The First & Only Pure Play Uranium Royalty Company

(NASDAQ: UROY)(TSX-V: URC)

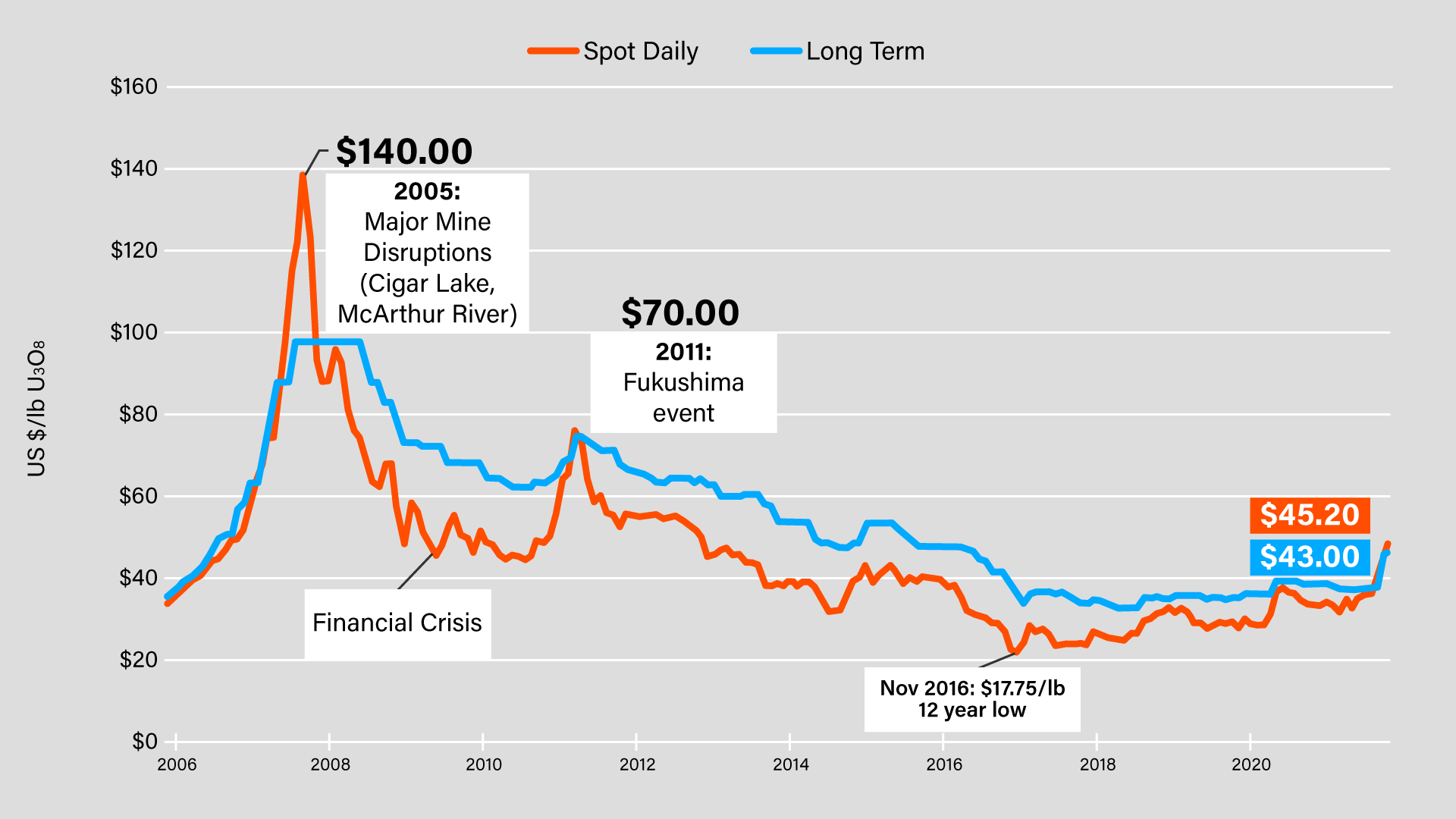

The new uranium bull market is underway…

…and best of all, it’s still early-innings which means you haven’t missed out on the coming profit windfall.

The company featured in this report — Uranium Royalty Corp. (UROY/URC) — is the first company to apply the successful royalty and streaming business model exclusively to the uranium sector. Since going public in late-2019, the company has quickly amassed an industry-leading portfolio of interests on 16 development, advanced, permitted, and past-producing uranium projects in multiple jurisdictions, including royalties on Cameco’s world-class McArthur River and Cigar Lake mines. URC is simultaneously building a robust inventory of physical drummed uranium well below current U3O8 spot prices. The firm is extraordinarily well-funded with over C$100 million in cash, marketable securities, and physical uranium holdings. Currently trading at an ideal entry-point around US$4 per share — Uranium Royalty is positioned for exceptional growth at the onset of a powerful resurgence in the North American uranium sector as the world turns to emission-free “green” nuclear energy powered by uranium, aka yellowcake.

The profound impact of COVID-19 on the global uranium market, coupled with a renewed acceptance of nuclear as clean, reliable, emission-free energy has kicked off events that are already seeing the uranium spot-price — and related equities — ratcheting higher.

Currently, the price of uranium is right around US$60 per pound. It’s likely headed north of US$75 per pound soon — and this report details precisely why.

Over the next ten years, the world will need ~200 million lbs of uranium (or “yellowcake”) annually. But there is only about 150 million lbs per year globally with all-in sustaining costs (AISC) below US$50 per pound — and 20% or more of that has been knocked offline because of prolonged COVID-related disruptions.

At today’s spot price, only around 100 million lbs of supply per year is economic, or only about HALF of what the world needs. A spot price well above US$65/lb will be needed — and is expected — over the next few years.

That reality has kicked off a new bull market in U3O8 prices and select small-cap uranium stocks — including Uranium Royalty Corp. (NASDAQ: UROY)(TSX-V: URC).

A New Uranium Bull Market Emerges

Uranium’s previous bull market kicked off in 2006 when Cameco’s Cigar Lake Mine — which provides ~7% of global annual uranium supply — temporarily flooded during construction, prompting a run on uranium that sent the spot price to a jaw-dropping US$140 per pound.

It simultaneously sent uranium stocks significantly higher in percentage terms with names like UEX Energy, Energy Fuels, Laramide Resources, and International Enexco delivering a few thousand to +100,000% returns.

The commodities sector is known for the stocks within it offering leverage to the underlying price of the commodity.

The uranium subsector epitomizes this.

Uranium Royalty Corporation has been set up from the outset to capitalize on the uranium upswing the “clean-energy” world is bearing witness to now via the well-established royalty, streaming, physical-holdings model.

A Miniscule Market with Immense Leverage to Rising Prices

One thing to keep in mind is that the global uranium market is incredibly small compared to most other commodities.

One country alone, Kazakhstan, produces some 40% of global supply. It does this through Kazatomprom, its national uranium company, which listed 25% of its shares on the London Stock Exchange in 2018. Those shares have a market capitalization of roughly US$15 billion.

Kazakhstan is having production/supply issues of its own — more on that in a moment.

The next largest public pure-play is Cameco Corporation (NYSE: CCJ), which produces ~10% of annual global supply and has a market capitalization of around US$12 billion.

In other words, roughly half of the world’s uranium production is represented by less than US$30 billion in market cap. In contrast, Amazon has a market capitalization of nearly US$1.5 trillion!

From there, the pure-plays get small very quickly. The “largest” uranium producer in the United States, for example, is Energy Fuels (NASDAQ: UUUU).

Largest is in quotes given it will likely only produce between 30,000 and 60,000 pounds of U3O8 this calendar year. Its market cap is around US$1.5 billion but has mostly been below that for years.

If you were to look up the top holdings of the Global X Uranium ETF (NYSE: URA) — one of the most important uranium and nuclear industry indexes globally — you would see that those three companies (Kazatomprom, Cameco, and Energy Fuels) make up three of the top five holdings.

The other two of that top five are NexGen Energy (NYSE-American: NXE), with its world-class but undeveloped Arrow project in Saskatchewan, and Denison Mines (NYSE-American: DNN), with its large but also undeveloped Wheeler River project on the other side of Saskatchewan’s famed Athabasca Basin.

Those five companies make up over 50% of the sector ETF.

Importantly, in Q3 2021, Uranium Royalty Corp. was added to the Global X Uranium ETF — immediately elevating the firm’s profile as a top-emerging player in the global uranium space.

Uranium Royalty CEO, Scott Melbye — whom you’re about to hear from directly via our exclusive interview — commented on the Global X news via press release:

"The addition of URC to the Global X Uranium ETF is an important recognition of the value and growth potential of our royalty business model and comes at a time at which investors are seeking exposure to green, carbon-free nuclear energy through uranium equities. The global mega-trend towards the rapid decarbonization of our energy sector clearly plays into nuclear energy's strengths. Meanwhile, the improving uranium supply and demand fundamentals, driven by strong demand growth and substantial rationalization of global production, should drive a potential recovery of uranium prices in the short-term."

The bottom line is that the uranium world is incredibly small, which is why even slight inflows into the sector can create such stark leverage reflected in the equities — especially in the small-caps such as UROY/URC.

Utilities Will Drive the Next Upward Leg of the Uranium Boom

The biggest and most important buyers in the uranium space are the utilities. And here’s where it gets really interesting.

For years, the utilities have been able to lock up uranium supplies at depressed prices.

That’s about to change.

The combination of supply cuts from the highest-margin producers and utilities coming back into the market will create the greatest uranium bull market anyone has ever seen.

You see, for utilities, price is secondary to securing supply. That’s because the price they pay for yellowcake makes up a very small portion of the total cost of operating a nuclear reactor.

And for mine start-ups and restarts to be economic, uranium prices need to be well north of US$60 per pound. That’s the low-water-mark incentive price to build a new uranium mine in today’s economy.

The point is… no North American mining company can bring a new uranium mine from development to production below US$60/lb uranium.

And that means we’re almost guaranteed to see higher U3O8 contract prices.

That’s why uranium bull markets are so powerful. It’s also why the profits can be so life-changing.

Whether the utilities pay US$60/lb or US$150/lb… THEY HAVE TO BUY!

With nuclear power providing some 15% of global baseload clean electricity… either the utilities buy yellowcake at higher prices… or the lights go out!

The utilities’ last major contracting cycle was in 2010. And when you look at the levels of uncovered reactor requirements starting next year and the year after that... every year, it gets larger and larger and larger.

Not only is the biggest buyer about to rush back into the market… but governments that just years ago vowed to move away from nuclear energy are now realizing that there isn’t a cleaner, safer, more economic and reliable option in the world.

A Global Push for Clean Nuclear Energy

Europe kicked off 2022 declaring nuclear power as “environmentally sustainable” meaning it will be eligible for billions of dollars in clean energy subsidies.

Here in the US, a new type of reactor is set to be built in Wyoming, and, in January 2022, we learned that the US is partnering with Bill Gates and the Japan Atomic Energy Agency to put the blueprints in motion.

Even better, the US Department of Energy just took the first steps toward producing more uranium fuel right here in the United States. It includes the establishment of a US$1.5B Strategic Uranium Reserve over 10 years for US domestic uranium and conversion with $75M in appropriations expected for fiscal 2022.

Needless to say… it’s about time as the US continues to be more than 90% reliant on foreign countries for its uranium requirements.

Globally speaking, the US, China, Japan, India, South Korea, and several western European nations are now fully onboard with a cleaner energy future that will require vast amounts of yellowcake.

As just one powerful example, China has now confirmed its intent to build 150 new nuclear reactors over the next 15 years as part of its newly-enhanced decarbonization mandate.

That's more reactors than have been built in the last 35 years!

France also just announced that they’re going to be building a new generation of nuclear reactors for the first time in decades.

There’s also the advent of Small Modular Reactors — or SMRs — right here in America.

SMRs offer key advantages over traditional reactors such as a relatively small physical footprint, reduced capital investment, ability to be sited in locations not possible for larger nuclear plants, and provisions for incremental power additions.

In other words, strong tailwinds are forming for the uranium sector at large.

And then, there’s the retail speculator who, until now, hasn’t had a viable vehicle to buy physical uranium with the press of a button or by placing a phone call.

That’s all changing now…

Sprott Inc. has now launched what amounts to a new uranium ETF by taking over Uranium Participation Corp (TSX: U)(OTC: URPTF).

The formation of the Sprott Physical Uranium Trust is a big deal. In fact, we believe Sprott's 200,000-plus investors will look at this as a way to directly purchase physical pounds without having to take delivery — which Sprott will do for them.

They’ve done it with gold. They’ve done it with silver. And now they’re doing it with uranium!

Sprott has already announced an initial investment of over US$1.3 billion. That will likely grow in the coming quarters.

The Kazakhs quickly followed suit with their own US$500 million physical uranium fund.

Those two funds are combining to tighten an already strained uranium supply market… resulting in the first upward leg of the new uranium bull market with U3O8 prices surging from US$20/lb to currently around US$60/lb.

We mentioned the utilities; they’ll be next to come in. Historically, it’s the utilities that have been the main driver for higher uranium prices.

And there are signs the utilities are about to enter the market to secure their next long-term U3O8 contracts.

Once that happens, we could see uranium prices surge first to US$75 per pound… and eventually to record highs above US$140 per pound.

Could we see US$200 yellowcake in the not too distant future? We believe so!

And while that high a price would likely be unsustainable over the longer-term — it won’t matter.

That’s because any surge above US$75 per pound would send the share prices of select small-cap uranium firms multiples higher… resulting in substantial gains for well-positioned investors.

So yes, the gains in the uranium spot price will be incredible... but the top junior uranium exploration firms will make those gains look paltry in comparison.

Enter Uranium Royalty Corp. (NASDAQ: UROY)(TSX-V: URC).

Uranium Royalty Corp.:

A Detailed Look at the World’s First &

Only Pure Play Uranium Royalty Firm

For speculators, Uranium Royalty Corp. is the first company to apply the successful royalty and streaming business model exclusively to the uranium sector.

URC’s robust portfolio includes interests on 16 development, advanced, permitted, and past-producing uranium projects in multiple jurisdictions, including royalties on Cameco’s world-class McArthur River and Cigar Lake mines.

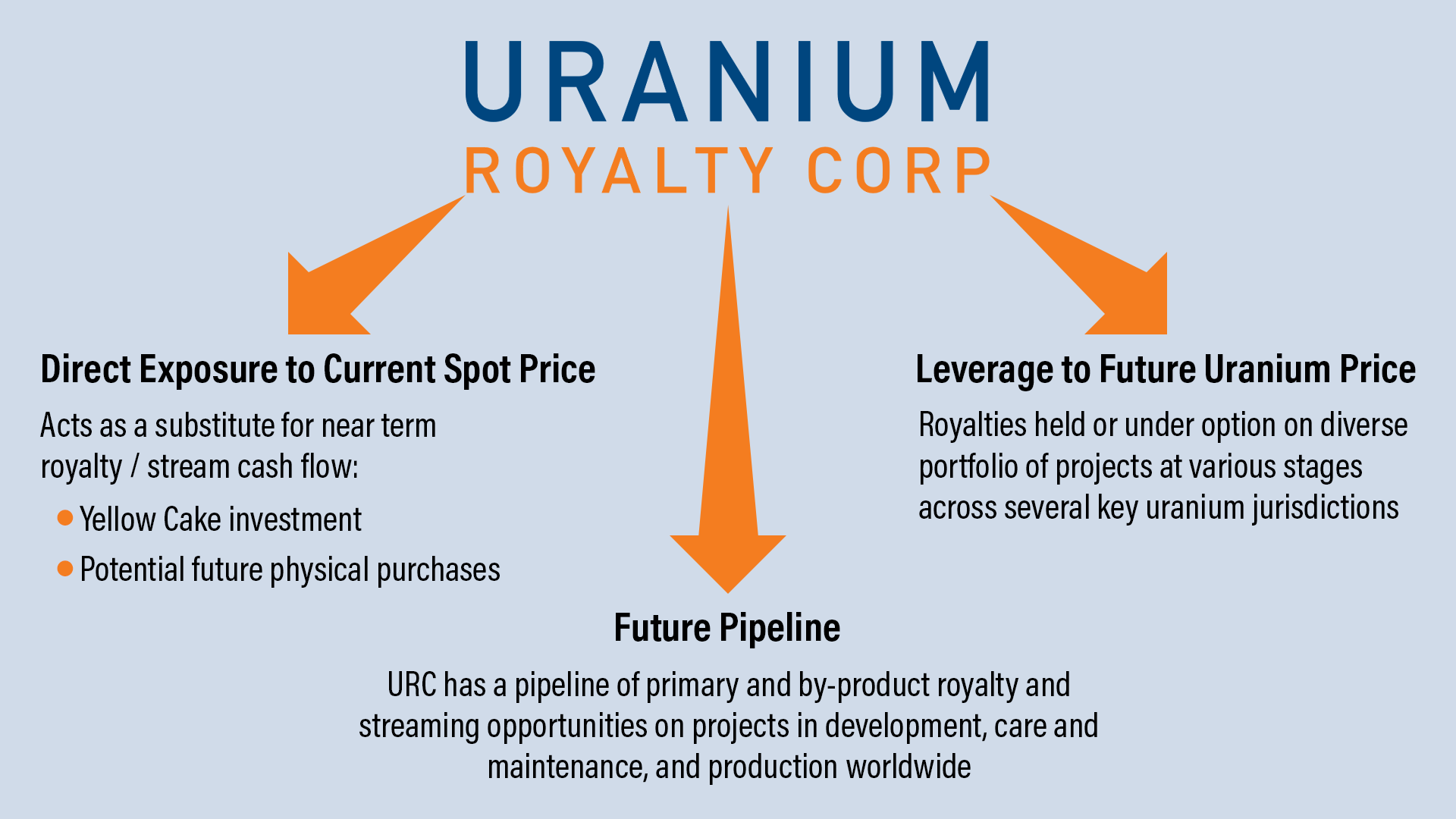

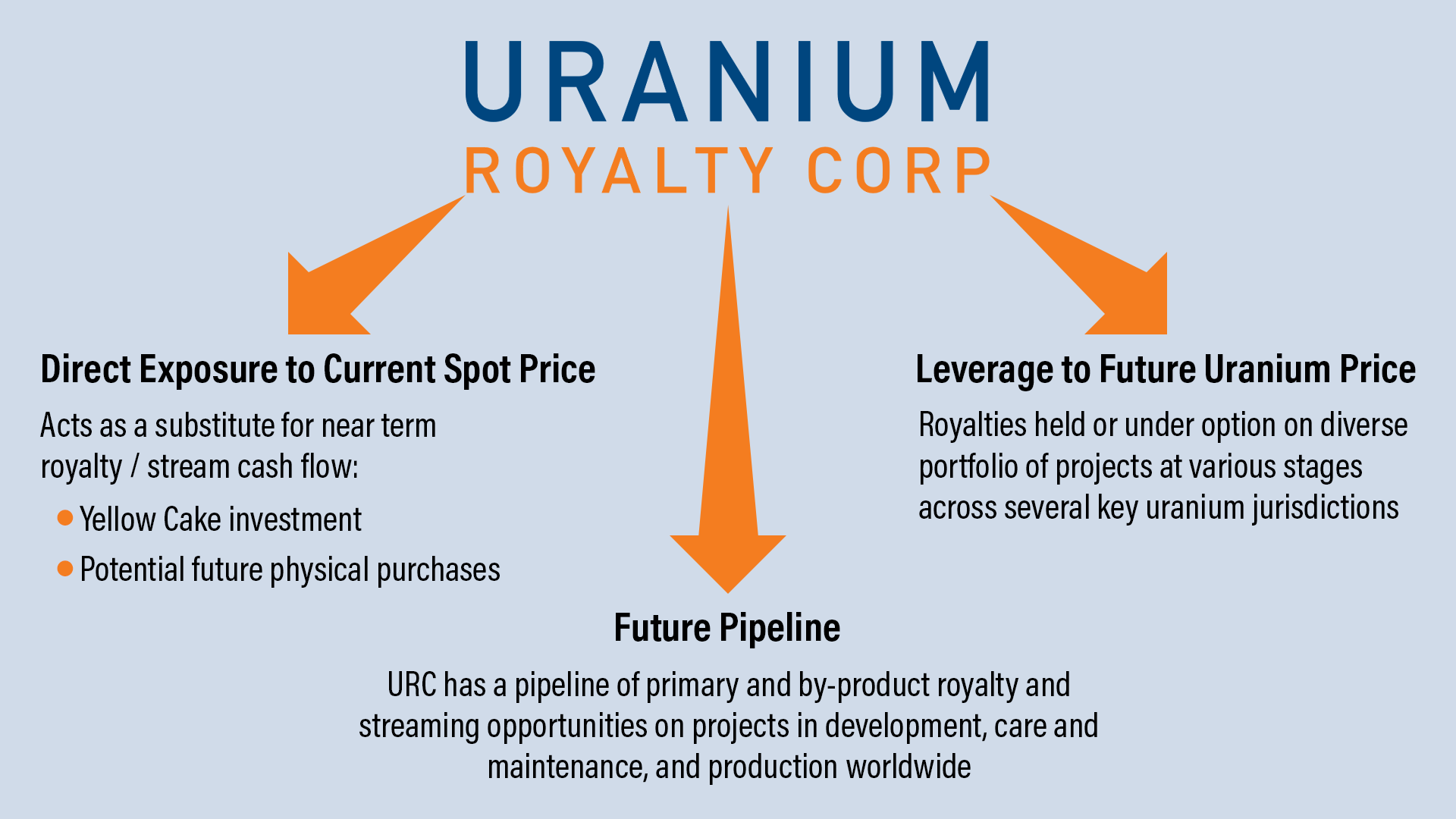

The company’s proven model has the distinct advantage of providing exposure to rising uranium prices — via royalties, streams, and physical inventory — without the risks of having to own, develop, or operate any uranium mining projects.

And with the incredible amount of COVID-related disruptions the mining industry as a whole has faced and continues to face — those aforementioned advantages have never been more front and center for stakeholders.

Also advantageous is the fact that URC’s counterparties and operators include many of the sector’s leadling growth-oriented uranium firms (see below) including UEC — the largest shareholder of UROY/URC at 14 million shares, or a 19.5% interest.

In Q2 2021, Uranium Royalty completed the landmark acquisition of royalty interests on Cameco’s McArthur River and Cigar Lake uranium mines in Canada’s prolific Athabasca Basin — the #1 highest-grade depository of uranium in the world.

That transformational acquisition provides the company and its shareholders with exposure to the two largest high-grade uranium mines on the planet with ore grades upward of 100X the global average.

Combined, McArthur River and Cigar Lake have capacity equal to about one-fifth of global forecasted uranium demand.

The agreement also includes a royalty on the high-grade Dawn Lake Uranium Mine, which has been active since 1977 with resources of approximately 18 million lbs U3O8.

Also in the Athabasca, Uranium Royalty owns a 1.97% net smelter royalty (NSR) on Rio Tinto’s development-stage Roughrider Uranium Project.

Large Base of Physical Uranium Holdings

In addition to royalties and streams, Uranium Royalty Corp. offers investors exposure to physical uranium via its 3.8% stake in London-listed Yellow Cake PLC.

Under a 10-year supply agreement with Yellow Cake PLC, Uranium Royalty has now increased its physical uranium inventory by 300,000 lbs to 1,348,068 lbs at an overall weighted average acquisition price of US$39.80/lb U3O8.

To-date, Uranium Royalty has taken delivery of ~350,000 lbs U3O8, which is being stored at Cameco’s Blind River Fuel Services facilities in Ontario, Canada (see below).

Additionally, in Q4 2021, Uranium Royalty entered into a supply stream agreement with CGN Mining Company Ltd. for 500,000 lbs U3O8 to be delivered starting in 2023 and running through 2025 at a weighted average price of US$47.71/lb.

Those two accretive transactions provide UROY/URC shareholders with increased leverage to physical uranium at a time when prices are anticipated to rise due to a fundamental supply/demand imbalance and increased long-term contracting by utilities.

As a result, the company is now sitting on more than C$100 million in cash, marketable securities, and physical uranium.

Not bad for a junior resource firm that’s only been around since late-2019!

Checking Every Box for Sustained Growth

Uranium Royalty is the only uranium equity that gives speculators exposure to the price of uranium as well as participation in exploration upside with fixed operating costs and NO development or sustaining capital costs.

It does this through its intelligent royalty, streaming, physical-holdings model (see below).

And by all metrics, shares of UROY/URC appear significantly undervalued at present.

Trading right around US$4 per share with a market cap of roughly US$400 million… a case can be made for a billion-dollar valuation based on the current trading value of other companies in the space and by looking at comparable companies in the precious metals space.

In addition to the high-profile royalty/streaming acquisitions, Uranium Royalty recently uplisted to the NASDAQ, announced a C$25 million bought deal financing, and, as mentioned, has begun taking delivery of physical uranium from London-based Yellow Cake PLC — not to mention the large supply stream agreement with CGN.

As a result, Uranium Royalty currently boasts an enviable balance sheet of over C$100 million of cash, marketable securities, and physical commodities — which is almost unheard of in the junior resource space.

As uranium prices continue to rise, we believe Uranium Royalty Corp. (NASDAQ: UROY)(TSX-V: URC) will continue to elevate its profile as a go-to name in the space, leading to a positive rerating of its shares.

Our own Gerardo Del Real of Resource Stock Digest and Junior Resource Monthly sat down with Uranium Royalty president & CEO, Scott Melbye. Scott has held senior positions with some of the largest producers in the uranium space and knows the industry like the back of his hand.

He lays out the future growth prospects for Uranium Royalty Corporation in the new uranium bull market below. Enjoy!

2022 Uranium Bull Market:

The Next Cycle of Capital Investment Begins

Building near-term production and cash flow with Uranium Royalty Corp.

Exclusive Interview with URC President & CEO Scott Melbye

Gerardo Del Real: It’s great to have you back on. Listen, UROY/URC is positioned as the first and only pure-play uranium royalty company. And any time I look at a potential investment or a speculation and I see the words “first and only,” and then I combine that with what I believe is going to be a red-hot uranium bull market — it gets my attention!

And so I want to get into the business model and I want to get into the differentiators and that first-mover advantage that Uranium Royalty Corporation has. But before I do that, I would love for you to provide a brief overview of your background because the experience is pretty impressive.

Scott Melbye: Well, thanks, Gerardo. Yeah, I'm absolutely excited about Uranium Royalty Corp. This is something that I'm really excited about in my career. I've been in the uranium industry and the nuclear energy industry now for 36 years… so every aspect of uranium; trading, brokerage, et al.

I worked for a utility company, the Palo Verde Nuclear Station, down in Arizona buying uranium for the power plant. But most of my career has been on the mining side with three of the four largest uranium mining companies in the world… managing their global marketing activities.

And so I'm kind of more in an entrepreneurial phase of my career at this stage as an executive vice president of Uranium Energy Corp. and taking on the CEO role at UROY/URC, which was founded by UEC and helped with the launch of this new company.

So it's kind of taking everything I've learned and the experience I've gained over these 36 years and putting them into what's a very exciting business model.

Gerardo Del Real: So let's talk about that business model. I think that — for speculators out there — if they look at the precious metals space and they look at a 20, 30, 40-year chart and they look at performance, as far as equities go in the gold space, if you look at royalty companies, you can see that they clearly have outperformed the market especially the last decade or so.

It's exciting to me to have an opportunity like UROY/URC, because, again — you are the first company to apply that business model to the uranium space. For those not familiar with the model, can you explain it to everyone?

Scott Melbye: Well, sure. And this isn't a new idea, as you've mentioned. In base and precious metals, the royalty and streaming industry has become a US$40 billion industry and was really pioneered by companies like Franco-Nevada, Wheaton Precious Metals, and Royal Gold.

But basically, royalties have been around as long as there's been mining. These business models are built around companies that purely invest in these royalty and stream interests in developing developers and mines and putting them together into a package that allows investors to participate in those royalties and streams.

So we as a royalty company in the uranium space… it's quite unique. It's become a big deal in base and precious metals but we're the first-mover in uranium.

And it's not a bad time to be doing that because the uranium industry has gone through, and does go through, these prolonged cycles and deep bear markets where investment in new mines really cuts back on that new investment.

But we're now in a stage where we need significant new mine production in the next 5 to 10 years. And there's going to be a lot of investment needed, and it's going to take all forms.

There's going to be a lot of equity raised, debt financing. But royalties and streams are another way in which a developer can finance getting their project into production. And it's basically granting a financial interest on future production streams of that mine in taking the cash today. And the investor gets the benefit of the revenue; either product streams in physical uranium or a portion of the revenue streams from that mine when it produces.

Some of the advantages — and you really see it in companies like Franco-Nevada, Wheaton Precious — there's some of the highest gross profits per employee of any business in the world today because you don't have to own the mine. You don't have to staff them. You don't have large G&A overhead.

You're basically investing in other companies' operations. They have all of those challenges. So you could have a company that has four or five employees that's generating $100 million in revenue, and it's quite scalable as well. As the company grows, the G&A does not need to grow that much with it.

So we're at a very early stage. We launched with the IPO in December of 2019 so we're very much in the early stages but very excited to be off and running and kind of fully in position now as this next cycle of capital investment begins in the uranium industry.

Gerardo Del Real: Scott, the last time you and I chatted, we talked about the royalty model and how UROY/URC was leveraging that network that the team has and the expertise to acquire these very, very accretive royalties that, in a better market, are going to do phenomenally well for shareholders.

And it appears that everything is lined up for that better market, including Sprott jumping into the mix with a big announcement. But you've had a couple of big announcements of your own.

You’ve commenced trading on the NASDAQ. That's a big milestone. Congratulations on that front! And then, I want to talk about your 10-year supply agreement to actually acquire US$10 million of physical uranium from Yellow Cake PLC. A lot going on in the space, Scott.

Scott Melbye: Absolutely, yeah... it’s very exciting times! I think in our last interview, we talked about how just the fundamentals — just the nuts and bolts of the fundamentals of uranium supply and demand — were really finally coming together after, as any depressed commodity on a long prolonged bear market would go through, you would see supply and demand react.

And so we were already very, very optimistic going into the market the last year or so. And then, COVID hits and cuts more supply from the market, and demand is back to pre-Fukushima levels. So yeah, it's exciting times!

And we've also had some… I would call them more micro factors in the market rather than the broad macro factors… but they've been quite significant. I think a number of players in the market, and particularly junior uranium companies, have all looked at uranium trading around US$30 a pound [Editor’s note: now ~US$60/lb]. And knowing what it costs to explore, develop, and mine uranium globally today — to be able to buy uranium in the drum around UA$30 a pound is a huge bargain.

And I think you've seen Uranium Energy Corp., Denison, Boss, Energy Fuels — a number of companies — all jumping in to buy uranium at this stage in the cycle, which is certainly a very bullish indicator. It was something that the Wall Street Journal wrote about this week and has been getting a lot of attention.

But it really does point to the recovery of the uranium market. As utilities now go back to their normal procurement cycles and get back in the market and start buying again, they may find that that pot of material is a lot smaller than maybe they thought it was.

And another big development is the announcement that Sprott is going to take over the UPC [Uranium Participation Corporation] fund. And we can only imagine Sprott, of course, having a huge resource investor base — both retail and institutional — talk to people day in and day out who love hard assets and invest in commodities. And I think they'll be telling this uranium story to their networks.

And I think you'll really see the potential for UPC to grow under this new structure… and that means buying more uranium as well. So I think in the coming months, we'll look for that added boost just as we've seen the 10-million-plus pounds bought by juniors over the last couple of weeks. So it's all very bullish.

Gerardo Del Real: I couldn't agree more. I mean, referencing the Sprott announcement, that's an investor base and an institutional base of over 200,000 eager speculators and investors that will now have access to essentially control physical purchases, right? And I think that's something that we just haven't seen in the space at that scale.

And it coincides with companies like UROY/URC — companies like other uranium names in the space — that are actually allocating capital to purchasing physical pounds and waiting until those prices go up.

I foresee a scenario where the utilities overplay their hand and are going to have to come back in an expedited fashion but at much higher prices. Do you share a similar sentiment... or do you see something different?

Scott Melbye: No, I clearly see that. I mean, at the end of the day, we're a commodity like anything else, and these supply and demand factors have to come into play. We're not the most efficient market — like some of the copper, gold, or other commodities — but clearly, we see that happening.

This was all kind of a driving factor for us at UROY/URC to elect the option that you mentioned under our 10-year supply agreement through the Yellow Cake PLC contract with the Kazakhs. We just took delivery of our first tranche — just under 350,000 pounds at a US$28.73 price — so it really emphasizes the strategic value of our long-term option agreement with Yellow Cake.

And just to remind your listeners, that was something that we acquired as a foundational shareholder in Yellow Cake when they went public over three and a half years ago; that we retained a US$10 million per year option — maximum to US$31 million total — out of their US$1.2 billion contract with Kazatomprom.

So we felt it was the right time to exercise and take those pounds, and they're now sitting in our account at Cameco's facility in Ontario, Canada. So again, we're just adding to that general trend towards non-traditional purchasers in the market right now.

And I think the utilities probably see this and should be a wake-up call that they've been enjoying low prices on the spot market and in the near-term carry trade market. But that's only as good as there's abundant spot supplies. I think we're certainly tightening now to where we'll see the price go up.

So again, it was also good timing for us to be listing on the NASDAQ, as you mentioned, to be able to just make it that much easier for shareholders in the United States to buy and sell our shares and trade in US dollars on the NASDAQ. I think we're the only pure uranium company on the NASDAQ presently.

So we're the one and only uranium royalty company in the uranium space. But now we're also the only NASDAQ-listed uranium company as well. And I think it's not to be lost that all of the cutting-edge companies in tech and particularly in green energy and ESG investing and everything — these cutting-edge companies are all on NASDAQ.

And I think, clearly, we're seeing that nuclear energy — with its no carbon emissions and clean energy — really fits the narrative, and investors are looking for those kinds of investments. So we're very happy to be positioned on the NASDAQ and up and trading; so far so good!

Gerardo Del Real: A lot to like! I think your timing is excellent; obviously, years in the making. You mentioned the option agreement to purchase these pounds of uranium wasn't just something that happened last month or last year. This was something that was years ago, right?

Scott Melbye: Yeah.

Gerardo Del Real: And so again, how quality teams behave is they take advantage of bear markets to strike very opportune deals for their shareholders. And congrats to you and the team. I think you did that brilliantly!

Scott Melbye: Thank you! Yeah, it's exciting. I think we have the right model at the right time... and to be bringing this royalty and streaming model has been such a big, big investment story in base and precious metals.

It's also become a big source of alternative mine finance in those other commodities. We're just thrilled to bring it to uranium and give investors one more really pure-play in the uranium space with diversified risk... so really positioned well.

Gerardo Del Real: You've had yourself a heck of a run this year. Still early-days, Scott, in your opinion, for those that think they missed out on the run?

Scott Melbye: Yeah, I can't emphasize that more. I mean, if this is a baseball game, we're probably in the first or second inning here because we've had a lot of strength and interest in the uranium equities over the last year.

It's kind of been this recognition of nuclear's role in the clean energy megatrend. But the uranium price really moved over US$30, moved towards US$31, US$32. With this recent purchasing, it fell back a little bit. But I think we're really in the early stages of the uranium spot price movement.

So if we're in a period here where we see prices moving from $30 to $40 [Editor’s note: now ~US$60/lb], then we'll really see the equities catch on fire. So they're off to a good start but I don't think investors have missed it if they're getting in at this stage. It's still much-to-come.

Gerardo Del Real: Scott, the team, the experience, and the model has attracted some of the most influential capital in the space. Can you share some of the influential shareholders you have… I mean, amongst them are Sprott and Rick Rule and several others. Can we get into that a bit?

Scott Melbye: Yeah, so the company was founded by a couple of, sort of, corporate shareholders that — Uranium Energy, being the largest with about a 20% share of the company — it vended in assets, as did Mega Uranium, vended in the Langer Heinrich royalty that we have on that mine in Namibia.

Altius, a well-known diversified royalty company, vended in a royalty on its Michelin project in Newfoundland, Labrador. Beyond that — and these companies were really instrumental in getting the company launched — we've sort of supplied not only assets but capital and sweat equity in terms of management support to get the company off the ground and get it IPO’d.

But we do have strong support from Rick Rule, Marin Katusa, and the Sprott folks. So we've got the right people backing us. We've got the right people on the team and just excited about where the uranium industry is headed.

Gerardo Del Real: The market is always forward-looking, and we've seen decent price appreciation in the uranium equities. What we haven't seen yet is that kind of hockey stick move in the spot price that we know tends to happen when the utilities get off the sidelines and start contracting at much higher prices.

Rick Rule has that often-quoted line, "Either the price goes up or the lights go out,” right?

Scott Melbye: Well, that is true. And we've seen all the right things in terms of the fundamentals of supply with production cutbacks. We're now at a point where, globally, we produce 60 million pounds a year less than what we consume in global reactors. That's a big draw on the secondary supply, and it was needed.

With Fukushima and the impact of those events, we needed to draw down and rebalance the market. Well, that's been happening in earnest now since 2017.

Demand is really exciting. I mean, we've clawed our way back to move beyond where we were pre-Fukushima in terms of global nuclear generation. So the market for our uranium is robust and growing. And we've added over 50 units to the grid in the last eight years. There's another 50-some under construction today and many more planned.

We also are benefiting from just the focus on a lower carbon future and carbon-free energy, which is very hard to come by. And there's limits to how much renewables of wind and solar you can put on a grid to where you start to get some diminishing returns. And we've seen that in places like California, in South Australia; Germany, obviously, being a good example.

So nuclear clearly plays a role in this lower carbon energy future. What's been more important, we've always known that in the industry… but we're seeing policy makers, environmentalists, and the general public warming towards nuclear's role.

The long-term prices are still not where they need to be. But the fact that this interaction between the buyers and sellers is beginning to occur in a more normal fashion is very encouraging for the uranium price.

Gerardo Del Real: You have the team. You have the experience. You have the balance sheet. I have to believe 2022 is going to be a busy, busy time for you, Scott.

Scott Melbye: Absolutely. Well, thank you, Gerardo. It was great speaking with you and your listeners today about Uranium Royalty Corp.

Gerardo Del Real: An absolute pleasure! Thank you for the insight, Scott.

A Powerful Growth Opportunity in Uranium

For speculators, Uranium Royalty Corp. (NASDAQ: UROY)(TSX-V: URC) is the first company to apply the successful royalty and streaming business model exclusively to the uranium sector — and, by all accounts, they’re off to a highly impressive start!

To-date, UROY/URC’s strategy has been primarily focused on acquiring existing royalties/streams — with the next wave of acquisitions anticipated to focus on new royalties, streams of physical uranium, and other uranium interests.

On the personnel front, the company recently appointed former head of Bank of America’s Metals & Mining Investment Banking, John Griffith — who has advised on more than US$60 billion of successful mining transactions including Goldcorp’s 2019 merger with Newmont — to its board.

That key addition will no doubt prove valuable in supporting URC’s growth initiatives going forward.

As noted, UROY/URC is well-funded with approximately C$104 million (as of December 13, 2021) in cash, marketable securities, and physical uranium holdings. The company currently has ~110 million shares outstanding on a fully-diluted basis.

With uranium currently trading firmly in the US$60 to US$65 per pound range and likely heading significantly higher in the coming quarters — right now is an excellent time to be taking a closer look at URC as the company continues to build its balance sheet and its portfolio of uranium royalties and streams in Tier-1 mining jurisdictions.

Uranium Royalty Corp. trades on the NASDAQ under the symbol UROY and on the Toronto Venture Exchange via the symbol URC.

Learn more about the company’s growing base of royalties, streams, and physical yellowcake holdings — along with its future growth initiatives — by visiting Uranium Royalty Corp.

Sign-up to receive upcoming URC news releases and important updates via email here.

— Resource Stock Digest Research

Coverage made possible by the sponsorship of our featured companies:

Click here to see more from Uranium Royalty Corp.