Right, sure. Well, Santa Ana really is a high-quality, high-grade discovery; probably one of the highest-grade silver discoveries, certainly in Colombia, and probably a good part of Latin America. It's in a very low-risk jurisdiction of Colombia where projects do move forward with both permitting and permitting for the mine stage. And we'll be moving the discovery to the next stage by publishing a robust maiden compliant resource in 2022.

Gerardo Del Real: Tell me about the approach to drilling this year. I mentioned that you've drilled quite a bit. I mentioned that you've hit some phenomenal intercepts. You mentioned in your presentation that the weighted average rate of 110 of 183 drill holes is 1,380 grams per tonne silver equivalent. That's phenomenal! And so tell me a bit about the approach to drilling this year.

Joe Hebert: Well, all our mineralization that we're planning to bring into the resource category before the end of the year, we've got a good handle on those because we've got an internal block modeling, we've got internal grade contouring. We know what we need in the way of drill density for the resource stage. We'll have one drill rig dedicated entirely to the resource stage in density-type drilling, and then we'll have two rigs continuing pure exploration.

The exploration targets in front of us are all well-advanced. We have a great advantage at Santa Ana in that everything outcrops so we are able to basically get on top of a vein system, trench it, sample it, and usually come up with an individual drill target of silver ore in kilograms; trench that, step that off and drill it.

So it's a nice ‘put your hands on it, step off and drill it’ type of situation. So it's a very high success rate on discovery. And again, the chutes that we discovered that we hope to bring into the resource are fairly well-behaved, good grade continuity, and good prediction of great projection from drilling.

Gerardo Del Real: So you have the infrastructure, you have the community relations, you clearly have the grade. You have over 30,000 meters that have already been drilled. You have a resource update coming up. And you're simultaneously doing exploration drilling, which, of course, provides that blue sky potential into what I think is going to be a really robust precious metals market.

If I play devil's advocate — and it's something that you actually addressed really well which is why I bring it up — but there's Slide 25 in your corporate presentation where you mention, ‘Outcrop is exploring and drilling the veins that Silvercorp is mining.’

And I thought that was a well-put-together slide, because, if I was going to play devil's advocate, I would mention the narrowness, the apparent narrowness, of the veins. You also have Slide 27 that I encourage everyone to look at where you actually believe that those narrow veins provide an advantage.

Can you speak to the width, the true width, of the veins and how they compare to companies and projects that have market caps in the half a billion to a billion dollars, right?

Joe Hebert: It's a narrow vein system but it's an extremely high-grade narrow vein system, which really makes all of the difference because with that grade, you have a lot of flexibility.

So if you look at our weighted average grade across all mineralization drilled to-date, you're in that 1,400 grams silver equivalent per tonne range. We would probably employ, in a future mining scenario, exactly what Silvercorp is doing in the Ying Mine with a bias towards a selective mining method called ‘resue.’ That's also what SilverCrest is employing in the Las Chispas Mine.

So it's not so much a matter of the width of the veins as it is of the grade of the veins. And so in our internal guidance for the property, you look at that 1,400 grams of silver per tonne across the board, we think we'll still be able to maintain, on a resource basis, between 550 up to 750 grams silver equivalent per tonne. So even diluted to, say, a 2.2-meter stope width, which is what Zijin is using on the Buriticá Project in Colombia, we will still maintain some pretty incredible grades.

Gerardo Del Real: A lot to look forward to with Santa Ana but you also have other projects in your portfolio. And before I let you go, I'd love just a brief overview of those projects because it also provides multiple shots-on-goal moving forward, right?

Joe Hebert: Yeah, we have two other very high-grade vein systems that we're advancing. Those may be scout drilled by us or joint ventured. The one that would move furthest the quickest would be Argelia. It's notable there because we have 4-meter veins that run up to 22.5 grams gold and 10X that silver.

We also have another project that’s a little bit difficult to bring forward in that area so we're sort of bringing that forward slowly. And importantly, we also have our Oribella project, which immediately adjoins to the Agnico-Newmont joint venture at Anza.

And then, we have our Antares project, which is a direct analog and immediately adjacent to B2Gold's / AngloGold Ashanti's Gramalote Mine.

So really well-positioned. What we intend to do is focus where we can bring the most value the quickest, which is Santa Ana. And then look for partners. The most logical short-term venture partners we’d expect to be Antares and Oribella and then scout drilling programs on Argelia.

Gerardo Del Real: You just announced a C$5 million financing that was quickly upsized to C$6 million. It appears there's strong interest there. You have some cornerstone shareholders in Sprott Asset Management and Eric Sprott, among others. I love management teams that have skin-in-the-game. My understanding is that Outcrop management owns just over 25% of outstanding shares. Is that accurate?

Joe Hebert: Yeah, that's still accurate and not without a little bit of wincing in order to do it because I've participated in every placement we've put together in recent memory.

Gerardo Del Real: I love to hear it. Joe, I'm looking forward to having you back on. Obviously, looking forward to assays. Again, I think your timing is excellent. Is there anything else that you'd like to add?

Joe Hebert: I don't think so… except that we're just a good team of ore finders; we know what we're doing; we have the experience in Colombia. It's basically a last frontier, and we have a high-grade, robust silver-gold discovery that we're bringing to the next stage this year. So I think there's just a lot of excitement in terms of upcoming news to the market.

Gerardo Del Real: Looking forward to having you back on for that upcoming news. Thank you again for your time, sir.

Joe Hebert: Thank you.

The Opportunity

Outcrop Silver & Gold remains largely undiscovered by Wall Street — giving investors a timely opportunity to get involved in OCG/OCGSF at this exciting development stage.

Outcrop’s roughly 132 million outstanding shares are currently trading around C$0.25 — giving the company a market cap below C$40 million.

As detailed, the Outcrop team is systematically adding silver-gold ounces at the flagship high-grade Santa Ana silver-gold project, Colombia, by way of the drill ahead of its maiden resource report slated for release later this year.

With silver and gold prices up sharply thus far in 2022 — and with the high grades the company is consistently encountering — there’s little doubt that larger miners are keeping a close eye on Outcrop’s current 18,000-meter drill program at Santa Ana.

You hear directly from CEO Joe Hebert. He says…

“... Santa Ana really is a high-quality, high-grade discovery; probably one of the highest-grade silver discoveries, certainly in Colombia, and probably a good part of Latin America. It's in a very low-risk jurisdiction of Colombia where projects do move forward with both permitting and permitting for the mine stage. And we'll be moving the discovery to the next stage by publishing a robust maiden compliant resource in 2022.”

In other words, 2022 is shaping up to be a very exciting year for Outcrop Silver & Gold, especially with silver and gold prices sharply on the rise to start the new year and with a robust drill program underway.

Speculators can expect a steady stream of news flow throughout 2022 as drill results are released over the coming months ahead of the maiden resource.

Now is the time to begin conducting your own due diligence on Outcrop Silver & Gold Corp. A great place to start is the company’s corporate website.

The company’s shares trade on the Toronto Venture Exchange under the symbol OCG and on the US-OTC Bulletin Board Exchange under the symbol OCGSF.

Be sure to sign-up to receive the latest news and company updates directly from the company.

Follow our exclusive interviews with top management plus a lot more.

— Resource Stock Digest Research